Regarding Invoice Deliveries for Transactions that Span Multiple Years

Introduction

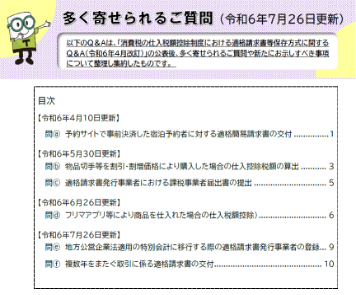

On July 26, the National Tax Agency (NTA) added two more “frequently-asked questions” (FAQs) concerning the invoice system, clarifying how to handle the delivery of invoices for long-term transactions that span the taxable period, such as the provision of monthly maintenance (e.g., system maintenance) services over a period exceeding one year.

An Invoice Covering Multiple Years Can Be Issued Together for the Same Transaction

The "date of transfer of taxable assets, etc.," which is a required item on an invoice, should be stated as "a certain period of time when an invoice is prepared for transfers of taxable assets, etc., carried out within a certain period of time within the taxable period".

As stated here as "within the taxable period," even if an invoice is issued for services for a certain period of time, when the period of the transaction crosses the seller's taxable period, the invoice is, in principle, issued separately for each taxable period.

*See [Principle Processing] below.

On the other hand, there is no problem in listing all transactions across taxable periods on a single invoice or issuing an invoice prior to the transfer of taxable assets.

Considering these points and the simplicity of invoice delivery practice, it is proposed that, for items such as monthly system maintenance contracts where the same taxable asset is transferred continuously for a certain period of time, as long as the seller is an invoice-issuing business entity continuously for the period subject to invoice delivery, the period exceeding the scope of the taxable period also will be collectively eligible for invoice delivery.

*See [Exceptional Treatment] below.

For example, if a seller, a corporation with a fiscal year-end in March, concludes a system maintenance contract for the period from January 1, 2024 to December 31, 2025, the processing principle and exceptional treatment of items to be stated on the invoice are as follows.

Principle of Processing

| January 1, 2024 ~ March 31, 2024 | 300,000 yen | consumption tax 30,000 yen |

|---|---|---|

| April 1, 2024 ~ March 31, 2025 | 1,200,000 yen | consumption tax 120,000 yen |

| April 1, 2025 ~ December 31, 2025 | 900,000 yen | consumption tax 90,000 yen |

| Total billing | 2,640,000 yen | |

Exceptional Treatment

| January 1, 2024 ~ December 31, 2024 | 2,400,000 yen | consumption tax 240,000 yen |

|---|---|---|

| Total billing | 2,640,000 yen | |

Buyer Prorates Deduction for Each Tax Period

A buyer who has received an invoice that includes multiple taxable periods must calculate the amount of tax credits by prorating the amount for each taxable period. The calculated amount of each tax credit is not shown on the invoice, but this is not a problem.

Reference: Frequently-Asked Questions (July 26, 2024)

https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/pdf/0024004-026.pdf

Handling of Company-Paid Medical Checkup Expenses

Introduction

It is common for companies to cover the cost of medical examinations for their employees as part of their benefits packages. Although some argue that the company must pay the medical institution directly for such medical checkups, payroll taxation does not arise if certain requirements are met, even if employees pay for the checkups and are later reimbursed by the company.

No Actual Method for Covering the Cost of Medical Examinations is Determined.

Besides salaries, bonuses, etc., other economic benefits paid by a company to its employees in cash are also included in the ‘salaries’ category, and are subject to income tax.

However, expenses incurred by the company for employee benefits are not subject to payroll taxation, except in the following cases:

- The amount of economic benefit received by the employee is significantly large

- Provided only to people in specific positions, such as executives

Based on this treatment, a question-and-answer (Q&A) case study by the National Tax Agency clarifies that payroll taxation is not required for the costs of physical examinations and health checkups for employees paid for by the company, if all applicants are able to receive the checkups, and the company pays for such checkups for all those who undergo them.

Examination expenses not subject to payroll taxation:

- All applicants must be able to receive medical examinations

- The company pays the costs of all employees who undergo the medical exams

- The costs incurred by the company must not be significantly (strikingly) large.

There is no specific mention in the notices or Q&A cases as to whether the company pays directly to the medical institution for the medical checkup, or whether the employee pays for the checkup and the company reimburses the employee at a later date.

