”Frequently-Asked Questions” about Invoices Has Been Published

Introduction

After the October 2023 revision of the Invoice Q&A, a compilation of questions received by the national tax authorities has been published in the form of "Frequently-Asked Questions".

If a Description is Different between a Receipt and the Invoice Publication Website

This describes how to deal with a case where the description on the receipt (simple invoice) received differs from the search result on the invoice-issuing business’s public announcement website. There are cases where a receipt with a trade name (a "doing business as" name) is received, but when the invoice registration number on the receipt is searched for on the website of the invoice-issuing business operator, only the name or title of the business operator is displayed - not the trade name. In such cases, it has been clarified that if the validity of the registration number can be confirmed, the purchase tax credit is allowed, as a valid invoice.

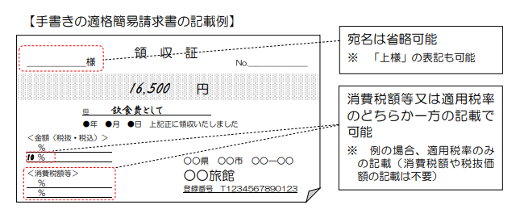

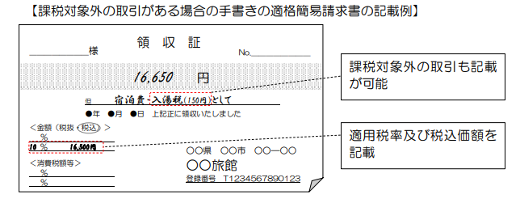

Delivery of a Handwritten Receipt

Although there is no obligation to issue invoices or simplified invoices for transactions not subject to consumption tax, such as bathing tax, examples of two handwritten simplified invoices are shown in question (3), including a case of a transaction not subject to taxation, as transactions not subject to taxation can also be included in a simplified invoice.

*Figures taken from the National Tax Agency’s “Frequently-Asked Questions”

Regarding Invoices Issued by Tax-Exempt Businesses

A response regarding transactions with tax-exempt businesses was also presented. Tax-exempt businesses are not allowed to deliver invoices, but they are still allowed to deliver billings that do not fall under the ‘invoice’ category.

However, the delivery of documents that may be mistakenly identified as invoices is prohibited and subject to penalties. For example, documents with alphanumeric characters that resemble registration numbers may be misidentified as invoices.

In addition, even if a tax-exempt business includes an amount equivalent to consumption tax on a bill, basically it is not subject to penalties as long as there is no risk of misidentification as an invoice. Q&A (4) clearly states that it is appropriate for tax-exempt businesses also to charge the amount equivalent to consumption tax incurred at the time of purchase, on top of the transaction price.

Even in Transactions with Invoice-issuing Businesses, Transitional Measures Can be Applied

For taxable purchases from consumers, tax-exempt enterprises, and taxable enterprises that are not registered as invoice issuers, there is a transitional measure that allows 80% of the amount equivalent to purchase tax to be deducted for a certain period. It has also been clarified that the transitional measures are not limited to transactions with parties other than invoice-issuing businesses, but also include invoices received from invoice-issuing businesses that do not include a registration number, etc., if those invoices meet the description requirements for categorized (differentiated) invoices, etc.

In order to qualify for the transitional measures, it is necessary to keep books stating that the transitional measures apply, such as "80% deductible," "exempt," etc., as well as invoices, etc., listing the same items as required for categorized invoices, etc.

Reconfirming about Gifts Given through the Taxation by Settlement at the Time of Inheritance System

Introduction

It is expected that the number of gifts given through the system of taxation by settlement at the time of inheritance will increase. However, if you are going to give or receive a gift using this system, you must do so after careful consideration. Rashly choosing to give/receive a gift this way without considering your future gift plans could cause you to end up facing significant risks. When giving a gift utilizing the taxation by settlement at the time of inheritance system, be sure to fully understand both the advantages and disadvantages before giving the gift.

Gifts during and after January 2024

As of January 1, 2024, a basic exemption of 1.1 million yen will be established with respect to gifts given through the system of taxation by settlement at the time of inheritance. This is different from the basic exemption of 1.1 million yen for gift tax (calendar-year gifting), so after January 1, 2024, the following two will proceed simultaneously:

- Basic exemption amount for calendar year gifts: 1.1 million yen

- Basic exemption amount of 1.1 million yen for taxable gifts given through settlement at the time of inheritance

While calendar year gifts on or after January 1, 2024 will be subject to carry-back (持ち戻し) for seven years, gifts taxable at the time of inheritance will not be subject to such carry-back, so we often hear people say that after 2024, gifts taxable at the time of inheritance will probably increase. However, there are some points that must be kept in mind if the system of taxation by settlement at the time of inheritance is used.

What is a Taxable Gift at the Time of Inheritance?

