Sales of 3 Million Yen or Less from a Side Business Classified as Miscellaneous Income

Introduction

The National Tax Agency has begun soliciting opinions regarding the revision of the Basic Income Tax Notice. In this month’s newsletter, the criteria for determining "business income" and "miscellaneous income" are presented, and explained below. Perhaps you think that if you submit a "notification of commencement of business", the income from the business will be considered as business income. However, whether or not a "notification of commencement of business" has been submitted does not affect the classification of income.

Taxation of Side Income

The National Tax Agency has been working hard to create an environment for proper reporting of "income related to new fields of economic activity" such as the sharing economy, and “income related to side jobs”. However, until now, it has been difficult to determine the income categories for such incomes.

For example, income from side jobs is basically classified as miscellaneous income. However, there have been many cases in which taxpayers have reported their income as business income and applied the special deduction for the blue return, even though the income did not actually reach the level of business income, or in which taxpayers have received income tax refunds by applying losses incurred from side jobs against employment income. The newly-announced amendments will seemingly clarify the scope of miscellaneous income, taking into account income related to new fields of economic activity, such as the sharing economy and income from side work.

Cannot be Aggregated with Employment Income from Side Jobs

In principle, whether income falls under the category of "business income" or "miscellaneous income" is determined by whether the activity engaged in to earn the income was carried out to the extent that it can be called a “business” in the sense of how the word is commonly used in society.

Rarely, there are people who think that if they submit a "notification of commencement of business,” their income from such business will naturally be considered as business income, but that is not the case at all. In this regard, the proposed amendment states that if "the income is not the person's principal income, and the amount of such income does not exceed 3 million yen," then the income falls under "miscellaneous income" unless there is specific evidence to the contrary.

In other words, after the revision, income from a side business with income (sales) of 3 million yen or less will fall under the category of "miscellaneous income," and will not be eligible for the special blue tax return deduction nor profit/loss aggregation with employment income - both of which are available with business income tax returns.

Income in Excess of 3 Million Yen Might Not Constitute Business Income

It should be noted that even if your income (sales) exceeds 3 million yen, the amount does not automatically become "business income”. It is being stipulated with this amendment that income (sales) of 3 million yen or less is, in principle, "miscellaneous income," but there may be cases where income (sales) exceeding 3 million yen is still considered "miscellaneous income”.

In principle, only when income (sales) exceeds 3 million yen will it then be determined whether the activity to earn the income falls under the category of "business income" or "miscellaneous income”, based on whether the activity was conducted to the extent that it can be called a business in the socially-accepted sense of the word. It is also noteworthy that this amendment will apply to income tax for the year 2022 and thereafter, so the amendment will affect this year's tax year as soon as it is passed.

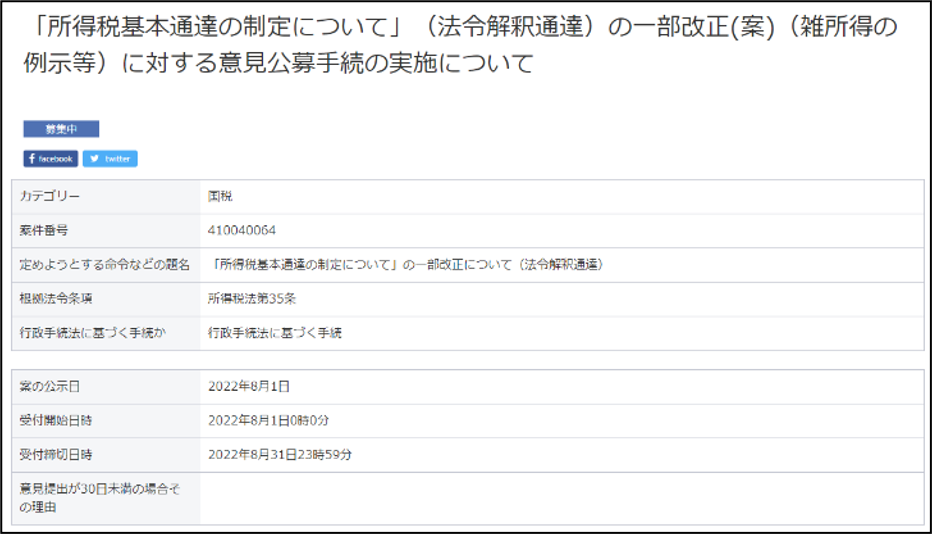

< August 1, 2022: Comments sought on the proposed amendment(s) to the Basic Income Tax Notice >

https://public-comment.e-gov.go.jp/servlet/Public?CLASSNAME=PCMMSTDETAIL&id=410040064

Wire Transfer Fees under the Invoice System

Introduction

There are probably no Japanese businesses that carry out no transactions with banks, including bank account transfers. When the invoice system is introduced, what kinds of documents should be kept regarding bank transactions? We will explain about this using the example of bank transfer fees, which are incurred by all businesses.

Application of the “Special Exception Allowing Preservation of Only Ledgers (Account Books)”

When you make a transfer over the counter, via ATM, or even through Internet banking, you are likely to pay a transfer fee. These transfer fees are subject to consumption tax, and the financial institution is obliged to deliver an invoice for the transfer fee at the counter or through Net banking, and the user is required to keep the transfer fee invoice.

