Points to be Noted Regarding Year-end Adjustments This Year

Introduction

The period of year-end adjustments is approaching. This year, they will have more revisions than usual. Let’s look at the points which will be modified.

Increase of the Basic Deduction

The basic deduction is one of fourteen tax deductions (which, like the deductions for medical expenses and social insurance premiums, can be deducted from income) and uniformly deducted from taxpayers’ income when calculating income tax. Due to a revision, the deduction amount will be raised uniformly to 480,000 yen starting from the year 2020. Currently it is 380,000 yen.

As a result, the basic deduction will be decreased for those with high incomes; however, such levels are beyond the scope of year-end adjustments.

Review of the Employment Income Deduction

While the basic deduction will be raised by 100,000 yen, the employment income deduction is to be uniformly reduced by 100,000 yen. As it will offset the increase of the basic deduction, in the end nothing seems to have changed. So, what is the reason for raising the basic deduction?

The government is aiming to increase the number of sole proprietors, to promote “work-style reform”. Those affected by the decrease in the employment income deduction will be salaried employees, called サラリーマン in Japanese. Sole proprietors will be unaffected.

In addition, the maximum amount of the employment income deduction is gradually being reduced, based on the view of the Tax Commission that “the deduction amounts for high income-earners are too large”. The ceiling is being lowered in stages - until last year, the maximum level eligible for the deduction was annual employment income of 10 million yen, whereas from this year it will be 8.5 million yen. This equates to a tax increase for those with annual employment incomes surpassing 8.5 million yen, except for cases in which “Deductions for Adjustments to Income Amounts” (所得金額調整控除listed below) apply. Those who have annual employment income of 8.5 million yen or less are not affected by this tax reform.

“Deductions for Adjustments to Income Amounts” Newly Established

As noted above, the tax burden will increase for those who have annual employment income over 8.5 million, due to the revision of the employment income deduction. However, considering that many households with corresponding income levels include children/elderly members, the employment income deduction is adjusted upward when a high-earned-income filer is in such a situation. As a result, employees earning large incomes who live in households with children/senior citizens will see no tax increase even if they have an annual income over 8.5 million.

If any of the following descriptions apply, the employee taxpayer shall be entitled to an employment-income deduction, even with earned income exceeding 8.5 million yen.

- the tax filer is severely handicapped

- the filer has dependents under 23 years of age

- the tax filer has a severely handicapped spouse or dependents of the same household

A filer with children should fall under requirement #2, due to having dependents under 23 years of age. Households with elderly residents should apply under #3. In this way, the adjustments are performed without increasing the tax burden on households with children/elderly members.

Year-End Adjustment Forms Significantly Changed

Introduction

The most important point for this year’s year-end adjustments is that the year-end adjustment form has been significantly revised. Generally, dealing with the forms early will be necessary, because they will have to be submitted in a format different from the ones thus far.

Year-End Adjustment Format Significantly Changed

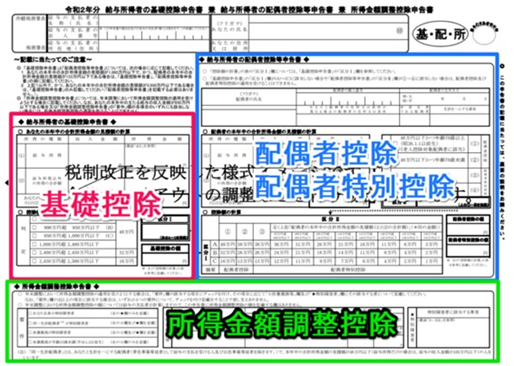

Concerning year-end adjustments, salaried employees with spouses have had to submit the form named “salaried employee’s spousal deduction declaration” (給与所得者の配偶者控除等申告書). From this year, a “declaration of a salaried employee’s basic deduction” and a “declaration of an income adjustment deduction” will also be required.

These two new kinds of declarations actually end up being integrated with the “salaried employee’s spousal deduction declaration”, ending up as a new form with quite a long name - the “Declarations of a salaried employee’s basic deduction, spousal deduction and income adjustment deduction” (給与所得者の基礎控除申告書兼給与所得者の配偶者控除等申告書兼所得金額調整控除申告書).

First, as for the basic deduction field in the red frame, all officers and employees are required to fill it in. Please explain to all such individuals, so that they are sure to do so. Next, the spousal deduction / spousal special deduction fields are only for married persons providing for a spouse. Unmarried persons should be informed that they need not be concerned about these.

