Don’t Forget to Account for Employment Adjustment Subsidies

Introduction

Many people seemingly applied for employment adjustment subsidies due to the effects of COVID-19. When receiving them, one must be aware of some points regarding financial statements. It takes some time from an application until the payment is actually wired to an applicant, and the time lag can cause a problem.

Overview of Subsidies for Employment Adjustments

Subsidies for employment adjustments are to support a portion of employee leave payments and wages, etc., when employers who have been forced to downsize due to economic reasons because of COVID-19, carry out employment adjustments by putting employees on temporary leave while maintaining their employment based on labor-management agreements.

The employment adjustment subsidy system existed previously, but it has been in the spotlight due to the economic effects of COVID-19. Various special measures have been taken during an urgent response period; also, the effective interval for such measures originally scheduled to conclude at the end of December 2020 has been extended to the end of February 2021.

When to Account for Income from Employment Adjustment Subsidies?

Regarding the accounting periods for income from grants and subsidies, there are two ways they are treated. One way is a kind of financial incentive that is provided when certain criterion are met. Regarding this type, it should be accounted for when notice is received of the decision to provide it. In subsidies related to COVID-19, sustainability subsidies and rent support funds would fall under this category.

In contrast, the way of handling subsidies such as employment adjustment subsidies is different, as they are intended to compensate for a share of expenses. Employment adjustment subsidy amounts must be accounted for through estimates when employees are put on leave, as leaves are a reason for the subsidies being authorized.

Even if subsidies haven’t been applied for - let alone paid - it is required that they be recognized as income when the employee leaves occur.

For instance, when a company which settles accounts in December applies for employment adjustment subsidies for December’s wages, and if its employees’ wages are included in expenses, then the firm must account for the income from those corresponding subsidies. The same is true in a situation where the subsidies haven’t yet been received at the end of December.

How the Subsides are Handled in Practice

In this way, employment adjustment subsidies could be said to have a characteristic of reimbursing leave allowances for employees.

Even if the concrete amount for a subsidy hasn’t been decided for the business fiscal year in which the day(s) of the leave resulting in the subsidy fell, the amount of the subsidy needs to be estimated and accounted for as expected income in that fiscal year.

Practically, it should be accounted for as the subsidy amount listed on the application form for the employment adjustment subsidy.

Because employment adjustment subsidies are included in the work of a certified social insurance labor consultant, it can be easily imagined that a tax accountant might fail to account for the estimated income amounts to be received from subsidies due to not knowing that the subsidies were applied for.

Please be sure to contact a person in charge of tax matters if you have applied for an employment adjustment subsidy, but not yet received it.

2021 Japan Tax Reform Proposals Determined

Introduction

Japan’s tax reform proposals for 2021 have been decided. Let’s check what kinds of revisions have been made.

Tax System for Promoting Research & Development, etc. for Large Enterprises

Points concerning large enterprises include changes in the tax system for promoting research and development, as well as the establishment of a tax system for supporting capital investment aimed at achieving carbon neutrality by 2050 (global warming countermeasures) and promoting DX investment.

In addition, for a fixed interval, a special system will be established that raises the upper limit for deductions of past loss carryforwards. It will be for companies working on carbon-neutral businesses, DX, business restructuring, etc., and will allow them to deduct more than the current limit of 50% of taxable income for large enterprises.

