Subsidies for Business Restructurings Determined

Introduction

The third supplementary budget was enacted, and the determination was made to introduce subsidies for business restructurings. Below is a general conceptual outline.

Government to Subsidize ‘Post-COVID-19’ & ‘With-COVID-19’ Responses

In order to cope with the new social situation in the post-COVID-19 & ‘with-COVID-19’ periods, subsidies for business restructurings of up to 100 million yen are being provided to small and medium-sized enterprises (SMEs) that are trying to enhance their productivity by shifting to different industries and/or business categories, or restructuring their businesses.

The main feature of this subsidy is its amount - up to 100 million yen. This should definitely be a motivator for companies that are considering entering into new businesses or changing their business models in order to respond to the economic and social changes caused by the new coronavirus infections.

However, it is important to note that, in principle, the subsidy will be paid after the project is completed, so the company must first procure the project funding on its own.

The application process starts in March, and after an application is accepted and a subsidy is decided, the subsidy project starts. After the project has progressed for about one year, and the results of the project are reported, the subsidy will be paid. The actual payment of the subsidy will take a little longer.

Specific Application Examples

The updated booklet on the homepage of the Ministry of Economy, Trade and Industry indicates fifteen cases by industry as specific application examples.

For example, in the food and beverage industry, which is one of the industries most affected by COVID-19, the following can be mentioned:

| ① | Building renovation and equipment costs to reduce the size of the restaurant space, and start new takeout sales; |

| ② | Costs of implementing an online-only ordering service system to meet home delivery and take-out demand; |

| ③ | Costs for renovation of stores to implement drive-in style takeout sales of meals; |

| ④ | Advertising expenses for the launch of a new meal delivery business for the elderly. |

Even such a small change in industry or business category may be eligible for subsidies. Other examples include the cost of installing a system to sell clothes online for retailers, or the cost of advertising for service providers (for instance, online yoga classes - which generally have been held in a studio.

Requirements and Subsidy Amounts

The amounts of subsidies for small and mid-size enterprises (SMEs) range from 1 million to 60 million yen, and the subsidy rate rises to two-thirds (2/3). In addition, in the ‘SME graduation’ category (where a company increases in size, becoming a larger entity), companies which meet certain requirements for a special category can receive a maximum of 100 million yen. The requirements for SME subsidies are:

| ① | Total sales for any three months in the six months prior to the subsidy application must have decreased by 10% or more compared to the total sales for the same three months before COVID-19 emerged. |

| ② | Formulate a business plan with a certified management innovation support organization or financial institution, and work on restructuring the business. |

| ③ | The subsidized business achieves an average annual increase of 3% or more in the amount of value added, or an average annual increase of at least 3% in value added per employee, within three to five years after the end of the subsidy. |

Also, a special emergency declarations-related category is planned for establishment for companies whose sales in any month from January to March 2021 are down by 30% or more compared to the same month of the previous year or two years prior.

National Tax Agency Guidance on Expenses Incurred Working from Home

Introduction

Following is an explanation of how to deal with allowances for employees working from home (telecommuting), and commuting allowances, based on the "FAQ (with Regard to Withholding Income Tax) on Expenses Incurred Related to Telecommuting" guidelines released by the National Tax Agency.

In Principle, Payroll Taxation is Applied to Uniform Payments.

Q: Some companies are gradually starting to provide ‘working from home’ (telecommuting) allowances, such as Panasonic Corporation's decision to provide 3,000 yen per month for telecommuting starting in April. If a company provides a telecommuting allowance to all its employees, how will it be handled?

A: Telecommuting allowances paid uniformly are basically subject to payroll taxation. On the other hand, no taxes are required if the expenses for the "business use portion" are paid via reimbursement of actual expenses. The FAQ document shows a simple method of calculating the "business use portion" of telecommunication and electricity expenses.

Communications Expenses are Exempt from Tax for 1/2 the Number of Days Workers Work fromHome.

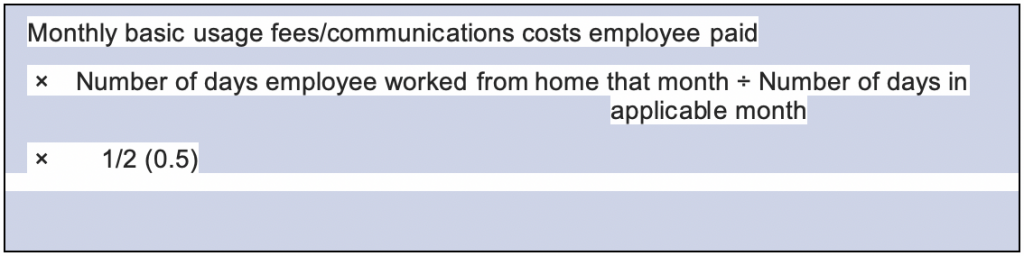

For certain types of communications expenses, one-half (1/2) of the expenses for telecommuting days can be considered as part of business use. For example, if a company pays its employees for communications costs incurred for Internet access, as calculated according to the following formula, then the company is not required to tax those payments as salary to those employees.

Regarding telephone charges, like Net communications expenses, when a company pays its employees the basic usage fees for the employees’ phones calculated using the above equation, the fee reimbursements shall not be taxed as employment income. Furthermore, for “employees engaged in work utilizing frequent business calls”, not taxing payments for calling charges which are calculated using the same equation will not be a problem.

Electricity Charges are Prorated by Floor Space, etc.

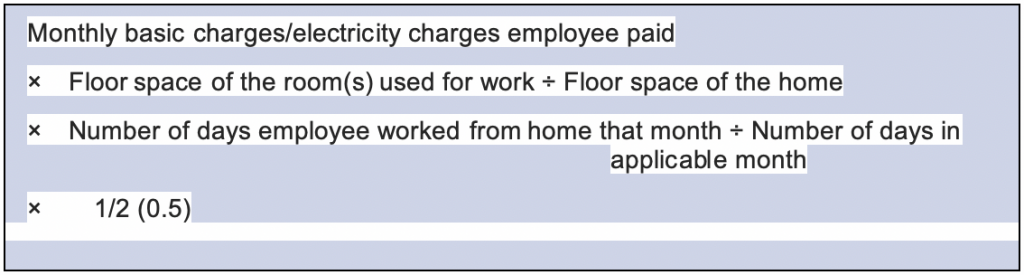

An equation is also available for electricity charges. The business use portion is calculated based on the "floor space of the room(s) used for work”, etc., as a percentage of the "floor space of the home”.

In this way, methods of calculating communications and electricity costs, etc., which do not need to be taxed as payroll, have been published. However, calculating these amounts for each employee is a very complicated procedure, in reality, many companies will probably pay flat amounts even if they are taxed as salaries.

Commuting Allowances Remain Tax-Free.

As mentioned above, only the portion of the telecommuting allowance that is used for business purposes is untaxed. On the other hand, commuting allowances do not need to be prorated based on the number of work days in a month.

Regarding commuting allowances, even if the number of times employees go to the office is reduced as a result of the COVID-19 situation, no prorated calculation will be required, and they remain tax-exempt. However, if telecommuting is adopted, as a general rule, at a company, and employees end up not being expected to go to the office, the same commuting allowance as before may be subject to salary taxation.