Lastly, the green-enclosed (income adjustment) field only needs to be filled in by those with earned incomes surpassing 8.5 million yen.

In this way, it’s necessary to explain in advance who needs to fill in which parts of the form.

The situation should be avoided where one loses time due to being asked by people with earned income under 8.5 million how to fill out the bottom section.

Single Parent Deduction Newly Established

Regarding so-called “single parents”, although there exists a deduction for widows & widowers, recently the number of unmarried single parents has been increasing. In response to this, a “single parent deduction” was established this year.

The current deduction for widows/widowers requires bereavement, divorce or a situation where it is unknown if the person’s spouse is alive or dead. Therefore, unmarried persons have been unable to benefit from it. The new system was established from the point of view of implementing tax policies which treat every single parent household equally.

Those eligible are people who are unmarried (or else it is unknown whether their spouses are dead or alive), plus they meet the following requirements:

- have children of the same household whose total income is 480,000 yen or less;

- the taxpayer’s total income is 5 million yen or less; and,

- the person’s residence card does not state that they are in a common-law marriage.

In cases where the conditions for the single parent deduction are met, instead of submitting the aforementioned “Declarations of a salaried employee’s basic deduction, spousal deduction and income adjustment deduction” form, rather it would be necessary to file the “Declaration of (Change in) Deduction for Dependents of an Employment Income Earner”, with a description of how the filer qualifies as a single parent. The form must be filed by the day prior to their last payday for 2020.

Problems which Arise when Foreign Technical Interns have Difficulties Returning Home

Introduction

Due to the effects of novel coronavirus, the situations of foreign technical interns who cannot return to their home countries in spite of the expiration of their training periods are resulting in major problems. What issues occur when they stay because they can’t return home?

What is the Foreign Technical Training Program?

The Foreign Technical Training Program is a program for non-Japanese to acquire skills and proficiencies which would be hard for them to get in their home countries, through employment contracts with Japanese companies, etc. Presently it is said that about 410,000 foreign technical interns are staying in Japan.

Their wages are subject to taxes with a progressive tax rate when they are “residents”, or with a uniform 20.42% withholding rate when they are “non-residents”.

Almost all of the approximately 410,000 foreign technical interns take technical training based on the residence status called “technical intern training (i)”. This status is generally given to “non-residents” on the premise that they will return home within one year.

To assist foreign technical interns experiencing difficulties returning home due to the effects of COVID-19, the Ministry of Justice arranged so that those interns could get their visa status changed to the status of “designated activities”, which makes it possible for them to work for “six months” if they so wish, for the purpose of raising money to cover their costs of their extended stays in Japan.

People Staying in Japan Over One Year Become” Residents"

As mentioned above, the residence status of foreign technical interns who were stranded in Japan was changed as a countermeasure; nevertheless, for tax purposes, when the interns pass the one-year mark of their stay, they become “residents”.

If an individual’s status changed at the end of the one-year period of training under the technical intern training (i) category to a six-month designated activities status, that person qualifies as a “resident” as soon as (s)he has spent one year in Japan.

Measures such as treating such individuals continuously as “non-residents” will not be implemented, even if the reason for a person being in Japan is due to their difficulty in returning home because of the new coronavirus. Also, the Ministry of Justice is accepting changes (extensions) to the designated activities status which make it possible for non-Japanese technical interns who lose their jobs due to bad business conditions for the companies which provided training, to work for one year here.

In such cases, because the trainees are presumed to work while having lived in Japan over one year, they will be included among “residents” from the time of agreement on any new employment contracts based upon presumptive applicable regulations.

Some Countries’ Citizens Exempt from Tax under Tax Treaties

When tax treaties/conventions are concluded between Japan and countries which foreign technical interns come from, if such agreements include tax exemption clauses for “business apprentices”, then the wages paid to such interns could be exempt from withholding taxes - regardless of whether they are “residents” or “non-residents”.

For instance, because tax treaties with China and Thailand include tax exemption clauses, taxes on nationals of those nations can be exempted by submitting an “Application Form for Income Tax Conventions” via the companies doing the training.

The training provider companies should first confirm details such as whether or not withholding is being carried out at the tax rate of 20.42% for “non-residents” in the case of technical intern training (i), as it will provide a good opportunity to re-check withholding levels for the foreign interns.