An Overview of the 10,000-Yen Standard for Entertainment Expenses

Introduction

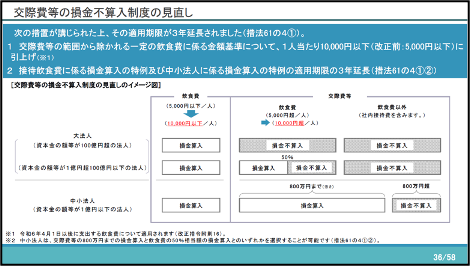

Previously, food and beverage expenses of ¥5,000 or less per person could be excluded from entertainment expenses. However, since April 2024, this has been revised to 10,000 yen or less per person. This revision is meant to reflect rising prices and support the restaurant industry, so let's take a look at the details again.

Overview of 10,000-Yen Rule

Providing simple food and beverages is essential to facilitate business negotiations and meetings with clients and other parties.

The reason for the increase in the maximum deductible amount from 5,000 yen to 10,000 yen per person is to provide support for restaurants in response to the ‘Covid-19’ pandemic of 2020, and the rise in various prices in 2023.

The requirements for this rule are the same as for the ¥5,000 rule. The National Tax Agency(NTA)’s Q&A section is essentially carried over as-is, with only the amount updated. The main requirements are as follows:

- The deduction is limited to situations where a company's own employees entertain clients, etc. with food and beverages. However, the issuance of food and beverage coupons, or the payment of food & beverage expenses for invitations to golf or travel, etc., or paying food/beverage expenses for a customer are not considered to be food and beverage entertainment.

- The deduction is limited to when the total amount of food and beverage expenses (the total amount paid to the restaurant, etc.), divided by the number of participants, is 10,000 yen or less per person. If the amount per person exceeds 10,000 yen, the entire amount is considered entertainment expenses, etc.

- Food and beverage expenses include the costs of boxed lunches provided for client events, etc., as well as the costs for social gatherings hosted by the company or by trade associations, etc., that include food and beverages.

- The deduction does not apply for in-house food & beverages.

- Documentation (including the date of the meal, the names of all attendees from the client’s side, the number of attendees, the name of the restaurant, the cost of the meal, etc.) must be kept to prove that the amount is 10,000 yen or less per person.

- If any of the documentation concerning the above five requirements are incomplete, in principle, the entire amount will be treated as entertainment expenses, etc.

Specific examples

For example, if four business partners and two employees of the company have dinner together and the total amount is 60,000 yen or less, the food and beverage expenses are excluded from entertainment expenses, etc. However, if the total amount exceeds 60,000 yen, the entire amount is treated as entertainment expenses, etc. However, if the total amount exceeds 60,000 yen, the entire amount will be treated as entertainment expenses. In addition, food and beverage expenses for in-house year-end and New Year's parties are excluded from this system, regardless of the amount.

Tax Audits in Full Swing

The old ¥5,000 rule and the new ¥10,000 rule were/are used by many corporations because of their significant tax-saving benefits. However, this special exception allows exclusions from entertainment expenses, etc., as a "formal standard”.

When having food & beverages with clients, the names of all counter-parties, the number of participants, etc. must be documented. In addition, as mentioned above, in-house food and beverages are not applicable. The NTA has warned in advance that "splitting a single meal," "misrepresenting the other parties," "padding the number of participants," etc., are considered concealment or disguizement of facts, and are subject to heavy additional taxation.

It has been reported that tax audits concerning the old 5,000-yen rule have been conducted nationwide, with some issues having been pointed out. Since the deductible limit has doubled from 5,000 yen to 10,000 yen for expenses incurred on or after April 1, 2024, it is anticipated that tax audits will be strengthened.

Reference: Revision of the system of non-deductibility of entertainment expenses, etc.

https://www.nta.go.jp/publication/pamph/hojin/kaisei_gaiyo2024/pdf/J.pdf

Regarding the Determination of Company Housing Rent

Introduction

"Corporate housing for executives," which is a system of renting out housing in the name of a corporation, is a very beneficial mechanism for avoiding payroll taxes when providing housing to executives, provided that it is properly managed.

However, care must be taken in setting the rent. Failure to set an appropriate amount may result in unexpected payroll taxation.

No Payroll Taxation If Amounts Equivalent to Rents Stipulated in a Notice Are Received

The economic benefit of renting company housing to an officer at a lower-than-normal rent (the difference between the rental value of the company housing and the actual rent collected) is subject to payroll taxation for that officer.

On the other hand, if you collect a monthly "normal rental amount" from an officer, the officer is not subject to payroll taxation as there is no economic benefit.

