Proposals for Revising the Invoice System

Introduction

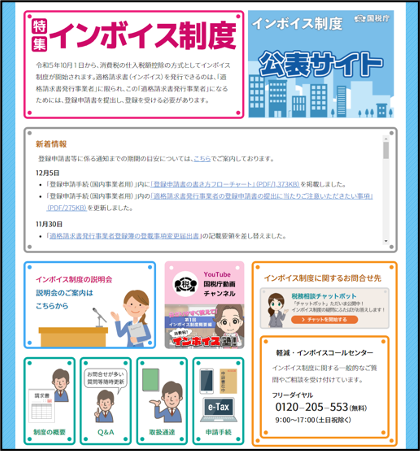

The invoice system will finally start in October 2023. Three proposed revisions to the invoice system for small businesses are discussed here. Let's examine their contents.

New Measures Regarding the Invoice System

The following three revision proposals are being debated for the smooth implementation of the invoice system for consumption tax, which will start on October 1, 2023.

Proposed revision measure #1 pertains to a special exception for tax-exempt businesses that elect to become taxable businesses when introducing the invoice system. In such cases, the amount of tax payment would be reduced to 20% of the amount of tax on sales. The plan is for it to be implemented for three years, for small businesses with taxable sales of 10 million yen or less in the base period (i.e., two years prior / two fiscal years prior).

The amount of consumption tax that each company would have to pay if it chooses to become a taxable business would vary. However, the amount of tax payment would be reduced to 20% of the consumption tax deposited. This can be said to be a very advantageous measure for small businesses.

Proposed Revision Measure Affecting Many Businesses

Proposal #2 is a measure applicable to businesses with taxable sales of 100 million yen or less in the base period (two years prior/two fiscal years prior), which would allow taxable purchases of less than 10,000 yen to be credited against purchase taxes even if invoices are not kept, so long as pertinent entries have been made in the books of account.

Under the current system, for taxable purchases of less than 30,000yen, purchase tax credits are allowed as long as books of account are kept - even if receipts or other documents are not preserved. On the other hand, under the invoice system, in principle it will be required that an invoice must be preserved in order to apply for the credit for taxable purchases - regardless of the size of the purchase. However, it is now expected that taxable purchases under 10,000 yen will not require storage of receipts.

The invoice system will be introduced over a period of six years from its implementation.

Small Return Invoices No Longer Required

Proposal #3 addresses concerns that amounts equivalent to transfer fees and other expenses deducted for the buyer's convenience at the time of settlement, etc., will become a new administrative burden when the seller treats them as "sales discounts”. For small discounts of less than 10,000 yen, it is no longer necessary to issue a return invoice.

It was stipulated that a new return invoice must be issued when the consideration for sales is returned; however, it has been indicated that this is no longer necessary for small amounts.

Exceptions for Business Travel Expenses and Public Transportation in the Invoice System

Introduction

When a company pays for an employee's business travel expenses, the documents to be kept depend on with whom the company settles the account. Under the invoice system, only the books of account need to be kept for employee travel expenses to be eligible for the purchase tax credit. However, this special exception is only allowed when the other party is an employee, etc. Please make sure to check this carefully to avoid misunderstandings.

Special Exceptions for Business Travel Expenses and Public Transportation

Under the invoice system, in principle, an invoice must be kept in order to claim the purchase tax credit. However, for transactions for which it is difficult to receive an invoice, the purchase tax credit can be applied merely by keeping account books with the necessary additional information.

Transactions for which it is difficult to obtain an invoice include business trip expenses paid to employees, etc. that are considered ordinarily necessary (the special exception for business trip expenses), and transportation costs for passengers on public transportation amounting to less than 30,000 yen (the special exception for public transportation).

For example, a company arranges in advance for a necessary 20,000-yen bullet train (Shinkansen) ticket and a 12,000-yen hotel stay for an employee on a business trip. Since the Shinkansen ticket cost is paid to a railroad company, and the amount is less than 30,000 yen, the company can apply the special exception for public transportation and receive a purchase tax credit by keeping only the books of account. Therefore, purchase tax credits can be applied to Shinkansen tickets even if invoices are not kept.

On the other hand, hotel charges are not public transportation, so they require preservation of invoices in order to receive a credit for taxable purchases. However, if the hotel charge is less than 10,000 yen and the company's taxable sales for the base period were less than 100 million yen, the proposed revision #2 described in the first article (see previous page) may make it unnecessary to keep an invoice.

