Special Measures for Fixed-Asset Taxes Started

Introduction

Special measures for fixed asset taxes were established in the 2023 tax reforms. The Q&A for the special measures have been released, and we will take a look at the details herein. In the event of an employee wage increase announcement, the fixed asset tax basis will be reduced to one-third of the original level for up to five years.

Reduced Fixed Asset Tax Basis

”Special measures for fixed-asset taxes on capital investments by small and medium-sized enterprises (SME’s) that contribute to productivity improvements and wage increases" were established in the 2023 tax reform. Eligible entities are corporations with capital of 100 million yen or less that have received approval for plans for the introduction of advanced equipment, etc. Subsidiaries of large corporations are not eligible, even if their capital is 100 million yen or less. As for sole proprietorships, they are eligible, as long as they have 1,000 or fewer employees.

If a small or medium-sized enterprise that has received approval of an introductory plan for advanced equipment, etc., meets certain requirements, its tax basis/base for fixed asset taxes on machinery and equipment, etc. that is subject to the plan will in principle be reduced by one-half for a period of three years.

Eligible equipment includes machinery and equipment, measuring tools, and inspection tools listed in their investment plans with a return on investment (ROI) of at least 5%.

Also, please note that the assets to be acquired must be new, and used assets are not eligible. The requirement is that the average annual return on investment is expected to be at least 5%. In this case, the average annual ROI is calculated by using operating income, the increase in depreciation, and the amount of capital investment.

Average annual return on investment (ROI) = Increase in (Operating income + Depreciation expense) / Capital expenditures

In addition, if a wage increase policy is set in the plan and announced to employees, the tax basis will be reduced by two-thirds for a maximum of five years.

No Cancellation for Non-Achievement

As mentioned above, under this special measure, if a company announces its wage increase policy to its employees and attaches a "document proving that it has announced the wage increase policy to its employees" when applying to the municipality about a plan to introduce advanced equipment, etc., the fixed asset tax basis will be reduced (for five years) to one-third of the original level for equipment acquired by March 31, 2024, and (for four years) for equipment acquired by March 31, 2025. Please note that a wage increase is defined as an increase of 1.5% or more in the total amount of salaries paid to employees.

In the published Q&A, the methods of announcing the wage increase method(s) are introduced. They include: e-mails to all employees; verbal explanation(s) at morning meetings; posting on company bulletin boards and/or internal portal sites; and notices distributed in writing.

Regarding a situation where a company announces a wage increase policy, but is unable to actually raise wages as announced, the Q&A states, "Since it is possible that economic conditions during the planning period may not necessarily allow wage increases as expected, this alone will not result in additional tax payments, etc." So even if a company is unable to actually raise wages as it stated, it will nevertheless receive a reduction in fixed asset taxes. In other words, even if the stated wage increase is not achieved, the fixed-asset tax will be reduced.

False Representations are not Acceptable

Please note that if your company files an application even though you have not announced a wage increase policy to your employees, you will not be eligible for the reduction. In such a situation, assuming that, ’Even if the company is unable to achieve a wage increase, it will still be eligible for a reduction’ is not valid.

Special Exception for the Collection of Admission Tickets, etc. with respect to Railroad Fares

Introduction

In addition to receiving and keeping invoices, we are examining the keeping of books of account alone, as a special exception in order to apply the credit for taxable purchases of railroad fares. When railroad users deduct taxes on purchases related to railroad fares, can they apply the Special Exception for the Collection of Admission Tickets, Etc.?

What is the Special Exception for the Collection of Admission Tickets, Etc.?

Special exceptions - i.e., when keeping only books of account in which certain categories of information are recorded and preserved {without keeping invoices} are enough - include the "Special Exception for the Collection of Admission Tickets, Etc.," the "Special Exception for Public Transportation," and the "Special Exception for Business Trip Expenses," among others.

Regarding the Special Exception for the Collection of Admission Tickets, Etc., it applies to transactions in which admission tickets, etc. containing the informational items required for simplified invoices are collected when used.

Some people may mistakenly think that the Special Exception for the Collection of Admission Tickets, Etc. can be applied when tickets and express tickets are collected at ticket gates when using shinkansen (bullet trains), etc. However, the special exception is limited to cases where admission tickets, etc. which contain the information categories included in a simplified invoice are collected.

For shinkansen and other services operated by JR companies, the items on a simplified invoice are not printed on the train ticket or limited express ticket itself; instead, a receipt corresponding to a simplified invoice is issued at a ticket vending machine or a manned ticket counter.

Therefore, even if a ticket or an express ticket is collected at a ticket gate for a bullet train, etc., the Special Exception for the Collection of Admission Tickets, Etc. cannot be utilized, because the information on the simple invoice is not written on the ticket.

So please keep in mind that the Special Exception for the Collection of Admission Tickets, Etc. cannot be applied for the tickets for shinkansen or other trains, or limited express tickets, themselves.

Properly Understanding the Special Exception Allowing Bookkeeping (Entries) Only

As before, at least for railroad fares related to JR train tickets and limited express tickets, the Special Exception for Collection of Admission Tickets, Etc. does not apply. Therefore, in order to apply the special exception for/allowing preservation of only account books, either the Special Exception for Public Transportation or the Special Exception for Business Trip Expenses, Etc., should be considered.