The "amount of normal rent" is calculated according to the floor area of the company housing to be leased, using the following formula

In cases where company housing is rented, and is not small-scale housing

The greater of the following amounts:

- An amount equivalent to 50% of the amount of rent paid by the enterprise

- (Tax base amount of fixed property tax of the house for the year x 12% [in the case of a wooden structure] + the tax base amount of the fixed property tax of the site for the year x 6%) x 1/12

As mentioned above, the amount equivalent to the rent is calculated based on the tax base amount of fixed property(asset) tax for the house and site (land). The tax base amount of fixed property tax means "the amount registered in the fixed property taxation registry as the value of fixed property(assets) as of the levy date (January 1)”.

Which Amount?

What needs attention here is the treatment of the tax base amount of fixed property tax for land. There is a special exception for residential land to reduce the tax burden, and both the "value in the base year" and the "value after application of the special exception for residential land" are listed in the fixed asset taxation ledger. In calculating the rent for company housing for executives, the "value after application of the special exception for residential land" is used. This is based on the concept of calculating based on the actual tax burden.

Note that this calculation method cannot be used for company housing that is overly luxurious or that is not considered ordinary housing. In such cases, an appropriate amount should be set based on market prices or rents of similar properties in the surrounding area.

Use of, and Precautions about, Corporate Housing for Executives

Corporate housing for executives is a program that benefits both the company and the executives. For the company, it helps to secure talented personnel and stabilize the residences of executives, and for the executives, it may reduce the burden of housing costs.

In order to properly administer this system, the following points should be noted:

- Setting appropriate rental rates: Accurately calculate and properly set a "normal rental amount".

- Record-keeping: Properly note the rental calculation basis and payment records to prepare for tax audits.

- Periodic review: The "normal rental amount" should be reviewed in accordance with changes in the property tax base.

- For luxurious company housing: In the case of luxurious company housing, market prices should be investigated and appropriate rental rates should be set.

- Responding to legal changes: Pay attention to amendments to tax laws and related regulations, and respond appropriately.

What If a Customer Leaves After Ordering, Without Paying?

Introduction

In the previous month's issue, we presented a case in which an unusual pet appeared just as a customer entered a soba (buckwheat) noodles restaurant, and as a result the customer left before placing an order. In that case, we explained that although there seemed to be no loss, there was actually an opportunity loss of 500 yen. This time, let us consider the case where the pet appears after the soba noodles have been made.

The Pet Appears After the Soba Noodles Have Been Made

The setting is a soba noodle shop that makes an average of 2,000 bowls of soba each month. The selling price is 800 yen per bowl. The restaurant employs a manager who is paid 300,000 yen per month and an employee who’s paid 100,000 yen a month. The cost of ingredients is 300 yen per bowl of buckwheat noodles, and other fixed costs, such as the rent of the store, total 300,000 yen a month. The profit per bowl is calculated as follows:

Selling price: ¥800 Ingredients cost: ¥300

Labor costs: (300,000 + 100,000 yen) / 2,000 bowls = 200 yen

Fixed costs: 300,000 yen / 2,000 bowls = 150 yen

800(selling price)-300(ingredients)-200(labor)-150(fixed costs) = ¥150 (profit)

One day, a customer entered the restaurant and ordered soba noodles. After making and serving the soba, an unusual pet came out of the back of the restaurant and startled the customer. The customer was so surprised that he left without paying the bill. The noodles got soggy (soft), and had to be thrown out. How much did the soba noodle shop lose because of the owner’s strange pet?

Losses Increase Depending on the Timing

The difference from the example in last month's issue is that this time the pet appeared after the soba noodles were made. In the example last month, the customer entered the restaurant, but left without ordering.

If the pet appears before the order is placed, the ingredients cost is zero because the soba noodles have not been made. However, in this case, since the noodles had been made, an ingredients expense of 300 yen was incurred. Because the labor cost and fixed cost were unchanged, the total loss was 800 yen. In this case, the loss would be larger than if the customer had left before the soba noodles were made, because of the ingredients' cost.

| The pet appears | The pet doesn't come out of its box | Difference | |

|---|---|---|---|

| revenue | 0 yen | +800 yen | △800 yen |

| cost of ingredients | △300 yen | △300 yen | 0 yen |

| personnel expenses | △400,000 yen/month | △400,000 yen/month | 0 yen |

| fixed cost | △300,000 yen/month | △300,000 yen/month | 0 yen |

| Loss if the customer leaves after ordering, without paying | △800 yen | ||

The Later that Something Bad Happens, the Greater the Loss.

The difference from last time is the timing of the pet’s emergence. If "the pet came out" constitutes a "bad event" for the store, then "the later the bad event, the greater the loss." This makes intuitive sense.

For example, let us assume that the "bad event" is the production of defective products in manufacturing. Which would cause greater losses, if the defective product occurred in the early stages of the process or if it occurred at the very end of the process? Needless to say, it would be worse if the defective product were generated in the process just before completion. This is why factories have several inspections - not only at the final stage of production, but also at intermediate stages.

We can say that recognizing the importance of early detection and prompt handling of problems, and then actually taking action on them, will help lead to long-term success and stability in business.