The system of taxation of gifts through settlement at the time of inheritance began in 2003, so has been in effect for 20 years now. Gifts of up to ¥25 million during one's lifetime are exempt from gift tax. A flat 20% gift tax is imposed on any portion exceeding ¥25 million.

However, it is important to note that all property donated via the system of taxation through settlement at the time of inheritance will be added to the donor's estate at the time of the donor's death, and inheritance tax will be imposed.

*The difference between the inheritance tax incurred at the donor’s death, and the gift taxes paid in the past will be adjusted.

The end result is that gift taxes are settled at the time of inheritance, so the gift taxes paid before are temporary in nature. This is the functioning of the system for taxation settlement at the time of inheritance.

Example: Utilizing the system of taxation settlement at the time of inheritance, a grandfather gives ¥5 million in cash to his grandson, and the grandson uses the cash to purchase listed stocks.

Even if the market value of the listed stocks was 20 million yen at the time of the grandfather's passing, only the ¥5 million cash portion would be subject to inheritance tax. Therefore, if you use this system to purchase property that is expected to increase in value, you will enjoy a benefit, while it will be a loss if you donate property that then decreases in value.

Disadvantages of Giving via the System of Taxation Settlement at the Time of Inheritance

The disadvantage of giving through the taxation of gifts by settlement at the time of inheritance is that once the choice is made, there can be no return to calendar-year gifting.

For gifts after the 25 million yen limit has been used up, a gift tax of 20% will be imposed on the portion of the gift which exceeds the basic deduction of 1.1 million yen, and the extra portion will be added to the donor's estate.

Another disadvantage is that the statute of limitations for gift tax will no longer be applicable. The normal calendar year gift statute of limitations expires six years after the statutory filing deadline, unless the gift is a malicious case. Even if you make a gift and inadvertently forget to file a return, you may not be subject to gift tax after a certain period of time.

However, the story is different in the case of gifts via taxation upon settlement at the time of inheritance. Once this system is elected, all gift amounts after the election are added to the estate. In other words, there is no longer a statute of limitations on the imposition of gift tax.

What are Debtor Classifications?

Introduction

Banks assign debtor classifications to loan recipients based on banks’ internal manuals. A borrower's ability to be approved for a loan depends on which debtor category they are classified in. Aiming for as good a debtor classification as possible will help lead to a comfortable cash flow.

What are Debtor Classifications?

Borrower/Debtor classification is a category set by a bank for each company to which it provides loans, and is determined based on the company's financial condition, profitability, and loan repayment status.

Based on the debtor classification of the company to which a loan is extended, and the state of securitization (how much the bank can recover if the borrowing company is unable to repay the loan, through subrogation by a credit guarantee association, sale of collateral, etc.), the bank sets aside an allowance for doubtful accounts for the loan to the company and prepares the financial statements of the bank itself.

Debtor classification was described in the Financial Inspection Manual enacted in 1999, and based on that manual, banks assigned debtor classifications to loan recipient companies, classified loans by the degree of risk of non-recovery based on the debtor classification, and recorded allowances for loan losses. The Financial Inspection Manual was abolished in 2019, but it is expected that the operation of debtor classifications will continue for each bank for some time to come.

Explanation of Debtor Classifications

There are five debtor categories, as follows:

- Normal borrowers

- Borrowers requiring caution

- Potentially bankrupt borrowers

- Effectively bankrupt borrowers

- Bankrupt borrowers

1. Normal Borrowers

These are companies that are performing well, have no particular financial problems, and are not delinquent.

2. Borrowers Requiring Caution/Special Attention

Borrowers requiring special attention are classified into "Other Borrowers Requiring Special Attention" and "Borrowers Requiring Supervision”. Borrowers requiring special attention are companies that are performing poorly, have financial problems, or have delinquent loans.

Among the companies requiring caution, those companies whose loans are wholly or partially "loans in need of supervision" are considered to be in need of supervision.

Sub-standard loans are loans that are delinquent for three months or more, or “loans with relaxed lending terms” (restructured loans). “Restructured loans” are loans for which the bank has granted a grace period for principal repayment, interest rate reduction or waiver, interest payment deferral, or debt forgiveness in order to support the borrower's business restructuring.

In other words, companies that are delinquent for more than three months, or have loans for which the bank has taken special measures, are classified as “Borrowers Requiring Supervision", while other companies with financial problems are classified as "Other Borrowers requiring Special Attention”.

3. Potentially Bankrupt Companies

The company is in financial difficulties, is in no condition for improvement, and has long-term delinquent loans.

4. Effectively Bankrupt Debtor

Although legally and formally bankruptcy has not occurred, the company is practically no longer in business and is as good as bankrupt, as seen by measures such as its sales offices having been closed due to voluntary closures by the operator.

5. Bankrupt Companies

The classification of a borrower by the bank will greatly affect the ease with which a loan is approved. A borrower classified as "Normal" is more likely to be approved for a loan, while a borrower classified in "Other Borrowers Requiring Special Attention" is less likely to be approved.