Relaxed Requirements for Application of the Income Expansion Promotion Taxation System

Introduction

As a result of the tax reform of fiscal year 2021, the requirements for the Income Expansion Promotion Taxation System (the Tax System Supporting Income Growth for Employees of SMEs) - which allows companies to receive a special tax credit for corporate tax purposes when they raise wages - have been relaxed. The hurdles for small and medium-sized companies to apply for the Income Expansion Tax Credit have been lowered, making it easier for them to take advantage of the new system.

Major Revisions

As a result of the tax reform in FY 2021, the requirements for the "Wage Increases and Investment Promotion Taxation System” for large companies and the "Income Expansion Promotion Taxation System” for SMEs have been significantly revised.

In this section, we would like to summarize the Income Expansion Promotion Taxation System for SMEs. Note that the amendments will apply to fiscal years beginning on or after April 1, 2021, so for companies with fiscal years ending in March, the amendments will be effective from the fiscal year ending in March 2022.

The maximum amount of the special tax credit that can be obtained by applying the Income Expansion Promotion Taxation System is equivalent to 15% of the increase in the total amount of salaries and bonuses paid to employees in the fiscal year in which the tax credit is to be applied. So if the total amount of salaries and bonuses increased by 1,000,000 yen compared to the previous year, the tax credit would be 150,000 yen.

Special tax credit limit

(Amount of salaries and wages paid to employees - Amount of salaries and wages paid to comparable employees) x 15%

Requirements for Application Simplified

After the amendments, the requirements for application of the "Income Expansion Promotion Taxation System" are as follows:

Requirements for application:

(Salaries and wages paid to employees - Salaries and wages paid to comparable employees) / (Salaries and wages paid to comparable employees) = 1.5%

The above requirement, simply put, means that the total salaries and bonuses paid to employees should have increased by at least 1.5% compared to the previous year.

Basically, all you need to do is to compare the total amount of salaries & bonuses paid to employees on the income statement and manufacturing cost report with the previous year’s amounts to determine if the requirements were met.

The Requirements Before the Amendments

In the past, the requirements for the application of the "Income Expansion Promotion Taxation System" were not as simple as the above. The total amount of salaries and bonuses paid to continually-employed staff (employees who received payments for all months from the beginning of the previous year to the end of the applicable year, and met certain requirements) had to increase by at least 1.5% compared to the previous year. Of the total amounts of employee salaries and bonuses paid on the income statement and production cost report, the amounts paid to continuing employees had to be extracted.

The extraction of the amounts paid to continually-employed personnel required a lot of time and effort, since it was necessary to check the conditions for enrollment in employment insurance, such as the exclusion of older employees and day laborers, since continually-employed staff must be those who are insured under the general employment insurance system.

With the 2021 tax reform, that extraction of the amounts paid to continually-employed personnel will no longer be necessary, and the eligibility requirements can be determined based on salaries and bonuses for all employees. This will not only reduce the administrative burden, but also lower the hurdle for the application requirements.

About the IT Introduction Subsidy of 2021

Introduction

While much attention has been focused on business restructuring subsidies, the 2021 version of IT introduction subsidies has also been released. The Small and Medium Enterprise Agency (SMBA) has created a low-infection-risk business category for “IT introduction subsidies 2021”. The first round of deadlines has already ended, but they are planning to set three or four deadlines in total.

A Budget of 230 Billion Yen

The low-infection-risk business category of the IT introduction subsidy of 2021 will support businesses that introduce IT tools that improve labor productivity, make work less face-to-face, and reduce the risk of infection from the new coronavirus infection, by raising the maximum subsidy rate to two-thirds {2/3} (compared to one-half {1/2} in the regular category). The subsidy will be funded by 230 billion yen allocated in the third supplementary budget for fiscal 2020.

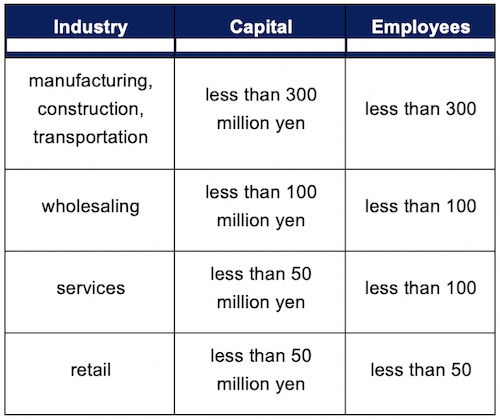

The subsidies are available to small and medium-sized enterprises (SMEs) and small businesses that meet the capital and number-of-employees requirements specified for each industry. Typical examples are listed below.

Applications for PC Rentals Alone are Not Acceptable.

