Passage of the Second Supplementary Budget Bill

Introduction

On June 8, the second supplementary budget worth 117 trillion yen in public projects was proposed to the Diet, seemingly providing more opportunities for small- and medium-sized enterprises to benefit from support measures. It includes the introduction of rent support subsidies, a strengthening of the subsidy response for the sustainment of businesses, and an expansion in employment adjustment subsidies.

Introduction of Rent Support Subsidies for Six Months of Rent

“Rent support subsidies” for enterprises to help pay their rent were introduced for providing relief to those whose sales had decreased significantly due to the extension of the emergency declaration in May.

For enterprises to be eligible for the subsidy, they must meet the two following conditions:

- Of enterprises paying rent, small- to medium-sized companies and sole proprietors (including freelancers) with capital less than one billion yen; and,

- During the period from May - December 2020, “Sales decrease(d) 50% or more for any month compared to the same month of the prior year”, or else “sales decrease(d) 30% or more for three consecutive months compared to the same period of the prior year“.

The amount will be equivalent to the most recent six months of rent (monthly amounts) at the time of application.

Subsidy rates and maximum subsidy amounts (monthly) are shown below.

| General principle |

Exceptions (in cases of possession of multiple stores, etc.) |

|

|---|---|---|

| Subsidy rates |

2/3 of monthly rent | 2/3 of monthly rent, plus 1/3 of the portion of monthly rent which exceeds the monthly rent maximum |

| Maximum amounts |

Corporation 500,000 yen Sole proprietor 250,000 yen |

Corporation 1 million yen Sole proprietor 500,000 yen |

Certain Freelancers Also Eligible for Subsidies for Sustainment of Businesses

Certain freelancers shall be eligible for subsidies for sustaining businesses when they report their income as miscellaneous or earned income, or, regarding one carrying on a business undertaking when they add up their income on their tax return. Documentation which allows verification of earnings, the situation of the enterprise, etc. is needed.

It is a prerequisite that their revenue decreased 50% compared to the same month of the prior year (last year) due to the “COVID-19” pandemic. In the case of a solo proprietor, though the subsidy amount maximum is one million yen, the amount of the sales decrease compared to last year will be the allowable limit.

Employment Adjustment Subsidy Enhanced in New System

Employment adjustment subsidies will be significantly expanded to support the livelihoods of residents in Japan who were obliged to suspend their business operations for a time due to the ‘new corona’ virus.

The daily maximum of 8,330 yen will be raised on an exceptional basis to 15,000 yen (330,000 yen per month) directed at small and medium-sized enterprises, as well as larger corporations. This will be applied retroactively from April 1, and extend until September 30.

Additionally, “financial aid towards temporary closures in response to ‘COVID-19’ infections (tentative name)”, which workers can apply for directly, will be established. A maximum of 330,000 yen will be paid to those who cannot receive leave payments from their employers. Those eligible will be employees of small and medium-sized enterprises; they can receive up to 80% of their average wages (up to 330,000 yen per month).

This also will be applied retroactively from April 1, and extend until September 30.

Application of “Single Parent Deductions” from 2020

Introduction

The introduction of “single parent deductions”, to reduce the burdens of income/resident taxes for unmarried single parents, will enable a differential to be corrected; until now, tax deductions for widows/widowers on income/resident taxes haven’t been applied for single parents.

Tax Reductions thus far for Widows/Widowers

Until now there has been a system called ‘tax deductions for widows/widowers’ to reduce single parents’ income tax and resident tax burdens. This system has been limited to people who lost their spouses due to death or divorce, and did not re-marry, as well as certain cases when it is unclear whether the person’s spouse is alive or not.

In other words, the major premise is that the person has been married. Tax deductions for widows/widowers are applied for a person who is single due to divorce or the death of their spouse; they do not apply for people who never married. This resulted in the problem of application differing depending on marital history.

Also, the amount of deductions have differed between widows and widowers.

Initiation of the Single Parent Deduction

The revision introduced the “single-parent deduction” from the point of view of supporting all single parents equally, and also added certain modifiers to the tax deduction for widows/widowers.

