放宽「所得扩大促进税制」的适用条件

根据2021年度的税制改革,放宽《所得扩大促进税制》的适用条件,公司提高员工工资时获得法人税的特别税收抵免更容易了。

首先

为了降低中小企业的《所得扩大促进税制》的门槛,新采用了一种比过去更易运用的体系。

大幅度修改

根据2021年度税制改革,针对大企业的《提高工资、促进投资税制》和中小企业的《所得扩大促进税制》的适用条件进行了大幅度修改。

在此,首先总结一下中小企业的《所得扩大促进税制》。由于本次修订将适用于2021年4月1日以后开始的财政年度,因此对于财政年度在3月结束的公司,该修正案将从2022年3月结束的财政年度开始适用。

另外,适用《所得扩大促进税制》而受到的特别税收抵免的最高金额相当于,其适用企业财政年度内支付给员工的工资和奖金总额相较上一年度增加的15%。

如果比上一年度相比增加了总额100万日元工资和奖金,则可以获得15万日元的税收抵免。

特别税收抵免限额

(支付给员工的工资额-支付给员工的同比工资额)×15%

适用条件简化

改正后的《所得扩大促进税制》的适用条件如下。

适用条件

(支付给员工的工资额-支付给员工的同比工资额)/支付给员工的同比工资额=1.5%

上边的适用条件只是意味着支付给员工的工资和奖金总额应该比上一年度至少增加1.5%。

基本上,只要将损益表和制造成本报告书的员工工资和奖金总额与上一年度进行比较,就能判定是否满足适用条件。

改正前的适用条件

在本修改案之前,《所得扩大促进税制 》的适用条件并不像上述那样简单。按照之前的要求,支付给持续雇佣员工(从上一年度开始到适用年度结束的所有月份收到付款的员工,并满足某些条件)的工资和奖金总额必须比上一年度至少增加1.5%。

这意味着在损益表和制造成本报告中的员工工资和奖金总额中,有必要抽出支付给持续雇佣员工的部分。

连续雇佣员工是指,受雇佣保险保护的普通被保险人,因此高龄被保险人以及临时雇佣被保险人必须被排除在外,判定连续雇佣员工的手续十分繁琐复杂。

根据2021年的税制改革,不再需要筛选持续雇佣员工的工作,而且可以根据所有雇佣员工的工资,奖金来判定适用要求。 这不仅会减少企业行政负担,而且会降低申请要求的门槛。

如果有所得扩大促进税制的任何疑问,欢迎随时向本事务所咨询。

关于IT导入补助金2021

中小企业厅为“IT导入补助金2021”设立了低感染风险的企业配额。虽然第一轮募集已经截止,但是预计总共会募集3~4次。

首先

虽然事业重建补助金备受瞩目,但刚发布的“IT导入补助金2021”也十分具有吸引力。以下是内容摘要。

预算为2,300亿日元

“IT导入补助金2021”的低感染风险配额将支持那些为了提高劳动生产力,并通过远程上班来降低新冠疫情感染风险而积极引进IT设备的企业。最高补助率将会提高到3分之2(常规为2分之1)。 这笔财政支出将由2020年度第3次国家财政补充预算中列入的2300亿日元来资助。

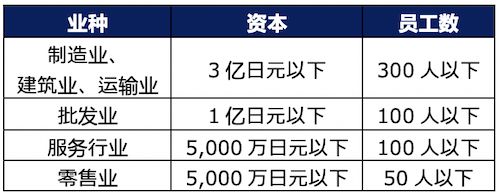

这次受补助的对象企业是,符合各行业独自规定的资本和雇员人数要求的中小型企业等以及小型企业等。代表性的几个行业记载如下图所示。

只租借电脑的企业想申请补助几乎不可能

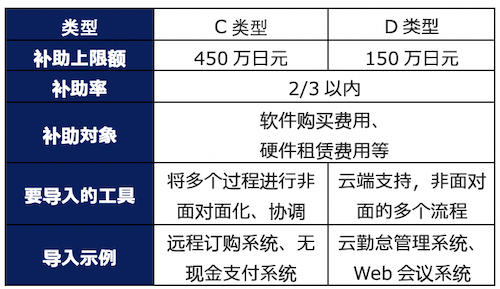

C类型和D类型的比较如下表所示。C型、D型的特征是个人电脑、平板电脑等硬件租赁费用包含在补助对象经费中。

但是,不能只申请硬件租赁,必须申请、导入包含两个以上提高下述生产效率流程要素的软件。

提高生产效率的流程

- 顾客应对、销售支持

- 结算、债权债务、资金回收管理

- 采购、供应、库存、物流

- 会计、经营、财务

- 总务、人事、工资、劳务、教育训练、法务、信息系统

- 业务专用

- 通用、自动化、分析工具

软件和硬件等IT工具,无论哪种类型都要求支持引进IT企业的经营者事先在事务局登记。另外,IT工具的导入和货款支付等将在补助金交付决定后进行。

收到IT导入补助金2020的人也成为对象

因为每个企业只能申请一种类型的资助,所以不能同时申请C型和D型两种方式。但是,如果申请未被接受,可以在下次的截止日期再次申请。

某些长期护理保险也要被审查?

我们上次提到过,将低退保价值保险的名义从公司转移到个人的方案漏洞即将被关闭,除此之外国税局也在密切关注某些长期护理保险方面的动向。

首先

利用各种民间保险的节税方案,总有一天会成为问题,而这个漏洞将被修正。 当各位受到保险公司推销时,要事先想清楚各种风险和因素。

被保险人以外的亲属

在商业保险公司销售的护理保险,通常在被保险人达到一定程度的需要被护理的状态时,允许被保险人自己领取保险金。

但最近,有一些产品允许被保险人的亲属,如被保险人的子女,代替被保险人成为保险金的受益人。

在护理条件下收到的保险金是不征税的,这是因为“以身体伤害为基础来支付的保险金”所以对领取保险金的被保险人本人不征收所得税。

根据税务局的通知,即使受益人不是被保险人,如果某个亲属如配偶或子女收到这笔钱,也会像被保险人本人收到这笔钱一样会被免税处理。

然而反过来说,利用此通知,将长期护理保险单受益人设定为亲属,与预期的长期护理费用相比,支付的金额也很大,亲属也不需要缴纳所得税,而且也不会成为赠与对象,可以说免税把钱赠送给亲属。

被征税的可能性是

但是,长期护理保险的付款之所以不征所得税,是因为付款是为了弥补身体受伤造成的护理费用等损失,即使收到付款,税负也不会增加。

因为有这个宗旨,上述通知还免除了对某些亲属,例如配偶,收到保险金的征税。他们在税务上被认为与被保险人共同负担生活,预计将承担护理费用。

脱离上述宗旨,为了减少赠与税或者遗产税的负担,支付的保险金数额远远大于相对较小的护理要求所预期的护理费用,受益人设定为被保险人以外的亲属收到的保险金,有可能不适用于该通知的初衷,存在不被免税的风险。

在这种情况下,领取保险金的人可能因为临时收入而被征税。当然,领取护理保险金的人如果是被保险人的亲属,也并不会被一刀切,实际的情况还要根据各自的保险合同来决定。

请警惕保险销售员的说辞

如上所述,仅从通知来看,如果被保险人的亲属成为护理保险金的受益人,也似乎将无条件地免于征税。

但是,在适用该通知时,需要考虑法令的宗旨等,还需要考虑个别事实来判断。轻易相信保险公司的推销说辞的所有内容有可能伴随着税务风险,请慎重判断。

如果被推销加入这种类型的长期护理保险而犹豫不定时,欢迎向我们咨询。