Significantly Strengthened Tax Incentives to Promote Higher Wages

Introduction

In the FY2024 tax reform proposal, a major revision of the taxation system for promoting wage increases was announced. The revision is aimed at achieving wage increases that exceed price increases, which is a top priority for the national government. Small and medium-sized enterprises (SMEs) will be able to realize a tax credit of up to 45%.

Tax Incentives for Small and Medium-Sized Enterprises to Raise Wages

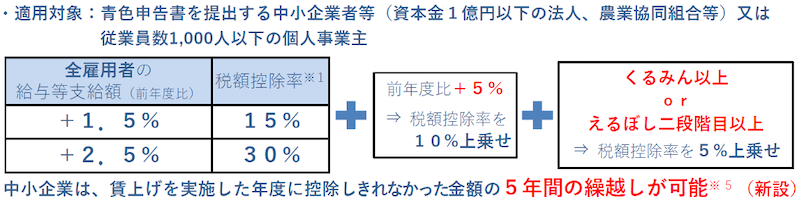

In addition to maintaining the 15% tax credit rate as a general rule, additional measures will be established for those companies that have received “Kurumin” or “Eruboshi" (second level or higher) certifications, to provide extra tax credits in order to encourage the raising of employee wages by small and medium-sized enterprises (SMEs) with capital of 100 million yen or less.

Companies that have been certified as having exemplary support practices for employees who are raising children (called a “Kurumin” certification), and companies that have been recognized as having implemented excellent measures to promote working women's activities (an “Eruboshi" certification - at the second level or higher), are eligible to receive the additional tax credits.

A company can become a Kurumin-certified company by obtaining certification from the Ministry of Health, Labour and Welfare as a company that supports child rearing. In addition, companies that have received the Kurumin certification, have made considerable progress in introducing and using systems to support a good work-life balance, and are making high-level efforts overall can then receive a ‘Platinum Kurumin’ certification.

Furthermore, if the company is recognized for its efforts related to support for working women, it can receive an Eruboshi certification and later a ‘Platinum Eruboshi’ certification, in the same manner as above.

With these certifications, the tax credit rate can reach 45% (compared to a maximum of 40% under the current system). As shown in the table below, it is possible to get the 40% tax credit rate without Platinum Kurumin or Platinum Eruboshi certifications.

New 5-year Carry-forward Deduction

In addition to an increase in the tax credit rate, a tax credit carry-forward system will be established to allow companies to carry forward excess tax credits for a period of up to five years. This is applicable in cases where a company meets the requirements for the tax credits to promote wage increases, but still incurs no corporate tax due to operating at a loss. It should be noted, however, that the tax credit carry-forward can only be applied when the total amount of salaries in the fiscal year in which the tax credit is carried forward exceeds the total amount of salaries in the previous year.

Establishment of a New Tax System to Promote Wage Increases by Midsize Enterprises

A tax credit for midsize companies (中堅企業) with 2,000 or fewer full-time employees will also be established. Previously available only for small, medium, and large companies will now be available.

Companies that fall into the category of midsized companies will be able to take advantage of favorable tax credit rates by applying the tax credits for mid-sized companies instead of those for large companies. Both tax credits will be available for fiscal years beginning on or after April 1, 2024. For more details, please refer to the QR code below.

Flat-Rate Reductions in Income and Residence taxes

Introduction

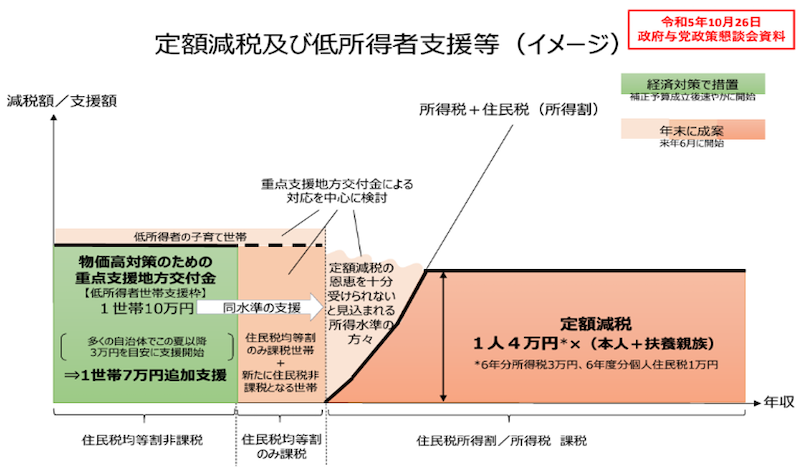

The Tax Reform Proposal for FY2024 provides for a flat-rate tax reduction of 30,000 yen for income tax, and 10,000 yen for residence tax, for the 2024 tax year. Taxpayers and their dependents, including spouses, will receive a combined income tax and residence tax reduction of 40,000 yen per person - the first such reduction since 1998.

