Applications for Rent Support Subsidies Begin

Introduction

With the adoption of the second supplementary budget, applications for rent support have finally started. Small and middle-sized enterprises and sole proprietors may receive benefits totaling a maximum of 6 million yen or 3 million yen, respectively.

What are Rent Support Subsidies?

Rent support subsidies are subsidies introduced to lessen the burden of rent costs, for the purpose of supporting enterprises which suffered major sales declines compared to the previous year due to the extension of the state of emergency in May, in order that they may sustain their businesses.

Except for so-called large companies, almost all enterprises and solo proprietors (those with capital of less than 1 billion yen) are eligible for the subsidies.

However, a condition is that revenue of the business in at least one month during the period May-December 2020 falls by 50% or more compared with the corresponding month of the prior year, or else that its total revenue for three consecutive months declines by 30% or more compared with the corresponding period of the previous year.

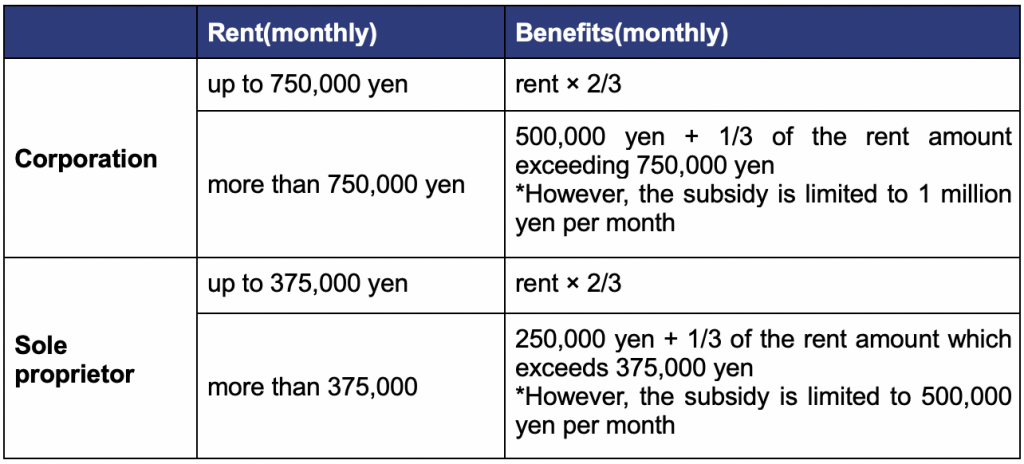

The maximum benefit amounts are 6 million yen for corporations and 3 million yen for sole proprietors. The subsidies will amount to six times the monthly benefit amounts shown in the diagram below, which lists the subsidy rates and maximum amounts each month.

Points to Note Regarding the Filing of Application Documents

Unlike COVID-19 subsidies for sustaining small businesses, rent support subsidy applications require the filing of a written pledge. Please be aware that in such cases, a rubber stamp is not used; instead, the business representative must sign the application form with their personal signature.

Also, filing a lease contract which is valid on both the day of the application filing and March 31, 2020 will be required. In cases where it is unclear if the lease is valid for both of those days or not, a lease certificate signed by both the renter and the lender is necessary.

If documents filed are incorrect, lacking necessary information, etc., delays in receiving subsidies will result. Since more documents are needed than with the aforementioned COVID-19 subsidies for sustaining small businesses, filers must take extra care.

Additional Benefits Provided by Tokyo

Municipal Tokyo is apparently considering adding to the benefits being provided through the national government’s measures. Though not yet confirmed, it appears that Tokyo will support another 1/12 of businesses’ rents totaling up to 750,000 yen per month - such that the 2/3 being subsidized by the national government will be increased to three-fourths (3/4) of total monthly rent. This Tokyo-specific support is being contemplated because rents in Tokyo are higher compared with other regions.

Some municipalities other than Tokyo are also seemingly preparing their own unique benefits systems pertaining to rent support subsidies. Future pronouncements should be paid attention to, so as to receive the most suitable benefits.

(Note that the subsidy system(s) which are officially announced may differ, as this article was written on 17 July 2020.)

Reconfirm about Meeting Expenses & Library/Educational Expenses

Introduction

It has been more than half a year since the dual-rate system including a lower consumption tax rate was introduced. Businesses other than those selling food and beverage products have also been affected. Let’s examine accounts in which mistakes can be made easily.

In Which Accounts Can Mistakes be Made Easily?

The new consumption tax rate system began in October 2019, and tax authorities have pointed out mistakes with tax returns which for the first time are dealing with the two tax rates.

Among those issues, “meeting expenses”, “library/educational expenses” and “social expenses” should be given special attention.

“Foods and drinks, excluding liquor and eating out” and “newspapers issued over two times per week (based on subscriptions)” are subject to the lower tax rate of 8%.

General businesses which don’t sell food or beverages should also pay attention to this matter, though basically food and beverages businesses such as convenience stores are affected most.

For instance, transactions subject to reduced tax rates, such as purchases of sweet teacakes given to visitors, occasional gifts called oseibo (お歳暮) and ochugen (お中元), newspaper subscriptions, etc. have taken place without due consideration of the tax rates.