If all applicants are able to undergo medical checkups, the company pays for the checkups for everyone who undergoes them, and the costs are not strikingly large, payroll taxation is not required for either method.

Internal Regulations Need to Be Developed

The fact that an employee pays for their medical checkup, and the company reimburses him or her at a later date, does not make the amount involved subject to payroll taxation.

However, since it is a payment of money to the employee, it’s wise to clarify that the company pays for all employees who receive the medical checkups, based on the company's rules and regulations, so that it will not be considered as salary during a tax audit.

For example, if a certain sum of money is paid to employees in the name of medical checkup expenses, or if there are no rules in the company regulations, etc., or the eligible employees vary, the payments may be pointed out in a tax audit as representing salary to the employees.

Save Receipts in the Company's Name.

When reimbursing employees, it is recommended that the employee submit a receipt in the company's name for reimbursement in order to make it clear that the cost of the medical examination is the company's responsibility.

Even if the receipt is addressed to the individual employee, if the company pays for the medical checkup for everyone who received such receipts, the subsequent reimbursements are basically not considered to be ‘salary, etc’. However, there is a possibility that the contents of the receipts will be confirmed during a tax audit.

How Much Did a Soba Shop with a Strange Pet Lose?

Introduction

This section explains costs specific to management accounting, called embedded costs and opportunity costs, based on the example of a soba (buckwheat noodles) shop. We will describe management accounting, which is accounting for decision-making. Financial accounting alone may not be a sufficient source of information for making business decisions, and management accounting is a useful information source in business settings.

The Amount of Loss in the Following Case

Suppose there is a soba shop that produces an average of 2,000 bowls of soba every month. The selling price of each bowl of soba is 800 yen. This soba shop employs a manager who is paid 300,000 yen per month and another employee who is paid 100,000 yen per month. The ingredients cost of the soba noodles is 300 yen per bowl, and other fixed costs such as store rent are 300,000 yen per month. The profit per bowl of soba is as follows:

Selling price: 800 yen - Ingredients cost: 300 yen

Labor costs: (300,000 yen + 100,000 yen) / 2,000 bowls = 200 yen

Fixed costs: 300,000 yen / 2,000 bowls = 150 yen

⇨ 800(sale) - 300(ingredients) - 200(employees’ pay) - 150(fixed costs) = 150 yen(profit)

There are not many customers and there is plenty of time to spare. Also, each customer usually eats one bowl of soba.

One day, a customer entered the restaurant and left without taking a seat because (s)he was made uncomfortable by an unusual pet in the back of the restaurant. I would like to calculate the amount of loss to consider if any action needs to be taken. What would be the amount of loss in this case?

Zero loss?

If the pet emerges and the customer leaves as a result, we can assume that nothing has happened - i.e., the loss is zero, since the customer in the end didn’t order anything. In financial accounting, this conclusion is correct. However, this is not the case in managerial accounting. The key point here is sales. If the pet had not appeared, the sale probably would have been 800 yen; so the pet caused a loss of sales. Therefore, compared to the situation where the pet didn’t appear, the sales level would be minus 800 yen.

The next point is the ingredients cost. In the case where the pet appeared, no soba noodles were made and served, so the ingredients cost is zero. If the pet hadn’t appeared, the ingredients cost would have been 300 yen, because soba noodles would have been made and served. Therefore, compared to the case where the pet did not appear, the ingredients cost increased by 300 yen only. Since labor costs and fixed costs remain unchanged, the total loss is 500 yen.

| The pet’s appearing | The pet not appearing | Difference | |

|---|---|---|---|

| sales | 0 yen | +800 yen | △800 yen |

| cost of ingredients | 0 yen | △300 yen | +300 yen |

| personnel expenses | △400,000 yen/month | △400,000 yen/month | 0 yen |

| fixed cost | △300,000 yen/month | △300,000 yen/month | 0 yen |

| Loss if one customer leaves | △500 yen | ||

Sunk Costs and Opportunity Costs

Costs specific to management accounting include embedded costs and opportunity costs. Embedded/Sunk costs are "costs that do not affect decision-making”. In the example above, labor and fixed costs were incurred equally in each of the situations. Therefore, they do not influence decision-making.

Another cost is opportunity cost. The definition is "the benefit that likely would have been obtained from other alternatives”. In the example above, this would have been 500 yen. Opportunity costs must be considered when making decisions. If these are not included, it would mean that the loss is zero and no action is needed.