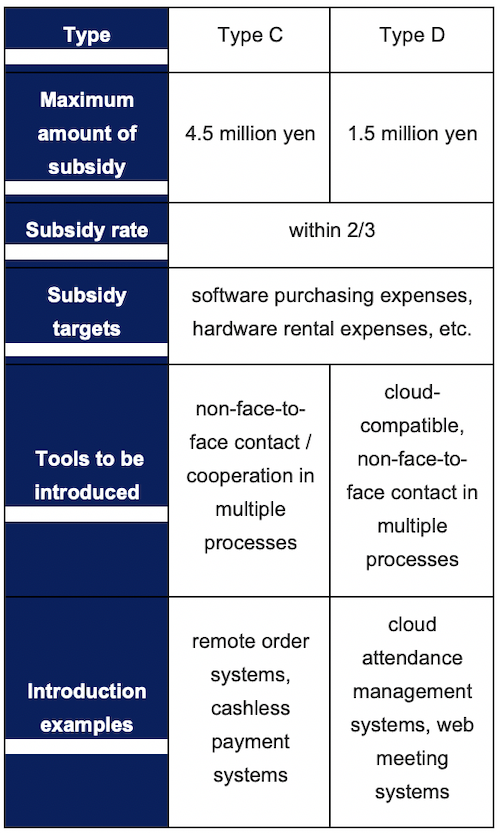

The table below shows a comparison between Type C and Type D. A feature of Categories C & D is that the costs of hardware rentals, such as PCs and tablets, are eligible for subsidies.

However, it is not possible to apply for subsidies based on hardware rentals alone - an applicant must apply for and introduce software that includes at least two elements of the productivity improvement processes described below.

Productivity Improvement Processes

- Customer service and sales support

- Settlement, receivables and payables, and fund collection management

- Procurement, supply, inventory, and logistics

- Accounting, management, and finance

- General affairs, human resources, payroll, labor relations, education and training, legal affairs, and information systems

- Business-specific

- General-purpose, automation, and analysis tools

IT tools, such as software and hardware, must be registered with the secretariat in advance by the IT introduction support business operator for all categories. The implementation of the IT tools, payment, etc. will take place after the decision to grant a subsidy is made.

IT Introduction Subsidy 2020 Recipients are Also Eligible

Only one type of subsidy can be applied for per company, so it is not possible to apply for both Type C and Type D subsidies. However, if your application is not accepted, you can apply again by the next deadline.

May There be Cuts to the Tax-Exempt Portions of Certain Long-Term Care Insurance Plan Payments?

Introduction

It has historically been the case that tax-saving schemes using various types of private insurance eventually become a problem, and then they are dealt with. It seems that the National Tax Agency (NTA) is also watching developments in certain long-term care insurance plans. If you receive an insurance plan solicitation, please understand such circumstances when considering whether or not to sign a contract.

If a Relative of the Insured Person is the Beneficiary?

Private insurance companies usually offer long-term care insurance policies that allow the insured person to receive insurance benefits when that person falls into a certain condition requiring nursing care.

Recently, however, there are some products that allow the insured individual's children or other relatives to be the beneficiaries of the insurance money, instead of the insured person.

Insurance benefits received in the event of a nursing care condition are exempt from taxation; this is because "payments based on bodily injury" are considered tax-exempt. The insured person’s income is not subject to income tax.

Furthermore, according to an NTA notification, even if a recipient is not the insured individual, if a certain relative such as a spouse or a child receives the insurance money, it is treated as tax-exempt - just as if it were received by the insured himself/herself.

However, there are some people who think that they can use the notification to give money to their relatives tax-free, by setting relatives as beneficiaries based on long-term care insurance policies that pay large amounts of money when compared to the expected costs of long-term care. By doing so, they seemingly believe that their relatives will not be subject to either income tax or gift tax.

The Possibility of Being Subject to Taxation

However, the reason why long-term care insurance money is exempt from income tax is that the insurance money is paid to make up for losses such as nursing care expenses caused by physical injuries. As a result, the tax burden does not increase even if payments are received.

Because of this, the above notification also exempts from taxation certain relatives, such as spouses, who are expected to bear the costs of nursing care from the same ‘purse’ into which insurance payments are received.

In cases where the insurance payment(s) is large compared to the nursing care expenses expected for a relatively minor nursing care condition, and the beneficiary is a relative of the insured for the main purpose of reducing the tax burden, the insurance is not considered to be actual “insurance” as envisioned in laws, ordinances or general notices. Therefore, the income received might not be treated as being tax-exempt.

In such a case, the insurance beneficiary may be taxed for a receipt of temporary income. Of course, this does not mean that every beneficiary who is a relative of an insured person is taxed; the decision will be made based on the specific contract.

Beware of Insurance Sales Talk!

As stated above, looking at the notification alone, it would appear that if a relative of the insured is the recipient of the nursing care insurance payment, the money would be unconditionally exempt from taxation.

However, in the first place, in applying the notification, judgment must be made based on the individual facts, taking into consideration the purport of the laws/regulations. Believing whatever an insurance company tells you is risky, so you need to make a careful judgment.