Rented Company Housing Also Eligible for Rent Support Subsidies

Introduction

If certain requirements are met, company housing and dormitories are eligible for rent support subsidies. What are the requirements?

“Subleasing” not eligible for subsidies

Rent support subsidies were established with the aim of reducing the cost burdens of renting land and housing for small and middle-sized companies which had incurred significant drops in sales due to the emergency declaration issued in response to the spread of the new corona virus.

Companies can be granted up to 6 million yen in subsidies, while sole proprietors may receive up to 3 million yen. The rent subsidies caused a great deal of confusion as to whether company houses and dormitories leased on behalf of executives and employees are eligible for the benefit, due to “paying rent for land and buildings held for one’s own business” being one of the conditions to receive a subsidy.

This matter is explained as follows on the Ministry of Economy, Trade and Industry’s web site:

“If a corporation rents a property for company housing or a dormitory for its employees based on a lease agreement, and records the rent of the property as land rent and house rent on its income tax return, etc., in principle it will be eligible for benefits. On the other hand, if the property is subleased to employees based on a lease agreement, it is not eligible for benefits.”

What Caused the Confusion?

It is the part of the above excerpt which states, “On the other hand, if the property is subleased to employees based on a lease agreement, it is not eligible for benefits.” that resulted in confusion.

When a company provides rented housing for its executives and/or lower-level employees, it is common to collect a certain amount of rent in order to avoid payroll tax. That is, it is usual for companies to sublease such housing, etc. to its executives and other employees.

In this case, information was circulated that company housing and dormitories were not eligible for rent support subsidies. It was also common to see posts on social media stating that call center personnel actually responded that such company facilities were ineligible.

If not Ordinary House Rent, it is not a “Sublease”

In order to avoid payroll taxes, if a company collects an "amount equivalent to rent (based on the property tax base)" from its officers and employees, or if the company “collects 50% of the rent”, it is not considered to be a sublease. On the other hand, if the company collects rent equivalent to the rent being paid by the company, it is regarded as a sublease.

Accordingly, corporate housing rented by a company will generally be eligible for rent support subsidies by meeting other requirements.

Although the contents of this article are also posted on the members' page of the Japan Federation of Certified Public Tax Accountants' Associations, there apparently are still some people who misunderstand this topic.

<cf. FAQ on Rent Support Subsidies>

https://www.meti.go.jp/covid-19/yachin-kyufu/qa.html (in Japanese)

Towards Company Structures where Illegal Acts do not Occur

Introduction

The uncovering of illegal acts by executives or other employees never ceases, regardless of the size of companies. Care is especially important at a time when the effects of a recession are beginning to take hold. It can be expected that employees will be forced to forgo salary increases and bonuses due to the effects of COVID-19. In such cases, managers must be on the lookout for possible irregularities carried out by executives or employees.

Effects of the New Coronavirus Shock

According to reports, due to the impact of COVID-19, listed companies’ April-June 2020 financial results are expected to show an overall 20% decrease in sales and a 70% drop in operating profits (which represent their main business profits), compared to the same period of the preceding year.

The pandemic caused both of these declines to widen from the January-March period, and on a quarterly basis, it appears to be the largest quarterly decline in 11 years - roughly equivalent to the April-June period of 2009 (drops of 23% in sales and 72% in operating profits) following ‘the Lehman Brothers shock’.

Under such conditions, many companies will have no choice but to put off regular pay raises. By the same token, bonuses will not be paid as usual.

Additionally, TV, newspaper and online news regarding economic upheaval will likely gradually worsen public anxiety. We can easily assume that this will cause more people to be concerned about the future.

Under such circumstances, managers will also have to pay attention to the possibility of illegal acts being carried out by executives and other employees.

It’s necessary to be aware that some executives or employees may resort to crime because of their personal difficulties.

Of course, there is no doubt that countermeasures need to be taken regardless of whether the economy is booming or depressed, but it is during recessions that we need to be especially careful.

Handling a Tax Return if Embezzlement is Discovered

When embezzlement by an executive or employee is discovered, the company seeks compensation for damages. However, there are many cases where the embezzlers have “spent much of their ill-gotten money on food and drink, etc.”

In such a situation, is it possible to record a bad debt loss? It is necessary to do so with caution.

In a past case, the court refused to allow recognition of bad debt losses in the fiscal year in which the claim for damages arose because it was not objectively clear that the "full amount" of the claim was uncollectible; this was due to the fact that even though the former employee who committed the fraud was insolvent with excess liabilities of 80 million yen, (s)he still owned a condominium, and had bank savings and other assets.

Considering the status of subsequent collection efforts and repayments, recording a bad debt loss in "the fiscal year in which it becomes apparent that the entire amount is uncollectible” is permitted.

Note that it is not "any fiscal year" after the fiscal year in which the loss is determined to be uncollectible which is used arbitrarily, but rather "the fiscal year in which it becomes clear that the entire amount is uncollectible”. Please be careful in this regard, as the matter is very complicated.