However, ATM transfer fees of less than 30,000 yen are exempted from the obligation to deliver an invoice because it’s difficult to deliver an invoice due to the nature of the business. In this case, the user can receive a credit for consumption tax paid (credit for tax on purchases) by keeping account books with certain information, instead of keeping invoices.

This is because so-called vending machine services are exempt from the obligation to deliver and retain invoices. Since bank ATMs and money changers fall under the category of vending machine services, they are exempt from that obligation if the fee is less than 30,000 yen.

Therefore, it is conceivable that documents proving the transfer occurred may be issued when using ATMs as in the past, but it is not necessary to preserve such documents in order to receive the credit for consumption tax paid. Please note that the “Special Exception Allowing Preservation of Only Ledgers” does not apply to transfers made over the counter or via Internet banking, even if the fee is less than 30,000 yen. For those transactions, invoices must be preserved.

How to Qualify for the "Special Exception Allowing Preservation of Only Ledgers”

If a taxpayer wishes to deduct consumption tax paid (credit for purchase tax) by keeping only a ledger, it will be necessary to enter a statement to that effect in the ledger, as well as the addresses of the counter-parties.

If you used an ATM or other means to pay a transfer fee, you must enter the address of the location of the ATM that you used in your books. The name of the branch is not required; the address should be listed as the name of the city, ward, town or village. It is not necessary to write the exact street address.

In addition, if you wish to apply for the "Special Exception Allowing Preservation of Only Ledgers," you must write "Special Exception Allowing Preservation of Only Ledgers" in your ledger, so please don’t forget to write that as well.

If even one of the abstracts columns listed below is missing, you cannot complain even if the deduction for consumption tax paid (credit for purchase tax) is denied at the time of a tax audit. In practice, we do not think that missing one piece of information will result in an amended tax return being immediately necessary, but we will not know for sure until we undergo a tax audit under the invoice system.

[Image of the abstract columns of a ledger sheet]【帳簿の摘要欄の記載イメージ】

| Summary |

| bank transfer charge (transfer at ABC Bank ATM: Chiyoda-ku, Tokyo) *Application of "Special Exception Allowing Preservation of Only Ledgers” |

What Cosigners Should Consider Regarding Financing

Introduction

In principle, banks require that small and medium-sized enterprises (SMEs) have the owner of the business act as a cosigner on loans. In the event of an emergency, the business owner must repay the loan on behalf of the company. Do you know the difference between a guarantor (保証人, hoshounin) and a cosigner (連帯保証人 rentai-hoshounin)? Let's get a correct understanding about cosigners.

Guarantors and Cosigners

There is a difference between a guarantor and a cosigner. Unlike a guarantor, a cosigner does not have the right of defense of demand, nor the right of defense of retrieval.

The right of defense of demand is a right that allows the guarantor to insist that the creditor first demand the principal debtor (the company that received the loan) to repay the debt when the creditor (the bank) demands the guarantor to perform the guaranteed obligation (repayment on behalf of the company that is the debtor).

The right of defense of retrieval is the right of the guarantor to refuse to perform the guaranteed obligation to the creditor unless the creditor first collects on the property of the principal debtor.

In the case of a manager who has become a cosigner in a bank loan, unlike a simple guarantor, they have no right of defense of demand or right of defense of retrieval. Therefore, the bank can suddenly collect from the cosigner if the company is unable to repay the loan.

Reasons Why Cosigning is Required

Banks require managers to be cosigners for two main reasons.

The first is to ensure the company managers exercise discipline. It is conceivable that, as long as their own personal assets were not impacted, some managers wouldn’t worry very much if their company became unable to repay the bank.

In preparation for their company's bankruptcy, some managers might consider transferring the company's assets to individual managers, such as by setting high levels of executive compensation. To help prevent such moral hazards, banks demand that the managers be cosigners.

Second, it complements the creditworthiness of the company receiving the loan. This reason is especially important when the company's creditworthiness is weak, such as in the case of poor performance or bad financial condition. In particular, if a corporate manager has some amount of personal assets, the bank will be more likely to extend a loan, believing that the manager, as a co-signer, will be able to repay the loan from his/her own assets in the event that the company is unable to repay the bank.

Guidelines Concerning Management Guarantees

If a manager is a co-signer for a loan their company is receiving from a bank, he or she should be aware of the "Guidelines Concerning Management Guarantees".

The management guarantee guidelines were issued in February 2014. The Guidelines stipulate as follows regarding personal guarantees by management:

- Not requiring a personal guarantee by management if certain requirements are met;

- It is recommended that a manager consider setting aside a certain amount of living expenses, moving to a less expensive home, etc., in the event of an early decision to reorganize or close the business, even if they have provided a personal guarantee;

- In principle, the remaining amount of the obligation that cannot be repaid at the time of fulfillment of the guaranteed obligation shall be discharged.

We think the Guidelines are worth reading, because the main objectives are to eliminate the adverse effects of management guarantees, and to encourage management to take bold steps in business development and early business reorganization.