Take Care with Fixed Asset Tax Returns for 2021

Introduction

Regarding fixed asset taxes and city planning taxes for 2021, there is a possibility that your company will not need to pay them, or only will have to pay for half the normal amounts, if certain requirements are met.

Measures to Reduce Burdens resulting from Spread of COVID-19

The burden of fixed asset taxes and city planning taxes on commercial 家屋houses and depreciable assets might be lessened only for 2021 to support small and medium-sized enterprises whose sales decreased due to the new coronavirus, and/or measures taken to prevent its spread.

If a small or medium-sized enterprise, etc., whose sales for any consecutive three-month period during the February-October 2020 interval decreased by 30% or more compared to the same period of the previous year, follows the designated procedures by Monday, Feb. 1, 2021, then its tax base for fixed assets tax and city planning tax for 2021 will be set to zero, or else half the standard amount.

| decreased between 30% - 50% | 1/2 |

|---|---|

| decreased by 50% or more | zero |

Incidentally, requirements for rent support funds also include a drop in sales of 30% or more in a consecutive three-month period compared to the same period of the previous year. This applicable interval is between May to December 2020. Because this interval differs from that for fixed asset taxes and city planning taxes, care needs to be taken regarding these matters. The tax base for fixed assets tax and city planning tax being set to zero, or else half the standard amount, basically means that fixed assets tax and city planning tax are cut in half or to zero.

Assets on which Payments are Subject to Relief

Assets for which payments are subject to relief are commercial houses and depreciable assets. A dwelling owned by an individual as her/his personal residence, for instance, would not be included.

On the other hand, in a case where a person operates a real estate rental business as a sole proprietorship and lends a residential house as part of that business, if other requirements are met, the operator’s payments on that house would seemingly be eligible for relief.

In addition, when a residential house also serves as an office, payments for the office share are eligible; they are calculated based on the portion of the residence that is allocated to the business.

As only commercial houses and depreciable assets are eligible, land payments shall not be eligible for relief even if the land is used for business.

The Procedures

In specified districts in the Tokyo metropolis (the 23 wards), for instance, a tax return form called a “specific tax return” must be submitted to the Metropolitan Taxation Office by Monday, Feb. 1, 2021. Please note that if the due date passes, relief measures will no longer be available.

After mandatory fields are filled in, specific tax returns need to be submitted to support agencies for business innovation, etc. (“etc.” includes certified public tax accountants and tax accountant corporations) and be confirmed that requirements are met.

Though currently under modification, a system for filing electronically should be completed by the applicable deadline, so that returns can be filed not only using paper documents, but also through e-tax filing.

When is Income from Grants-in-Aid for Interest Expenses to be Recognized?

Introduction

As financing from central monetary institutions, special loans regarding COVID-19 are made to businesses which have suffered decreases in sales, to help them deal with the downturn due to the coronavirus pandemic.

Amounts Equivalent to Interest on Special Loans Eligible for Subsidies

The system for special grants-in-aid to cover interest payments aims to financially support business owners with aid equivalent to the amounts of interest - in the form of special lump-sum grants. Businesses are able to obtain virtually non-interest loans due to the subsidies.

Although it receives a lot of attention as interest-free financing, this doesn’t mean that no payments of interest are made. Instead, amounts equivalent to the interest paid are received as grants-in-aid, thus resulting in essentially no interest. In cases where your company has obtained the following kinds of loans, please confirm if the special subsidy system is applicable or not.

Loans subject to special grants-in-aid system (main loans)

| Central monetary institution | Special loan subject to special grants-in-aid for interest system |

|---|---|

| Japanese Finance Corporation (small and medium-sized enterprises) |

・special loans for COVID-19 |

| Japanese Finance Corporation (national life business) |

・special loans for COVID-19 ・special loans for COVID-19 for environmental sanitation business |

| Shoko Chukin Bank* | ・special loans for COVID-19 (crisis response loans) |

* means “Central Bank for Commercial and Industrial Cooperative”

Are Lump-Sum Deposits for Three Years Added as Gains When Received?

Generally, amounts received for expense compensation are required to be added as profits in the business year they are issued due to being confirmed income at the point they were issued, even if they will be allocated for expenses incurred in future business years.

On the other hand, the system for special grants-in-aid for interest expenses aims to convert a three-year term of a loan to one without interest payments being due. When provided, a one-time subsidy for three years of calculated interest is paid. Three years later, based on the actual interest payment amounts, the amount of the actual grant is determined. If there is a discrepancy between the original grant and the actual interest payments made, it is settled afterwards.

In other words, through the system for special grants-in-aid for interest expenses, the amount of actual income for the recipient is undecided at the time of the original grant. Whenever interest payments occur, it becomes necessary to book the interest amounts and the equivalent income amounts.

On the other hand, the system for special grants-in-aid for interest expenses aims to cover interest expenses, but the amount of income is undecided. Through one-time subsidies, the system helps convert a three-year term of a loan to one without interest payments being due; so when interest payments occur, it becomes necessary to book amounts equivalent to the subsidized interest as income.

In this case, as it is considered the grants-in-aid are simply being given temporarily, adding the amounts as income corresponding to each point in time during the three years is accepted as appropriate handling.