If Incorrectly Calculated at 10%…

If such transactions subject to the lower 8% consumption tax rate get incorrectly posted at the standard 10% rate, then those differences would result in underpaying overall consumption tax, which could end up with total taxes being underpaid.

In such a situation, it should be noted that additional tax for understatement of income, plus delinquent tax, would be imposed. It would seemingly be a rare case indeed where no transactions subject to the lower tax rate would have occurred within half a year.

Therefore, special attention to such transactions will be required in bookkeeping, so as to not mistake the consumption tax rate.

Please Also Pay Attention to “Lease Payments”.

The above cases involved applying the 8% tax rate; however, attention also needs to be paid when the tax rate of 8% will be applied not for the ‘reduced’ (lower) tax rate, but as part of transitional measures, which are often seen.

“Lease payments” would likely be the largest account in which 8% as a provisional measure would be applied. Lease charges should even now be subject to consumption tax of 8% if:

- the date of the contract was on or before March 31, 2019;

- the contract was started on or before September 30, 2019; and

- certain other conditions were met.

It should be noted that if such transactions are posted at the incorrect 10% rate, that would result in underpayments of consumption tax, due to the differences.

You should be able to determine if 8% or 10% for consumption tax is correct, by confirming the schedule for the lease contract(s) and payments.

Effects of These Mistakes Not Overly Significant

Posting at the standard tax rate of 10% incorrectly, as opposed to the lower tax rate of 8%, or transactions being subject to 8% due to transitional measures, if merely requiring a 2% difference correction, may not affect the tax amount significantly.

However, constructing a control environment designed to prevent small mistakes could also help prevent larger mistakes in the future. Let’s try to design robust systems for dealing with problems, even if the amounts involved seem small.

Understanding a Balance Sheet

Introduction

In the previous issue, the profit and loss statement (P&L) was explained. Here, we show the basics of analyzing “assets” and “liabilities” in a balance sheet.

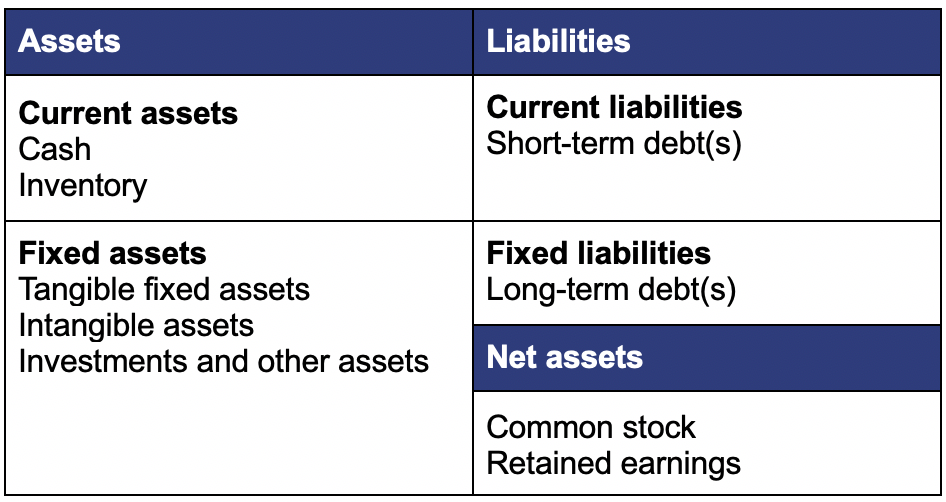

The balance sheet, abbreviated as “BS”, is largely composed of “Assets”, “Liabilities” and “Net assets”. Moreover, “Assets” are divided into “Current assets” and “Fixed assets”, whereas “Liabilities” are split into “Current liabilities” and “Fixed liabilities”.

Structure of a Balance Sheet

The BS is separated into left and right parts by a center line. The right side indicates ‘how the company has been raising cash’, while the left side shows ‘what it has invested in’.

Put more simply, a balance sheet indicates what the ‘cash gathered’ on the right side was ‘converted into, as the company’s property’ on the left.

Looking at the left side, you will see unconverted “Cash”, as well as cash converted into “Inventory” through purchasing, etc.

As “Tangible fixed assets” mean assets having a physical shape/structure, some of the company’s money was converted into things such as buildings and machinery.

Listed According to Ease of Conversion into Cash

On both sides, the listed order of the items from the top corresponds to how easy they are to convert into cash.

The left part of the BS is for “Assets”, and overall is divided into “Current assets” and “Fixed assets”.

“Current assets” are meant to be converted into cash quickly, while “Fixed assets” are not. One year is considered the dividing point, so this standard is called “the one-year rule”.

Strictly speaking, “the normal operating cycle rule” comes before “the one-year rule”. Nevertheless, when starting out, just remembering “the one-year rule” should be fine.

The right side indicates ‘how the company has been raising cash’. This includes ‘borrowing from others’, and these are categorized as “Liabilities”.

Similar to Assets, “Current liabilities” are debts to be repaid within one year, while “Fixed Liabilities” are allowed to be carried over to the following accounting year. What is borrowed from others must be paid back.

Next month’s issue will deal with “Net assets”, which do not require repayment.