National Tax Agency Publishes Brochure on "Flat-rate Tax Reductions"

Introduction

As mentioned in our previous issue, if the tax reform bill for FY2024 is passed and enacted in the Diet, a flat-rate tax reduction will be implemented from June 2024. On January 30, the National Tax Agency (NTA) set up a special website regarding the flat-rate tax reduction, and published a pamphlet for payroll managers. Payroll personnel need to prepare early to avoid confusion in June.

First, It’s Necessary to Determine Who’s Eligible

On January 30, the NTA set up a special website concerning the flat-rate tax reduction and published a pamphlet for withholding agents (payroll personnel) titled "How to Carry Out the 2024 Flat-rate Tax Reduction of Income Tax with respect to Withholding at the Source for Wages, etc.".

As for the contents, the details of "monthly tax reduction administration" and "annual tax reduction administration," respectively, were presented as two administrative tasks to be performed by payroll personnel.

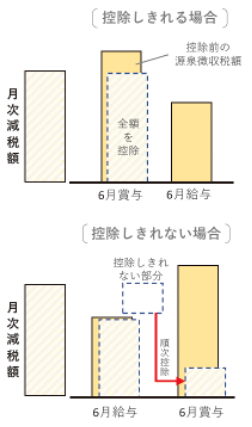

“Monthly tax reduction administration" refers to the subtraction of the fixed amount of withholding tax (the monthly tax reduction) from the amount of withholding tax on salaries, etc. (including bonuses) which are paid on or after June 1, 2024.

If the fixed amount cannot be fully deducted in June, the remainder of it is to be deducted sequentially from taxes withheld in July and thereafter.

The specific steps are as follows. Steps 1. through 3. should be completed by June, when the flat-rate tax reduction program begins.

*Figures: taken from National Tax Agency pamphlet

- Identification of people for whom the deductions apply

- Creation of a personalized deduction record book for each individual

- Calculation of monthly tax abatement amount

- Deductions at the time of payment of wages, etc.

- Administration after the deductions

Those Hired on or after June 2 are Not Eligible

The first step for a payroll clerk to confirm who is eligible for the deductions (1. above) is to determine the employees who are eligible for the monthly tax reductions. Eligible employees are those who are working at the company as of June 1, 2024 and who are residents who have submitted an Application for (change in) Exemption for Dependents of Employment Income Earner*. Those who are 'Column B Applicable’ paid salaries from two or more places, as well as those who joined the company on or after June 2, 2024, are ineligible.

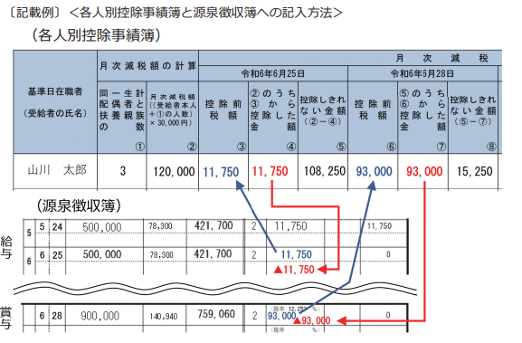

An Example of a Deduction Record Book for Each Employee is Included.

It is expected that many employees will not be able to fully deduct their entire monthly tax reduction amount with their first-time withholding tax (from their June salary payment). For recording/calculating amounts that cannot be fully deducted in the first month, it is advisable to use the "Individual Deduction Register" presented in the same pamphlet.

*Figure: taken from National Tax Agency pamphlet

<Reference> "How to Carry Out the 2024 Flat-rate Tax Reduction of Income Tax with respect to Withholding at the Source for Wages, etc.”:

https://www.nta.go.jp/publication/pamph/gensen/0023012-317.pdf {in Japanese}

"Frequently Asked Questions" Updated Regarding Electronic Transactions

Introduction

On January 22, 2024, the National Tax Agency (NTA) updated its "Frequently Asked Questions" section regarding the revised electronic transaction system that began on January 1, 2024. The NTA document clarifies regarding the preservation of documents output in conjunction with electronic transaction data.

Answers for Misconceptions

As of January 1, 2024, invoices and other data (electronic transaction data) exchanged via e-mail, etc., must in principle be stored electronically in a form that satisfies search requirements, etc.

Although electronic data must be stored electronically, for convenience of processing paperwork, it is sometimes necessary to store a document that was output based on electronic transaction data separately from the data itself. However, there has been a misunderstanding in some cases that, “Since electronic preservation of electronic transaction data is now mandatory, it is not acceptable to preserve written {hard copy} output”.

