Invoice System Preparation Checklist Published

Introduction

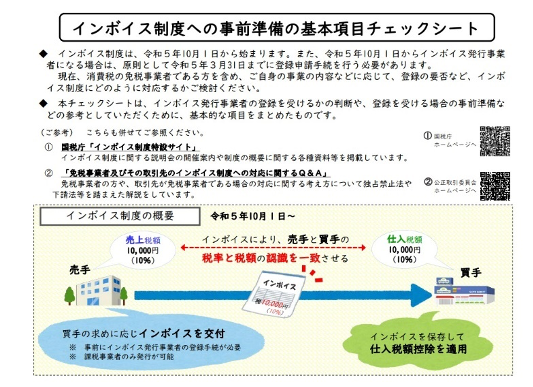

On September 22, the National Tax Agency (NTA) released the "Check Sheet of Basic Items for Advance Preparation for the Invoice System“. This month we'll discuss the check sheet (checklist) released by the NTA, as it may be of help for those who are unsure of what exactly they need to prepare. It is now less than a year until the start of the invoice system, so let's take solid measures.

Even Tax-exempt Businesses Need to Consider Registration

The checklist published by the NTA is divided into a registration section, a section for sellers, and a section for buyers, with items to consider and pay attention to from each perspective. Since businesses usually act as both a seller and a buyer, depending on each transaction, it is necessary to check the points to be noted from each perspective.

The registration section states that whether or not to be registered as an invoice-issuing business operator is at the discretion of the business, and that even if a business is exempt from consumption tax, it is necessary to consider the impact of being registered or not.

If your company is liable for consumption tax, it is unlikely that you will hesitate in deciding whether or not to register as an invoice-issuing business operator. For tax-exempt businesses, however, whether or not they choose to become a taxable business operator and register as an invoice-issuing business will have a significant impact on their future administrative procedures. Please note that even if your company is already a taxable business in regards to consumption tax, in principle you cannot become an invoice-issuing business operator unless you submit an application for registration by March 31, 2023.

Points to Check as a Seller

In the sellers’ section, as an invoice-issuing business, in order to fulfill the obligation of delivering an invoice, it is important to consider what documents are currently being delivered for each transaction, how to review the documents being delivered to determine whether they qualify as invoices, and to align one’s understanding with that of business partners regarding the registration, and what constitutes an invoice.

The invoice must include information such as the registration number, applicable tax rate, and consumption tax amount. If the consumption tax amount includes a fraction of one yen, the fraction is to be processed "once per tax rate per invoice". Please check the invoice format again.

In addition, businesses that were previously exempt from consumption tax will become taxable businesses upon registration, so it is also necessary to confirm whether or not the prices of goods and services will be reviewed when taking into account the consumption tax.

What to Watch Out for as a Buyer

The buyers’ section states that when filing a tax return under general taxation, it is necessary to confirm in advance whether the invoices, etc. received for the purpose of applying the credit for taxable purchases meet the description requirements, and to consider in advance how to store and manage the invoices, etc. received. It is important to make sure that invoices can be managed separately with or without invoice numbers when supplementing and managing invoices, etc. Please take a look at the check sheet published by the National Tax Agency as well.

https://www.nk-net.co.jp/nisiyodogawa/assets/files/taxinfo/09.pdf

Regarding Storage of Credit Card Statements

Introduction

Credit card statements are getting a lot of attention during preparation for the start of the invoice system. We have seen some misunderstandings about the storage of credit card statements, so let's take a look at that topic again.

Q: If I save my credit card statements, will I no longer need individual receipts?

A: Unfortunately, that is not the case. Even at this stage, before the start of the invoice system, such a method of document storage is not allowed.

Provisions of Corporate Tax Law

A corporation is required to keep books of account to record its transactions, and to preserve such books of account and documents prepared or received with respect to transactions, etc. for at least seven years from the day following the due date of filing the tax return for that fiscal year.

In the case of corporate tax law, if the payment amount, payment date, payee's name and address, and reason for payment can be confirmed in books such as the general ledger and journal ledger, the expense will not be immediately disallowed even if the receipt itself is not preserved.

* Of course, having the receipts, etc. is always best.

