关于跨年交易的发票交付

首先

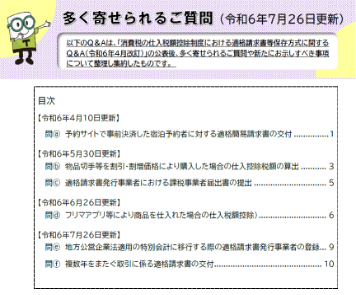

7月26日,国家税务局增加了2个关于发票系统的“常见问题”,明确了如何处理跨课税期间的的长期交易的发票交付问题,如提供超过1年的月度维护(如系统维护)服务。

如果是同一交易的话,可以汇总几年交付

作为发票必填项目的“课税资产转让日期”,应表述为“在课税期间范围内对一定期间内进行的课税资产转让等进行汇总制作发票时,该一定期间”。

正如这里所说的“课税期间的范围内”,即使是针对一定期间的服务汇总交付发票的情况下,交易期间跨越卖方的课税期间时,原则上也要按照该课税期间分类交付发票。

※参照后述的【原则性处理】

另一方面,将跨课税期间的交易汇总在一张发票上,或者在转让课税资产之前交付发票也没有问题。

考虑到这一点和发票交付实务的简便性,对于像每月的系统维护合同那样持续一定期间进行同一课税资产的转让等,只要卖方是发票交付对象的期间继续作为发票发行经营者,就会汇总超过课税期间范围的期间,承认发票的交付。

※参照后述的【特例处理】

例如,作为3月结算法人的卖方签订了从令和6年1月1日到令和7年12月31日期间的系统维护合同时,发票上记载的项目的原则性处理和特例性处理如下。

【原则性处理】

| 令和6年1月1日~令和6年3月31日 | 300,000日元 | 消費税30,000日元 |

|---|---|---|

| 令和6年4月1日~令和7年3月31日 | 1,200,000日元 | 消費税120,000日元 |

| 令和7年4月1日~令和7年12月31日 | 900,000日元 | 消費税90,000日元 |

| 总计 | 2,640,000日元 | |

【特例性处理】

| 令和6年1月1日~令和6年12月31日 | 2,400,000日元 | 消費税240,000日元 |

|---|---|---|

| 总计 | 2,640,000日元 | |

买方按比例计算各课税期间的扣除额

对于收到汇总了多个课税期间的发票的买方,必须通过自己按比例分配属于该课税期间的金额等方法计算进项扣除税额。计算出的进项扣除税额的数字在发票上完全不显示,完全没有问题。

参考:更多咨询处(令和6年7月26日)

https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/pdf/0024004-026.pdf

公司负担的健康检查费用的处理

首先

公司通常会为员工支付体检费用,作为福利待遇的一部分。有关健康诊断费,虽然有些人认为公司直接向医疗机构支付这些体检费用,但如果符合某些要求,即使员工垫付结算,也不会产生工资税。

体检费用的支付方法实际上没有明确规定

公司以货币形式支付给员工的工资、奖金和其他经济福利应作为工资和其他福利缴纳所得税。

但是,为了员工的福利,公司承担的费用,除了以下情况以外,不需要征收工资税。

- 员工获得的经济利益金额明显较多

- 该利益只提供给某些职位的人员,例如董事

根据这一处理办法,国税厅在一份问答案例研究中明确指出,如果所有希望进行体检的人都能够进行体检,并且公司为所有进行体检的人支付了体检费用,则由公司支付的员工体检和健康检查费用不需要缴纳工资税。

【 不征收工资税的体检费用 】

- 所有希望者都可以接受检查

- 接受检查的所有人的费用由公司承担

- 公司的负担费用明显不多

检查费用是由公司直接支付给医疗机构,还是由员工垫付后在公司结算,在通知和答疑事例中没有特别提及。

如果希望者全部接受检查,接受检查的全体人员的检查费用由公司承担,其负担额不显著的话,无论哪种方法都不需要缴纳工资税。

需要完善公司内部规定

只有员工垫付检查费用,日后在公司结算的方法,不会成为工资课税的对象。

不过,由于公司是在向员工支付费用,因此最好在公司规章中明确规定,公司为所有接受体检的员工支付费用,以避免在税务调查中被视为工资。

例如,如果以体检的名义向员工支付了一定数额的费用,或者公司内部规章制度没有规 定,员工并非都符合体检条件,那么在税务调查时就可能被指出这是向员工支付的工资。

保存公司名义的收据

在员工报销的情况下,最好以公司名义向员工索取收据,以明确体检费用由公司承担。

即使收据是以员工个人的名义开具的,如果公司为所有接受体检的人支付了体检费用,基本上也不会被视为工资等,但在税务审计时可能会对细节进行检查。

养着奇怪宠物的荞麦面店损失了多少钱?

首先

财务会计有时不能成为经营判断所需的充分的信息源,在商务现场成为有用的信息源的是管理会计。

以下情况的损失额是

假设每个月平均有做2000杯荞麦面的荞麦面店。荞麦面的销售价格是一杯800日元。这家荞麦面店除了月薪30万日元的店长之外,还雇佣了一名月薪10万日元的员工。荞麦面的材料费一杯300日元,除此之外店铺房租等固定的经费每月花费30万日元。每杯荞麦面的利益如下。

售价800日元・材料费300日元

人工费(30万日元+10万日元)÷2000张=200日元

固定经费30万日元÷2000张=150日元

800(售)-300(材)-200(人)-150(固)=150日元(利润)

客人不太多,时间上很充裕。另外,一位客人吃的荞麦面通常是一杯。

有一天,客人进店后,店里养的奇怪的宠物从里面出来,心情变得不愉快,没坐到座位就回去了。为了考虑要不要采取措施,我想计算损失额。这种情况下损失额是多少?

损失额为零?

如果宠物出来了,而客人离开了,那么可以认为什么都没有发生,即损失为零,因为客人终究没有进来。在财务会计中,这一概念是正确的。但在管理会计中,情况并非如此。这里的关键是销售额。如果宠物没有出现,销售额就会是800日元,而宠物会导致这些销售额的损失。因此,与宠物没有出现这一事实相比,销售额为零下800日元。

其次是材料成本。宠物出来的时候没有做荞麦面,材料成本为零。如果宠物没有出现,材料成本为300日元,因为荞麦面应该已经制作完成并供应。因此,与没有宠物出现的情况相比,材料成本只增加了300日元。人工成本和固定成本保持不变,因此总损失为500日元。

| 出现宠物 | 未出现宠物 | 差额 | |

|---|---|---|---|

| 销售额 | 0円 | +800円 | △800円 |

| 材料费 | 0円 | △300円 | +300円 |

| 人工费 | △40万円/月 | △40万円/月 | 0円 |

| 固定经费 | △30万円/月 | △30万円/月 | 0円 |

| 1名客人回去时的损失 | △500円 | ||

埋没的成本和机会成本

管理会计特有的成本有埋没成本和机会成本。埋没成本是指“不影响决策的成本”。在上面的例子中,人工费和固定费在比较对象的各个方面都产生了。因此,它不会影响决策。

另一个成本是机会成本。定义是“本可以从其他替代方案中获得的收益”。如果是上面的例子,500日元相当于这个。在决策时必须考虑机会成本。如果不考虑这个的话,损失就是零,对策什么都不需要。