In this example, the hotel charge is 12,000 yen, so an invoice is always required to be kept.

Generally, No Limitation with the Special Exception for Business Travel Expenses

When a company settles payments directly with a railroad company or hotel, the costs are handled as mentioned above. However, if a company settles the payments with an employee, the special exception for business travel expenses may be applied to the entire amount of business travel expense, etc., regardless of the amount or name of the expense.

The handling will differ depending on whether the company settles payments with a railroad company or hotel, or else with an employee.

For example, in the previous example, an employee pays for a bullet train ticket costing 20,000 yen and a hotel room costing 12,000 yen on behalf of the company, and settles the amount with (is reimbursed by) the company after the business trip. In either case, since the transaction is between the company and the employee, there is no need to keep an invoice of that transaction.

This is true even if the Shinkansen ticket costs more than 30,000 yen. The reason is that the special exception is not for public transportation, but for business trip expenses. So it is possible to receive a tax credit for public transportation tickets and hotels over 30,000 yen without keeping invoices, simply by keeping books of account.

Please note, however, that although there is no upper limit set for the amount of business travel expenses that can be covered by the special exception, the amount must be within the scope of what is considered to be normally necessary for a business trip.

In Principle, Save Invoices

Thus, for some transactions, the purchase tax credit can be applied even if invoices are not kept.

However, this is treatment only for exceptions, so please remember the principle that invoices are to be preserved.

About Dealing with Financial Institutions

Introduction

Financial institutions include not only private financial institutions, but also government-affiliated financial institutions. Which such institutions should small and medium-sized enterprises (SME's) consider when thinking about obtaining a loan? Let's consider how to interact with lenders.

Two Main Categories of Financial Institutions

Financial institutions can be broadly classified into (1) private financial institutions (banks, credit associations {shinkin} & credit unions), and (2) governmental financial institutions.

Many companies receive their first loans from Japan Finance Corporation (JFC), a government-affiliated financial institution. However, government-affiliated financial institutions are meant to complement private financial institutions.

The ideal situation would be to receive loans mainly from private-sector financial institutions, and to get loans from government-affiliated financial institutions as a supplement, rather than to continue to receive loans mainly from the JFC.

How to Properly Utilize Mega-banks, Regional Banks, Credit Associations, and Credit Unions

There are two types of banks: mega-banks and regional banks. Mega-banks are Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, and Mizuho Bank, and are distinguished from regional banks in each prefecture. How should these be utilized differently?

First, regarding mega-banks, it is difficult for them to deal with companies unless they have annual sales of 1 billion yen or more. Some mega-banks offer loans with credit guarantee associations to small and medium-sized companies which have annual sales of less than 1 billion yen, but it is unlikely that they will give you a loan on a proprietary basis.

Companies with annual sales of less than 1 billion yen should get both guaranteed and proprietary loans from regional banks, credit associations (shinkin), and credit unions, rather than from mega-banks. For the future, it is better to get a guaranteed loan from a regional bank, credit association, or credit union than from a mega-bank, even if the loans are the same. This is because it is meaningless to get a guaranteed loan from a mega-bank, since it will not lead to a proprietary loan.

If it is possible to receive both guaranteed loans and proprietary loans, it is preferable to receive proprietary loans; however, because they are not guaranteed by a credit guarantee association, the loan screening process at financial institutions is generally more difficult.

Also, if a company is able to obtain a proprietary loan, it would like to keep the guaranteed loan for later, as the screening process is less stringent than for a proprietary loan. This is because the company would prefer to keep the credit guarantee association's guarantee facility available in case the firm becomes unable to obtain a proprietary loan in the future due to deteriorating business performance or other reasons.

In addition, regional banks, credit associations, and credit unions will provide loans with execution amounts in the tens of millions of yen, as well as smaller amounts in the millions of yen. As financial institutions with deep roots in the community, such organizations take a stance of coexistence and co-prosperity with local businesses.

Although it is only a generalization, we see local banks, credit associations (shinkin), and credit unions with bankers who are more accommodating and willing to help when a company's performance deteriorates. On the other hand, the attitudes of mega-banks are not that different at any given time.

While a company is small, it is advisable to consider local/regional banks, credit associations and credit unions as its main lenders.