Total Fixed Tax Reduction of 40,000 Yen

For the 2024 income tax year, the amount of the flat-rate tax reduction is 30,000 yen per taxpayer with total income of 18.05 million yen or less (or 20 million yen if the taxpayer has only employment income), as well as his/her cohabitating spouse and each dependent. As for individual residence tax for the 2024 tax year, the tax cut is 10,000 yen per taxpayer having total income of 18,050,000 yen or less, his/her eligible spouse and each dependent.

First, to quote regarding the method of income tax deduction, "The tax deduction shall be applied towards the amount of withholding tax due for the first payment of salary, etc. received on or after June 1, 2024.” For example, if salaries for each month are paid on the 25th of the following month, the tax deduction will be deducted from the withholding tax amount for the May salary to be paid on June 25, 2024. If the amount of the flat-rate tax reduction is less than the amount of withholding tax with respect to the June 2024 payroll, the deduction is completed there; if, however, the reduction is greater than the amount of withholding tax for the June 2024 payroll, the deduction will be carried forward to July and thereafter.

On the other hand, the deduction method for individual residence tax is as follows:

A company responsible for paying a special collection shall not be required to pay a special collection when paying salaries in June 2024, but shall - after deducting the amount of the flat-rate tax reduction each month - collect 1/11th of the amount of individual residence tax when paying respective salaries, from July 2024 to May 2025.

This means that the special tax levy for June 2024 will be zero, and after July, the residence tax (after deduction of the flat-rate tax reduction) will be collected equally over the following 11 months.

The Work of Payroll Department Personnel will be Impacted

Since the flat-rate tax reduction for salaried employees is implemented through withholding/special tax collection, it is expected to affect the work practices of payroll department personnel. In particular, the flat-rate tax reduction for income tax will be complicated to deal with, because the amount of the flat-rate tax reduction and monthly withholding tax will differ for each employee depending on his/her family structure.

For example, if Mr. A, who is single, has monthly withholding tax of 8,000 yen, the flat-rate income tax reduction amount of 30,000 yen will not be fully utilized with his June withholding tax. Therefore, the remaining deduction amount will be used progressively from July, with the full amount of the reduction to be deducted by September.

On the other hand, in the case of Mr. B, who has a spouse and three dependent children, the amount of the flat-rate tax reduction is 150,000 yen (= 30,000 yen x 5 persons). If the monthly withholding tax is 15,000 yen, even if deductions are made from June to December, the full amount cannot be deducted by year-end, and a remainder will be left over. Basically, the amount that cannot be fully utilized (deducted) is to be settled through year-end adjustment.

https://www.kantei.go.jp/jp/singi/s_kondan/pdf/r051026_siryou.pdf

Financing Structures according to Borrower Classifications and Credit Ratings

Introduction

In our previous issue, we discussed debtor/borrower classifications of borrowing companies, which are set internally by banks. Let's see how a bank's lending attitude changes depending on the debtor classification. You may be able to determine your company's debtor classification based upon your bank's proposal.

What are Credit Ratings?

When a debtor/borrower classification is determined, in correlation with that classification, the bank assigns a credit rating to the company wishing to be financed. For example, a company that is classified as a "normal borrower" is rated from 1 to 6.

Normal borrower: A company that is performing well, has no particular financial problems, and is not delinquent.

Credit ratings are determined by various financial indicators calculated from financial statements, as well as qualitative aspects (such as the ability of management, the existence of successors, and the company's technological capabilities, which are not shown in the financial indicators).

However, the prerequisite for this is debtor classification. No matter how good the financial statements may be, if the borrower is classified into the "Other Borrowers Requiring Special Attention” category, it will not be able to become a normal borrower (in the above example, rated from 1 to 6). Needless to say, the better a borrower’s credit rating is, the more favorable the credit screening and the lower their interest rate is.

Banks' Lending Attitudes

Banks have transaction policies that determine what stances they will take in lending to their customers. Their transaction policies are linked to borrower classifications and credit ratings.

Although the structures of borrower classifications, credit ratings, and transaction policies differ among banks, generally their policy is to actively promote transactions with borrowers rated 1 or 2, promote transactions with borrowers rated 3 or 4, and maintain the status quo with borrowers rated lower.

When a company draws up a new set of financial statements, it is required to submit them to the bank that is providing them a loan. Then the financial statements are analyzed by the bank, a new credit rating is assigned, and a new transaction policy is determined.

Once a transaction policy is determined, it is basically unlikely to change until the next fiscal year. It is helpful to know what each bank's policy is towards your company in order to plan your company's future cash flow and financing structure.

How to Predict a Bank's Transaction Policy

It is difficult for loan recipients to know what kind of transaction policy a bank has for their company. One way to predict such a policy is to create a monthly chart of outstanding loans from each bank.

A table summarizing the changes in each bank's respective balances of proprietary loans and guaranteed loans over a period of about three years will provide some insight.

You can see what the loan balance for each bank was at its peak (when loan balances were at their highest). In particular, we recommend looking at how much in loans were outstanding at the proprietary loans peak.

After creating a monthly chart of outstanding loan balances, you can apply for a new loan to multiple banks and see what each bank's policy is toward your company, depending on if and how the desired loan(s) is approved.