In order to dispel such misconceptions, the "Electronic Transactions" section of "Frequently Asked Questions" (Addendum 4) indicates that, as described below, so long as electronic transaction data is not deleted and is electronically stored in a form that meets search requirements, etc., there is no problem with also storing the ‘hard copy’ documents that result from outputting the data.

【Document output of electromagnetic records】

Q: In our company, electromagnetic records (electronic data) and documents (paper) containing information about electronic transactions are mixed in transactions. We are taking appropriate measures to preserve the electronic data itself in accordance with the preservation requirements under the Electronic Bookkeeping Law, but for the convenience of accounting, we print certain electronic data, such as e-mails, in written form and file them together with other documents. Is there any problem in adopting such a storage method?

A: As per your question, there is no problem if the electromagnetic records containing information about electronic transactions are not deleted, and are preserved in accordance with the preservation requirements of the Electronic Bookkeeping Law. Then outputting such electromagnetic records in ‘hard copy’ (written) form and organizing them together with other documents is fine.

However, saving only the output document(s) is not acceptable. Since the electronic transaction data must be preserved, care should be taken to avoid deleting the electronic data when preserving/filing the printed document.

Other Matters

In addition, this document also indicates that the scope of electronic transaction data preservation coverage has not changed since January 2024.

For example, it is stated that even if a transaction document is called a "quotation," it does not need to be preserved if it was delivered to the other party and contains errors due to miscommunication, simple scribbling, etc., or if it is a draft composed before the formal quotation.

If the purchaser bought the product(s) on an e-commerce site, the purchaser needs to、save the data such as the receipt which relates to the purchase. However, if the buyer can check the receipt data on the e-commerce site at any time, they do not necessarily need to download and save the receipt data.

Furthermore, regarding certificates of ETC credit card usage for expressways, it is only necessary to electronically store those which are downloaded when the invoice system is applied. There is no need to obtain, download, and store usage certificates that have not been received by the taxpayer.

When the Repayment Burden on Existing Loans is Heavy

Introduction

How should managers respond when new financing is not available and repayment of existing loans is a heavy burden? When cash flow is tight, rescheduling should be considered.

What to Think When Your Company Can't Get a New Loan

A company that has applied for financing from a bank, but has not been approved and is unable to obtain new loans, while at the same time having large prior loans and a heavy repayment burden on those, can be thought to have a difficult cash flow situation.

Companies in this situation should consider reducing or deferring repayments of loans currently being repaid. Reducing or deferring loan repayments is called “rescheduling”.

Rescheduling improves cash flow. Some business owners have a fixed idea that they must repay the bank without fail, and try their best to continue repaying their loans without rescheduling, even when they cannot get new financing from the bank. However, even while debating whether or not to reschedule, the possibility of running out of capital increases.

How to Negotiate a Rescheduling

The smoothest rescheduling process is to negotiate with the main bank first, and once a policy has been decided on about how to reschedule, communicate the policy to banks other than the main bank, and then negotiate and obtain their agreement.

It is a good idea to apply for a rescheduling period of one year. Banks often say that one year is too long, and agree to six months. When the rescheduling deadline arrives, if your profits have not increased enough to resume repayments at their base level, negotiate at that time to have the rescheduling renewed/extended.

Explanation to the Bank

The first step in negotiations about rescheduling is for the company manager to visit each of the banks from which the loan has been received, and inform them of his/her company’s desire to reschedule the loan. Rescheduling is a request to the bank to change the repayment schedule promised by the manager to the bank in the loan agreement or other agreement because the manager is unable to keep the schedule. Do not just make a phone call.

Documentation

After informing your bank of your desire to reschedule, the bank drafts a request for approval and circulates it internally, to decide whether or not to accept the rescheduling proposal. Each lender bank will request documents it deems necessary for examination of the rescheduling request. It is safe to say that the trial balance, business improvement plan, cash flow chart, list of loans, etc. are almost always requested.

In addition to your regular business plan, if you write an action plan on how your company will improve its business, it will become a business improvement plan. The bank(s) will require you to create and show figures and action plans for how the company's profit and loss (P&L) figures will change each fiscal year for the next 5 to 10 years.

Rescheduling does not mean that repayment is reduced or postponed forever. The goal is to have repayments temporarily reduced or postponed so that the company can improve its operations and become more profitable, and then resume (the original) repayments.

Summary of the rescheduling process:

- Confirmation of financial status

- Consideration of rescheduling

- Preparing for rescheduling negotiations

- Explanation to the bank(s)

- Preparation and submission of documents

- Examinations by bank(s)

- Executing the rescheduling