Therefore, even if you did not keep receipts for certain expenses paid using a corporate credit card, if you know the above information items from the credit card statements, there is no reason why the expenses cannot be charged off as long as you enter such information in your books of account. So, it is considered to be meaningful to keep credit card statements.

Provisions of the Consumption Tax Law

On the other hand, the Consumption Tax Law requires the preservation of books and invoices, etc. as a requirement for deducting purchase taxes, and in the case of transactions for which invoices are not issued, receipts will be considered as invoices, etc.

The following are required on such invoices, etc.:

- Name or title of the person who prepared the document

- Date of transaction

- Transaction details

- Amount of transaction

- Name or title of the business entity to which the documents are issued

It has been clarified that credit card statements are delivered by credit card companies to their card users, and are not documents prepared and delivered by the businesses that sold goods or services to the card users; thus they do not constitute the above invoices, etc. required under the Consumption Tax Law.

Therefore, under the Consumption Tax Law, there is no particular significance in the preservation of credit card statements. Rather, the preservation of individual receipts for payments made using credit cards is required.

The Same Under the Invoice System

There is no change regarding the above point even under the invoice system. Since the statement delivered by the credit card company is not issued by the client and does not contain the information that satisfies the requirements for an invoice, it is necessary to preserve the receipts issued by the shop, etc.

Even at present, we are not hearing of the credit card industry taking any actions such as including the information as invoices on the statements issued by credit card companies.

Businesses that have only been storing credit card statements should consider taking immediate action.

About Bank Collateral

Introduction

When you apply for a loan at a bank, you may be asked to pledge collateral. This section will explain about bank collateral, to assist in learning about collateral that banks require, including what kinds of assets are suitable and how they are evaluated.

Why Collateral?

When one applies for a loan from a bank, the applicant may be asked to pledge collateral. If the bank has collateral against the loan, it can convert the collateral into money to pay off the loan if it is not repaid in the future. In some cases, collateral is pledged against the bank's original loan, while in other cases, collateral is pledged against a loan guaranteed by a guarantee association.

There are many different things that can be used as collateral. Representative of a common type of collateral for bank loans is real estate. Also, deposits and securities are often pledged for such loans. Other types of collateral can include inventories of goods or products, accounts receivable, machinery, etc., but these are not often used as collateral for bank loans.

For example, if a company has received a loan of 70 million yen from Bank A, and has pledged real estate that can be sold for 50 million yen to the bank as collateral, if the company is unable to repay the loan, the bank can recover 50 million yen by selling the real estate. So the bank's loss due to the bad debt would be only 20 million yen.

If there were no collateral, the bank's loss would be the full 70 million yen. Thus, banks require collateral in case borrowers become unable to repay loans.

How Collateral is Evaluated

A bank evaluates how much an asset pledged as collateral is worth. The higher the value of the collateral, the easier it is for the bank to provide a larger loan. How do banks evaluate the value of collateral?

First, real estate includes land and buildings. In many cases, banks work with real estate appraisers to calculate the collateral value of real estate.

Although different banks use different methods to evaluate real estate, for land, the actual value is determined based on the inheritance tax assessed value, posted value, etc., and the collateral value is evaluated by multiplying this value by a certain multiplier. If a borrower is unable to repay the loan and the lending bank conducts an auction, it is not always possible to sell the property at the prevailing price; therefore, a bank considers the collateral value to be a lower value - i.e., the prevailing price multiplied by a multiplier. Generally, the multiplier is around 70%.

[Collateral multipliers]

When a financial institution lends, it calculates the value of the collateral (real estate, stocks, etc.), then multiplies this collateral value by a certain percentage (e.g., 100% for deposits, 80%-90% for stocks of blue-chip listed companies, up to 80% for real estate, etc.), and often lends up to that resulting amount.

Next is deposits. For deposits, it is very simple. The amount of a deposit itself becomes the valuation.

Finally, securities are often used as collateral. These include stocks of listed companies, corporate bonds, government bonds, and municipal bonds. Among these, stocks of listed companies and government bonds are generally used. The valuations of securities used as collateral varies from bank to bank, but the standard value for listed company stocks is 50% of the stock price, and for government bonds, 95% of the face value. Since stock prices fluctuate widely, banks tend to consider a multiplier around 50%, to protect themselves even if the stock prices were to fall to half their current level.