Wage Increases-Supporting Tax System and Reduced Tax Rates for SMEs

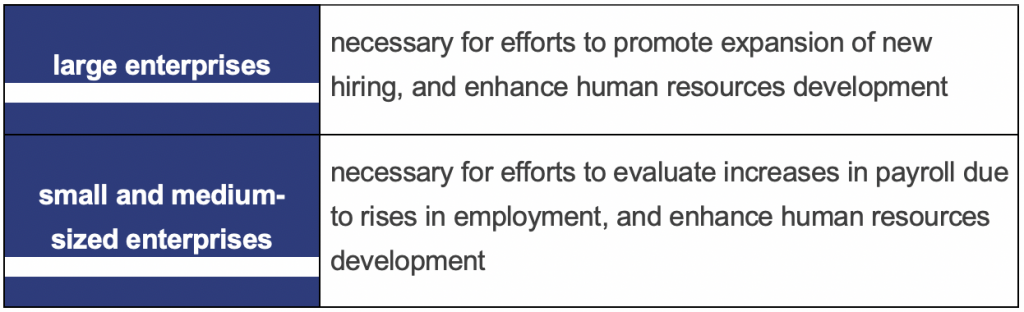

It has been decided to review the systems for large companies and for small and medium-sized enterprises (SMEs) regarding “tax systems pertaining to wage increases and investment promotion”. This will allow tax deductions in cases employee wages are increased at or above a fixed ratio.

Furthermore, the “special corporate tax rate for small and middle-sized enterprises” (reducing the corporate tax rate to 15% for the portion of income up to 8 million yen) until March 31, 2021, has had its effective period extended for two years.

It seems that there were many calls to extend the applicable period of the special system, which was introduced after the bankruptcy of Lehman Brothers, in view of the current economic situation.

Deductions for Housing Loans on Income Tax Returns

Regarding income tax, the special measure for deductions of housing loans, which was introduced at the time the consumption tax was upwardly revised to 10%, has had its deduction period extended for three years.

The measure will now be also applied to housing acquired during the period from January 1, 2021 to the end of December 2022, after originally applying to housing acquired through the end of December 2020. However, it is required to conclude a contract during the fixed period.

Also, the deduction of housing loans originally required floor area of over 50㎡; however, now it will be applied even if the housing has a floor area of 40㎡ - 50㎡, in cases where the owner earns less than a certain income.

Revision Regarding Donations of Money for Education

Problems were pointed out, and revisions considered, for a couple of temporary measures applicable through the end of March 2021. One is “tax relief treatment of gift tax pertaining to bulk gifts of education loans”, which exempts educational loans up to 15 million yen, and the other is “tax relief treatment of gift tax pertaining to bulk gifts of childcare and marriage funds”, exempting up to 10 million yen, when parents or grandparents open an account in the name of their children or grandchildren at an educational institution, and contribute a lump sum.

The applicable period will be extended for two years. On the other hand, donations shall become subject to inheritance tax when a giver passes away, if certain criteria are met. Additionally, in cases of donations to grandchildren, a 20% inheritance tax shall be added.