Regardless of marital history or sex, a single parent (earning less than certain income levels) who has a child with whom they share living arrangements will be eligible for the same “single-parent deduction” (deduction amounts: towards income tax 350,000yen, resident tax 300,000 yen). In addition, a widow in a situation other than the above will continue to be eligible for a deduction amount of 270,000 yen as the income tax deduction for widows (resident tax 260,000 yen); furthermore, an income tax limit for widows who have dependents other than their children is established, at the same level as that of widowers.

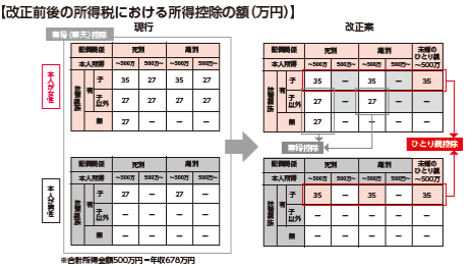

Amounts of Tax Deductions Before/After Revision

Please refer to the website of the Finance Ministry for details regarding the amounts of the deductions in income tax.

< cf: Individual Income Taxation & Property Taxation (PDF:226KB) >

https://www.mof.go.jp/tax_policy/publication/brochure/zeiseian20/zeiseian02_01.pdf

The diagram clearly shows the revisions, such that a single parent (regardless of their marital history or sex) who is supporting their child(ren) will be eligible for the single parent deduction.

On the other hand, it should be noted that there will remain differences between males and females regarding treatment of cases such as when the parent has a dependent(s) other than their child, or when they have no dependents.

Possibly Unrecognized by Some Eligible Recipients

Due to the system being new, some eligible employees who are single parents might not be aware of their eligibility.

Understanding a Profit and Loss Statement

Introduction

In management, it is essential to have a proper understanding of financial statements. Let’s deepen our view of five different profits on profit and loss statements {P&L or P/L}.

Structure of a Profit and Loss Statement

The top line of the P&L is “sales”, which refers to the sales of your company during the period. “Cost of sales” {or “cost of goods sold”, COGS} is listed under sales, and refers to the cost of the goods in stock which resulted in the period’s sales.

| Sales Cost of sales |

| ① Gross operating profit |

| Selling, general & administrative expenses |

| ② Operating profit |

| Non-operating income Non-operating expenses |

| ③ Ordinary profit |

| Extraordinary income Extraordinary losses |

| ④ Net income before income taxes |

| Income taxes |

| ⑤ Net Income |

The first profit of the five types of profit, "gross operating profit”, comes below cost of sales, and is sometimes called “粗利” in Japanese. Next are selling, general & administrative expenses - often abbreviated as “販管費” in Japanese - where all expenses regarding main business operations are recorded, as well as the personnel expenses for staff working in departments such as general affairs or accounting.

The second profit, “operating profit”, follows under selling, general & administrative expenses; it is literally the profit made from the company’s main business activities.

Next come “non-operating income” and “non-operating expenses”. “Non-operating” means ‘outside of general operations’ - for instance, “interest income” or “interest expense”. The third profit type, “pretax {or ordinary} profit”, is derived by adding or subtracting such interest from the operating profit. It is the profit made through main operating activities plus all other business activities, and in Japan is commonly abbreviated to kei-tsune (経常).

Below ordinary profit are “extraordinary income” and “extraordinary losses” (the latter is also called “one-time charges”). “Extraordinary” means ‘only occurring in the current fiscal year’. Adding or subtracting from ordinary income arrives at the fourth profit - i.e., “net income before income taxes”. The last profit, “net income”, is derived by subtracting taxes (e.g., corporate income tax) from the net income before income taxes figure. In newspapers and other media, “net income” is also called “current income”, “net earnings”, “the bottom line”, etc.

How to Read a Profit and Loss Statement to Enhance One’s Management Sense

Let us verify a point concerning the viewing of a P&L statement, to enhance our management sense.

For instance, if an employee was required to undergo a week of training which incurred a 50,000 yen training fee, how much would your company need to sell in order to cover that ¥50,000 fee? Of course the answer would vary depending upon the company’s profit structure, but if its gross operating profit rate (= {gross operating profit ÷ sales} × 100) were 5%, sales of one million yen would be necessary.

That is, a 50,000 yen training fee would actually be equivalent to one million yen in sales. Therefore, getting into the habit of examining P&L statements from the bottom can help cultivate a sense of cost management.