Journalizing Image

| grant-in-aid for interest 100 at time of receipt | |

|---|---|

| deposit 100 | advance received 100 |

| period X1 interest 40 at time of payment | |

| expense interest 40 | deposit 40 |

| advance received 40 | miscellaneous income 40 |

Journal Example when Using Coupons Common to Local Areas

Introduction

Under the “Go To Travel” campaign, besides travel expense subsidies, grant coupons common to local regions have started which are available for payments for goods, or eating & drinking at travel destinations. How are they to be journalized?

Coupons Common to the Area Do Not Apply to Discount of Goods

An amount equivalent to 70% (35% of travel costs) of subsidies by the national government called “Go To Travel” to support travelers should be allocated to travel expenses, and the remaining amount equivalent to 30% (15% of travel costs) should be granted to travelers as coupons common to the local area for use in payment for goods, etc. at souvenir shops, etc. at the travel destination.

Coupons common to local areas are a system whereby the government bears part of the costs for the goods that travelers buy with the coupons at shops which handle them.

In such a case, regarding consumption tax, similar to the application of the travel expenses, the total amount of the selling prices of goods should be subject to tax without the amount of consideration (including cash or coupons) changing.

As an example, suppose that when you go on a business trip and buy 5,400 yen (including tax, at the lower tax rate of 8%) - of goods as gifts for a customer, you pay by using five coupons worth ¥1,000 each, plus 400 yen in cash.

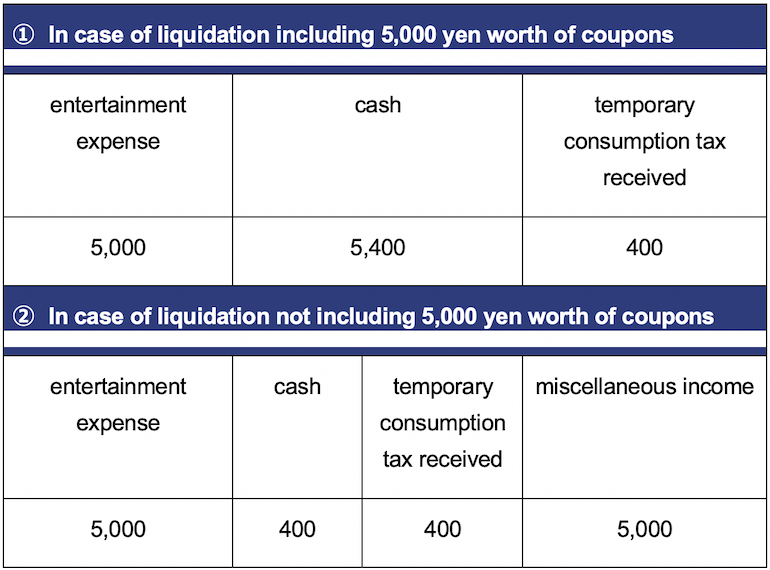

In this case, the amount including tax of taxable purchases will be 5,400 yen a company should add as entertainment expense. As for the shop selling the merchandise, it should include the amount of the taxable sales - i.e., ¥5,000 - excluding tax.

Regarding the account processing for ¥5,000 worth of coupons, companies generally reimburse employee traveling expenses, including this ¥5,000 for the employee. If not, the value of the coupons used should be added as miscellaneous income (consumption tax is not taxable).

Coupons are not Equivalent to Discounts on Goods

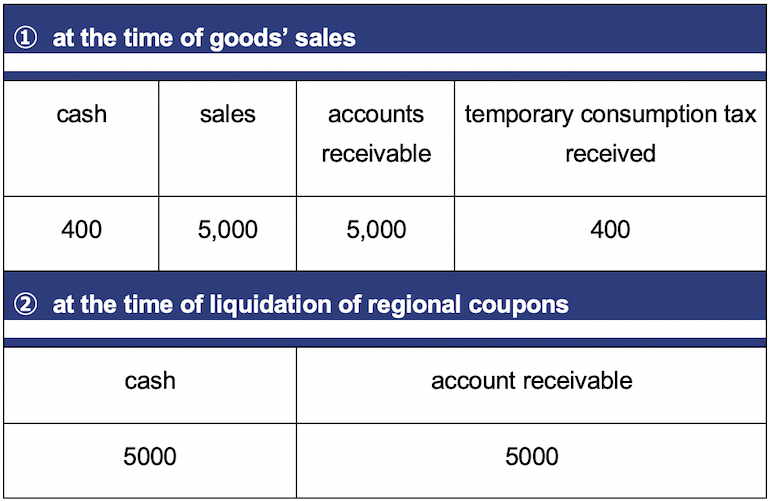

Store’s Journal Entries

Purchaser’s Journal Entries

(consumption tax is non-taxable)

Thinking about Cases where Amounts of Change Would Normally Be Received

There are two types of coupons common to local areas - via print medium and electronic medium. Neither type provides change to a purchaser who buys less than the coupon amount.

It should be noted that when the amount of the coupons which a purchaser pays with is larger than the sales price of the goods bought, the consumption tax depends on how the sales price of goods is displayed on the receipt, etc.