The Wealthy, Overseas Investors, and Internet Businesses Need to Take Care

Introduction

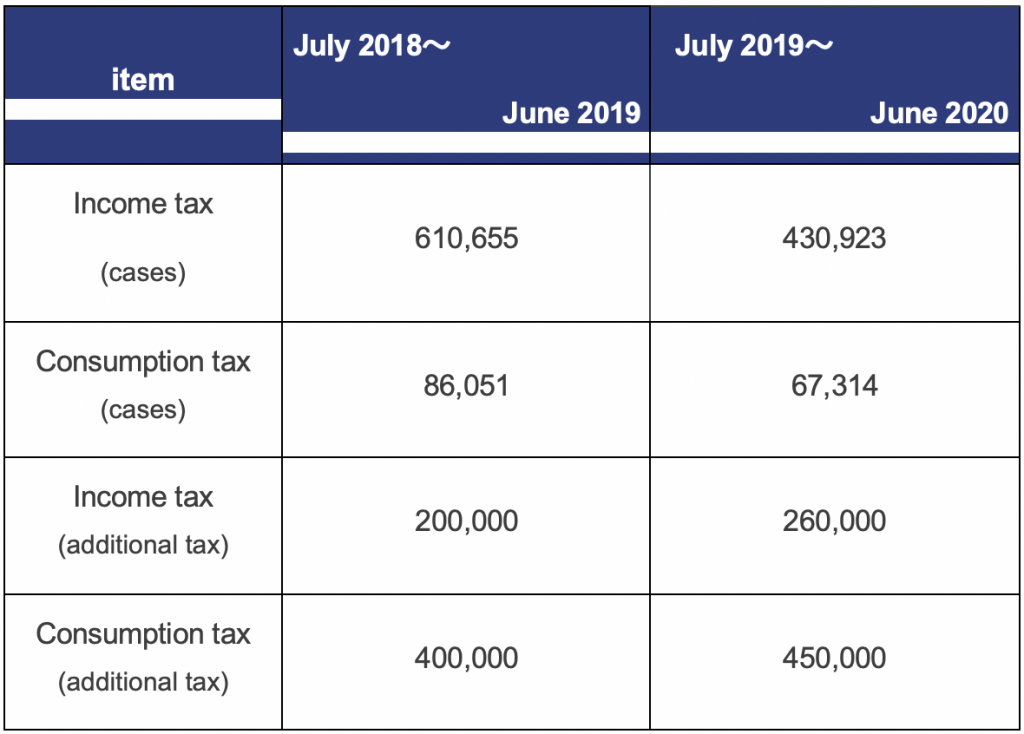

National Tax Agency announced research on the situations regarding income taxes and consumption taxes of solo proprietors from July 2019 through June 2020. It is possible to shed light on the fields the NTA has been focusing on by checking the data from past tax audits, to ascertain where one needs to pay special attention in regards to declarations.

Audit Cases Decreased Significantly

The number of audit cases from July 2019 to June 2020 fell significantly, partly due to the impact of COVID-19. Income tax-related audits were 430,923 cases (equal to 70.6% of the number from the same period of the previous year), whereas cases regarding consumption taxes of solo proprietors numbered (78.2% of the prior year’s number). On the other hand, the amounts of additional tax per average case for both income tax (260,000 yen; 130% of the prior year) and consumption tax (450,000 yen, 112.5%) rose.

Also, regarding taxes on capital gains, which tend to be high in the area of income tax, both the number of audits (13,221, 63.6% of the prior year’s number) and the amounts of undeclared income (110.6 billion yen; 72.5%) decreased. On the other hand, the undeclared income per case increased (8.36 million; 113.9%). It could be said that more efficient investigations were conducted, as additional tax generated per case increased, though the case numbers themselves decreased.

Additional Taxes on the Wealthy Classes and Individuals Investing Overseas Reach Record Highs

The number of audit cases of the “wealthy classes”, such as large-scale owners of securities and/or real estate, decreased; however, both undeclared income and additional tax reached record highs.

As “wealthy classes” deal with large amounts, in cases where income has gone undeclared, additional taxes tend to also be large amounts.

In addition, for individuals who invest overseas, both total and amount per taxpayer reached record highs after investigations were conducted utilizing statements of overseas wire transfers, etc. (statements that financial institutions prepare and submit in case of remittances to/from overseas), and CRS information (a system to exchange financial account information automatically to prevent global tax avoidance).

Even income earned abroad is subject to tax declaration/payment, as long as the filer is a resident of Japan. The idea that, ‘If only a little bit, it won’t be discovered.’ is not accepted.

Undeclared Income from Internet Businesses also Increased

Both audits and undeclared income for individuals operating Internet businesses including economic activities in new fields such as the ‘sharing economy’ are decreasing, but undeclared income per case has increased greatly. It has become clear that around 90% of audit cases failed to file a return, a state of ‘failure to file’. If an operator has continuously obtained profits through reselling and so on, naturally they are required to file tax returns and make tax payments.

Regarding Internet-based businesses, a team of specialists at the Regional Taxation Bureau examines them carefully. Therefore, it would be overly optimistic for a filer to think that simply because no payment record(s) was issued for profits they made, that they won’t be found out if they don’t file a tax return.