关于防卫特别法人税的税效会计的处理

首先

令和7年的税制改革将设立新的防卫特别法人税,这不会直接影响到令和7年3月期决算年度的公司,但如果采用税效果会计,则有一些要点需要注意。

防卫特别法人税

2月4日提交国会的税法修订案规定,在每个财政年度对公司的标准法人税额征收防卫特别法人税。由于该税将在令和8年4月1日以后开始的每个财政年度征收,所以在税务上不会影响3月结算法人的令和7年3月期结算。

防卫特别法人税概要

| 课税对象 | 每个课税年度的法人税基本税额(各种扣除前的法人税额) |

| 课税标准 | 标准法人税额(基本扣除额为500万日元) |

| 税额 | 标准法人税额x4%税率 |

| 课税年度 | 令和8年4月1日以后开始的每个会计年度 |

| 确定申报等 | 每个会计年度结束日的第二天开始的2个月内提交确定申报书 |

考虑到中小型企业,防卫特别法人税以标准法人税减去500万日元的基本扣除额征收。因此,如果法人税额低于500万日元,则不征收防卫特别法人税。

适用税效会计的处理

在税效会计中,递延税款资产及递延税款负债的数额按照结算日国会通过的税法规定的方法计算。企业会计基准委员会认为,如果修订税法在令和7年3月31日之前通过,当天迎来结算日的企业在适用税效会计方面有重要变更。具体来说,关于令和8年4月1日以后开始事业年度预计消除的暂时差异等计算递延税金资产及递延税金负债时,需要反映防卫特别法人税的影响。

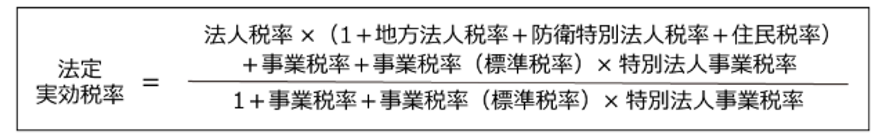

防卫特别法人税虽然在税效果适用指针第46项所示的税金中没有明示,但是作为对法人税的附加税而征收的。另外,法人税与其他利益相关的金额相当于作为课税标准的税金的法人税等。因此,在修正税法成立的情况下,根据以下公式计算法定实效税率遵循税效果适用方针的宗旨。另外,修改税法成立后,将进行与防卫特别法人税的创立相对应的企业会计基准等的修改。

应考虑防卫特别法人税影响的理由

防卫特别法人税是为了应对防卫费增加的新税,对公司来说是一项额外的税收负担。这项新税的引入改变了未来的税负率,因此需要在税效会计中中加以考虑。特别是对于大公司和高利润公司而言,税负的预期增加可能会对业务规划和投资决策产生影响。

地方税的直接缴纳导入两阶段认证

首先

随着3月24日支持eLTAX的软件PCdesk的系统更新,地方税直接缴纳的使用手续将发生部分变更。

直接缴纳是指

所谓直接缴纳e-Tax和eLTAX提交申报书等后,从纳税人自己名义的存款账户,在即时或指定的日期,通过账户扣款电子缴纳国税和地方税的手续。因为不需要特意去金融机关的窗口,很方便,所以使用直接缴纳的人很多。

使用时,需要事先向管辖纳税地的税务局提交专用的申报书,但是可以从办公室和自己家的电脑(地方税的情况)一次性向所有的都道府县、市区町村缴纳。另外,即使没有签订网上银行的合同也可以使用。

eLTAX进行系统更新

随着3月24日支持eLTAX软件的PCdesk系统更新,地方税直接缴纳的使用手续将发生部分变更。

具体来说,将进行以下更改:“支持取消指定到期日的直接付款”、“支持直接付款的两阶段验证”和“支持更改或添加电子邮件地址时的两阶段验证”。

其中,“直接付款的两步验证”需要关注。一些从业者对此表示担忧。细节是什么?

直接付款的两步验证"要求在直接付款时使用一次性密码进行两步验证,以加强安全性。一次性密码会发送到与用户ID相关联的注册电子邮件地址(最多三个)中选定的一个电子邮件地址。

在某些情况下,直接付款的纳税人(如公司负责人)的电子邮件地址可能没有注册,例如,只注册了咨询会计师事务所等的电子邮件地址。这是因为在实践中,eLTAX只供会计师事务所使用,纳税人本人并不经常使用。

在这种情况下,一次性密码不会发送给直接付款的负责人。有必要再次检查注册的电子邮件地址,必要时添加或更改电子邮件地址,以便将一次性密码发送给负责人等。

系统更新后的直接缴纳流程

系统更新后的地方税的直接缴纳如下流程。

- 在付款方式选择屏幕上选择直接付款方式。

- 选择“立即付款”或“在指定日期付款”。

- 选择发送一次性密码的电子邮件地址。

- 确认发送到所选电子邮件地址的一次性密码

- 确认PCdesk上显示的一次性密码。

税制改革对配偶特别扣除的影响

首先

令和7年度税制修改大纲中,没有直接涉及配偶特别扣除的修改。配偶特别扣除本身没有变化,但预计会受到关于年收入墙壁的税制修改的影响。

现行配偶特别扣除

现行制度上的配偶特别扣除是指纳税人本人(合计所得金额在1000万日元以下),配偶的合计所得金额超过48万日元在133万日元以下,不属于配偶扣除的适用对象时接受的。扣除额根据配偶的总收入金额和纳税人本人的总收入金额分阶段变动。

令和7年度税制改正变更点

根据令和7年度税制修改预定的配偶特别扣除的主要变更点有以下2点。

- 配偶的总收入,这是配偶免税额和配偶特别免税额之间的界限

- 可获得全额扣除的配偶的最高年薪收入

首先,(1)配偶的总收入是配偶免税额和配偶特别免税额的分界线,将受到令和7年度税制改革的影响,该改革将审查生活收入相同的配偶的总收入。在现行制度下,配偶特别扣除对象的配偶是不属于扣除对象配偶的配偶。扣除对象配偶的前提是符合合计收入金额48万日元以下的同一生计配偶。

换句话说,在现行制度下,总收入的边界线48万日元,如果总收入在48万日元以下,配偶有资格享受配偶免税;如果总收入超过48万日元但低于133万日元,配偶有资格享受特别免税。

修订后,同一在世配偶的总收入要求将修订为为58万日元以下,因此分界线将为总收入的58万日元。符合配偶特别豁免条件的配偶的总收入要求将在58万日元至133万日元之间。133万日元的上限不会改变。

可足额使用扣除额的配偶年工资收入上限

其次,(2)关于可以利用扣除额的满额的配偶的年工资收入的上限,根据令和7年度税制修改,可使用全额免税额的配偶的最高年薪收入从55万日元调整为65万日元。

现行,纳税人本人的合计收入金额在900万日元以下,且配偶的总收入在48万日元至95万日元之间,则配偶特别免税额的全额为38万日元。从配偶的总收入角度考虑,配偶的年薪收入为150万日元时,可全额扣除的最高限额为95万日元。

修改后,工资收入扣除的最低扣除额只提高到65万日元,配偶特别免税额的配偶总收入范围似乎没有变化。因此,配偶总收入的最高全额免税额将保持不变,仍为95万日元,但年薪收入将变为160万日元。

- 配偶免税额和配偶特别免税额之间的界限从配偶总收入的48万日元提高到58万日元。

- 有资格享受配偶全额特别豁免的配偶的年薪收入(38万日元)