Japanese Taxation and withholding income tax refund when Japanese resident sell real estate owned in Hawaii

The number of transfers of condominiums in Hawaii owned by Japanese people is increasing, probably due to the refraining from overseas travel due to COVID-19 and the depreciation of the yen due to the rapid exchange rate fluctuations from around last year.

Therefore, this time, I would like to talk about withholding tax when a resident of Japan (non-resident of Hawaii) transfers real estate and the refund procedure of the withholding tax after the transfer.

Here are the tax procedures for the Hawaii State Government that taxpayers who apply for foreign tax credits in Japan should know about capital gains from real estate in Hawaii.

1 Taxation and Refund Procedures by the Hawaii State Government for Residents of Japan

(1) Taxation and payment of withholding income tax at the time of real estate transfer

In the event of a sale of real property in Hawaii, the transferee is liable for federal income tax on the transfer price. In addition, Hawaii state law imposes withholding of state income tax at a rate of 7.25%. The withheld tax must then be paid to the state of Hawaii.

(2) Withholding tax refund procedures

In a situation in which the non-resident transferor’s income in Hawaii is solely from the transfer of real estate, the taxpayer is entitled to a refund of the amount of the tax withheld by submitting an application for refund, the APPLICATION FOR TENTATIVE REFUND OF WITHHOLDING ON DISPOSITIONS BY NONRESIDENT PERSONS OF HAWAII REAL PROPERTY INTERESTS to the State of Hawaii.

As income tax withholding is calculated by multiplying the transfer amount by the state’s withholding tax rate (7.25%), the tax burden is temporarily higher. Therefore, the net transfer amount is calculated by deducting the real estate acquisition costs and transfer-related expenses, and then is multiplied by the applicable tax rate to calculate the amount of tax due (final tax amount). An application is filed with the Hawaii state government for a refund of the difference between the withheld tax at the time of the real estate transfer and the final tax amount.

Japanese income tax law treats this tax refund as miscellaneous income.

2 Taxation at the time of a real estate transfer, and refund procedures

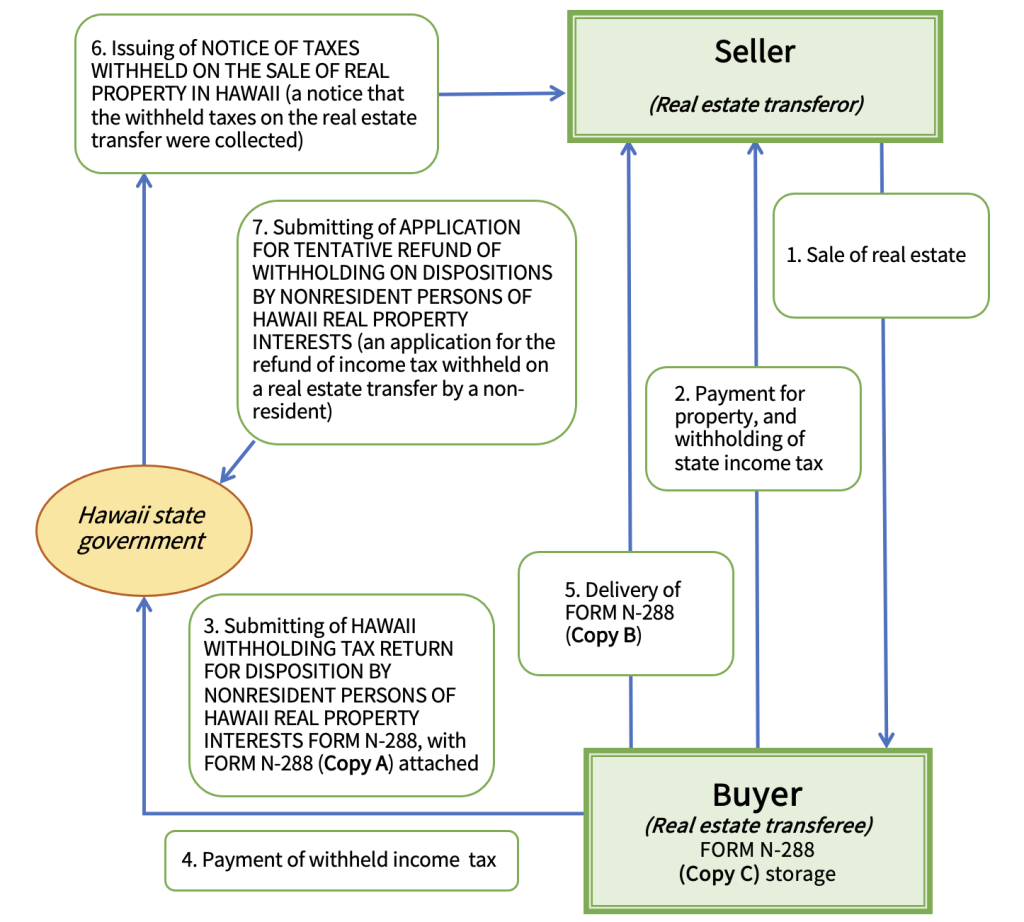

- Real estate transaction

- The transferee pays the (net) transfer price after deducting withholding tax at the rate of 7.25% from the real estate transfer price

- The transferee of the real property submits Form N-288 [HAWAII WITHHOLDING TAX RETURN FOR DISPOSITION BY NONRESIDENT PERSONS OF HAWAII REAL PROPERTY INTERESTS] and Form N-288A (Copy A)[Statement of Withholding on Dispositions By Nonresident Persons Of Hawaii Real Property Interests] with the Hawaii state government, filing notice of the purchase of the real estate from a non-resident and the withholding tax imposed on the real estate transaction.

- The real estate transferee pays the withholding tax to State of Hawaii officials.

- The real estate transferee provides the transferor with a FORM N-288A (Copy B)[Statement of Withholding on Dispositions By Nonresident Persons Of Hawaii Real Property Interests], while FORM N-288A (Copy C) iskept as a duplicate by the transferee.

- The Hawaii state government issues a NOTICE OF TAXES WITHHELD ON THE SALE OF REAL PROPERTY IN HAWAII (a notice that the withheld taxes on the real estate transfer were collected) to the transferor.

- The transferor of the real estate submits an APPLICATION FOR TENTATIVE REFUND OF WITHHOLDING ON DISPOSITIONS BY NONRESIDENT PERSONS OF HAWAII REAL PROPERTY INTERESTS (an application for the refund of income tax withheld on a real estate transfer by a non-resident) to the Hawaii state government for a tax refund.

[Process flow for Hawaii real estate transfers and refunds of withheld income tax paid to the Hawaii state government]