In this regard, the public transportation exception cannot be applied when the amount of one transaction is 30,000 yen or more. In addition, it should be noted that the Special Exception for Business Trip Expenses, Etc. cannot be applied when transportation tickets are purchased using a corporate credit card; instead, the payments must be made in advance by the employee, etc. Depending on the situation, the carrying out of expense reimbursements corresponding to the deduction of taxes on purchases of rail fares should be considered.

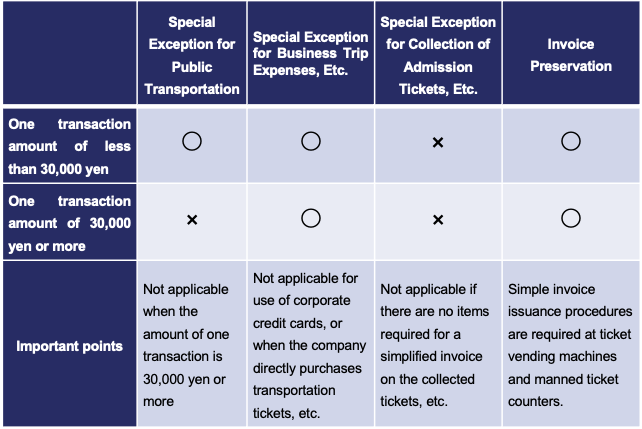

The following table shows whether or not the special exception allowing just the keeping of account books related to railroad fares applies. As for the very complicated Special Exception for Business Trip Expenses, Etc., as stated above, if a corporate credit card is used or if the company directly purchases the tickets, etc., it would be marked below as “x” (invalid).

The Bank Loan Screening Process

Introduction

When obtaining a loan from a bank, your company must undergo an examination. A Japanese bank's loan screening process is based on the ringi (approval) system*, but what is the flow of the process?

Let’s check the process by which a loan you have applied for is approved within the bank. Also, let’s look at cases where the final loan decision is made at the head office, rather than by a branch manager.

*the ringi (approval) system: the system in government offices and business corporations in which draft proposals are prepared by someone in charge of the matter and circulated for collective deliberation and final approval by particular (designated) officials or executives

{cf. https://www.linguee.com/japanese-english/translation/稟議制度.html }

Loan Decision Flow, Starting from a Loan Application

In a bank, there are customer relations, loan, and deposit departments/sections. The customer relations section makes sales trips outside the bank and accepts loan applications. Loan officers carry out loan screening, and deposit officers accept deposits, withdrawals, and transfers at branch counters and also perform clerical work inside. The customer relations section and the loan section are involved in the loan review process.

First, the customer relations department accepts loan applications from companies. For companies that are not assigned a banker at the bank, the loan officer may accept loan applications. The bank employee who accepts the application generally writes the ringi request for approval of the loan.

In some cases, the branch manager or deputy manager directly accepts loan applications from companies that are considered important clients for the branch, but in such cases, an employee in the customer relations section or loan section is chosen to be in charge, and that person writes the approval request.

If the customer relations section employee in charge has written the request for approval, the request is passed around in the following order: the customer relations section manager, who is the supervisor of the employee in charge; the loan section employee in charge; and the loan section manager, respectively, who add their opinions and approval or disapproval of the loan to the 'request for approval' document.

If, on the other hand, the loan section employee in charge writes the request for approval, the request is not circulated to either the customer relations section employee in charge or the customer relations section manager. Once the request for approval has been circulated to the head of the loan section, it is circulated to the deputy manager, who is the number two person in the branch, and then to the branch manager.

The Opinions of Those to Whom the Request is Circulated Are for Reference Only

In this way, the circular for approval is circulated from lower-level employees to the top positions within the bank.

In some cases, the branch manager makes the final decision to approve or disapprove the loan, while in other cases, after approval by the branch manager, the request for approval is circulated to the department at headquarters that reviews loans (e.g., the examination department), which then makes the decision at headquarters. In certain cases, approval documents are circulated to the directors and bank president as well.

Even if all the people to whom the document was circulated during the approval process approve the loan, if the final decision maker rejects the loan, the loan will be rejected, and vice versa.

This means that the opinions of those who viewed the document partway through the process are only for the reference of the final decision maker, when making their decision.

Who is the Final Decision Maker?

The bank's bylaws determine whether the final decision maker is the branch manager, the head of the head office, or a board member. The bylaws have the following criteria, and if the criteria are exceeded, the decision will be made by the general manager of the head office, not the branch manager.

(1) Total amount of loans

This is not the amount of the current loan being decided upon, but rather the entire amount of loans made to that customer if the current loan were to be approved. The larger the total loan amount to one company, the greater the risk of default for the bank, so these decisions are made by head offices.

(2) Corporate credit rating

A company's credit rating is a rating that the bank assigns to each company based on factors that are not represented in the company's financial statements or numbers. The worse a company's credit rating is, the higher the risk of default, so such decisions are made by the general manager of the head office.