Company Mechanisms which Help Prevent Crimes from Occurring Need to be Set Up

Thus, even if there is embezzlement by a director or employee, the amount of the loss cannot be easily expensed.

Above all else, it is important to create systems through which such crimes are prevented. Let's try to establish structures which are based on the point of view of executives and employees, and do not cause them to be suspected of crimes.

What are Subordinated Capital Loans?

Introduction

Subordinated loans were introduced as a measure to support small & medium-sized enterprises (SMEs) whose operations have suffered due to the new coronavirus. What are subordinated capital loans? Let's learn about not only their merits, but also about their disadvantages, so as to not utilize them without due consideration.

What are Subordinated Capital Loans?

Subordinated capital loans (also called “capital-subordinated loans”) are loans which have a lower priority than general liabilities, such as in the event of corporate bankruptcy. If a company goes bankrupt, there is an order in which debts such as loans are collected.

Taxes and employee salaries are at the top of the list in the order in which they are collected. Subordinated capital loans will be the last loans to be collected after these payments have been made. Therefore, banks and other financial institutions often consider capital-subordinated loans as almost uncollectible.

This means such loans are considered to be similar to financing which is almost uncollectible, and therefore, they are like capital contributions, as funds that will not be repaid. This is why their name includes the word “capital".

Major Differences from Ordinary Loans

Subordinated capital loans are considered as capital even though they are loans.

Financing can help improve a company’s financial situation, if its capital is reinforced. Due to obtaining financing (through a subordinated capital loan), a company’s capital has been increased and its financial situation improves. On the other hand, normal loans are liabilities. As a result of getting a regular loan, the company's financial condition (its capital adequacy ratio) has deteriorated, due to the increase in its debt.

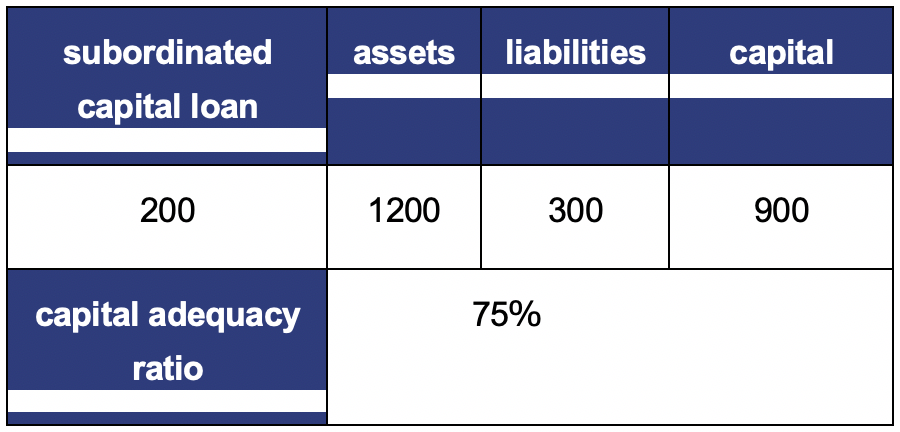

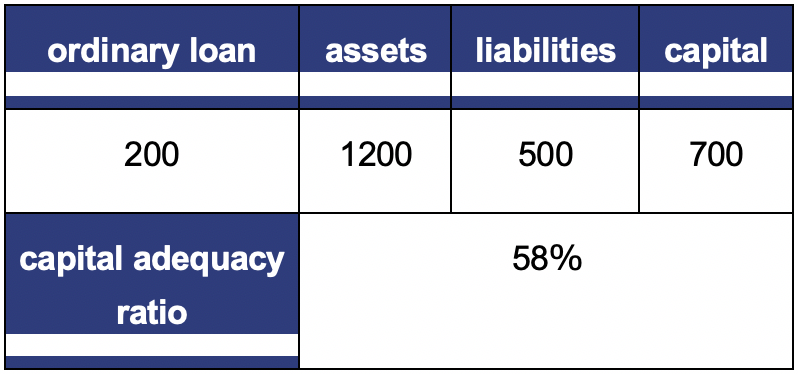

Suppose a company’s assets are 1,000 (units), liabilities are 300 and capital stock is 700 (resulting in a capital adequacy ratio of 70%) on an ordinary balance sheet. The firm borrows 200 units.

Via a Subordinated Capital Loan

Via an Ordinary Loan

Beware of Shortcomings

Though so far subordinated capital loans sound like a dream come true for a company, of course there are disadvantages as well.

The first disadvantage of capital-subordinated loans is the high interest rate. Since capital subordinated loans do not have priority for repayment, institutions which provide such financing will not lend on the same terms as regular loans. They usually require a higher rate of interest than regular loans do.

A second demerit is the long repayment period. Even if subordinated capital loans have a lower priority for payment in the event of bankruptcy or other situations, a loan is still a loan - it must be repaid.

In addition, repayment periods are longer than for regular loans, in order to extend the period of earning interest. This is because of the higher risk for the lender.

Thus, it is important to note that from a long-term view, capital-subordinated loans are a greater drain on the company's funds than are regular loans. These disadvantages should also be taken into account when considering whether or not to take out such a loan.