International cooperation among countries to prevent tax evasion and avoidance

As economic transactions become increasingly globalized, cross-border transactions are regularly taking place, and the structures for holding/managing assets are becoming increasingly complex and diverse.

In order for tax authorities to ensure the imposition and collection of taxes, it is important that they not only have access to information available domestically, but also to appropriately obtain information that is located outside the country.

In this issue, we will talk about the Convention on Mutual Administrative Assistance in Tax Matters (abbreviated as “the Convention”), a cooperative framework among countries for the prevention of international tax evasion and avoidance.

1 Cooperation among Countries

The ability of each country’s taxation authorities to gain access to information located outside their country is restricted due to the sovereignty (executive jurisdiction) of foreign nations. Therefore, tax authorities in various countries, including Japan, have concluded the “Convention on Mutual Administrative Assistance in Tax Matters” to provide tax-related information to each other based on tax treaties and other instruments, in order to combat international tax evasion and avoidance.

2 The Convention on Mutual Administrative Assistance in Tax Matters

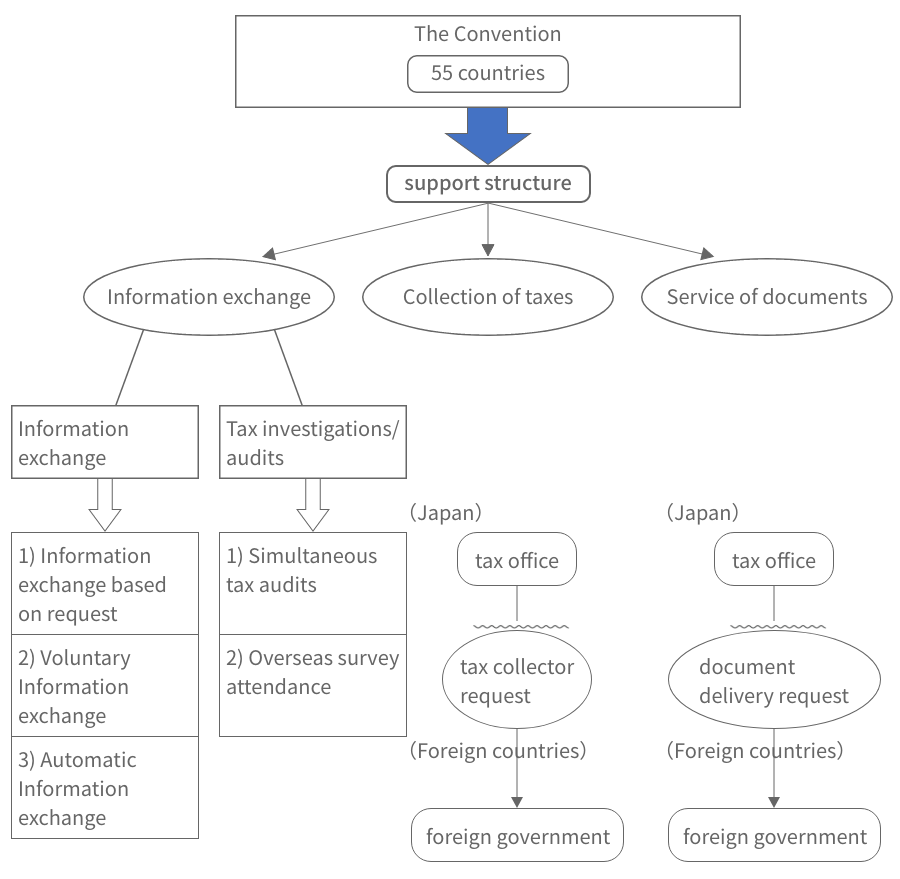

”The Convention” is a treaty between the tax authorities of each country to provide mutual administrative support in relation to taxation.

(1) Number of countries that have signed the Convention: 55 (as of June 18, 2013)

(2) Forms of administrative support

(a) Exchange of information: Exchange of information among the parties to the Convention (by request / voluntarily / automatically) and concurrent tax audits, as well as attendance at audits abroad.

(b) Mutual assistance in collection: When the assets of a taxpayer in tax arrears are located in another contracting party to the Convention, requests are made to the other contracting party to collect the tax.

(c) Mutual assistance in serving (delivering) tax documents: If an addressee of a tax-related document is in another contracting nation, then a request is made to serve the document in that nation.

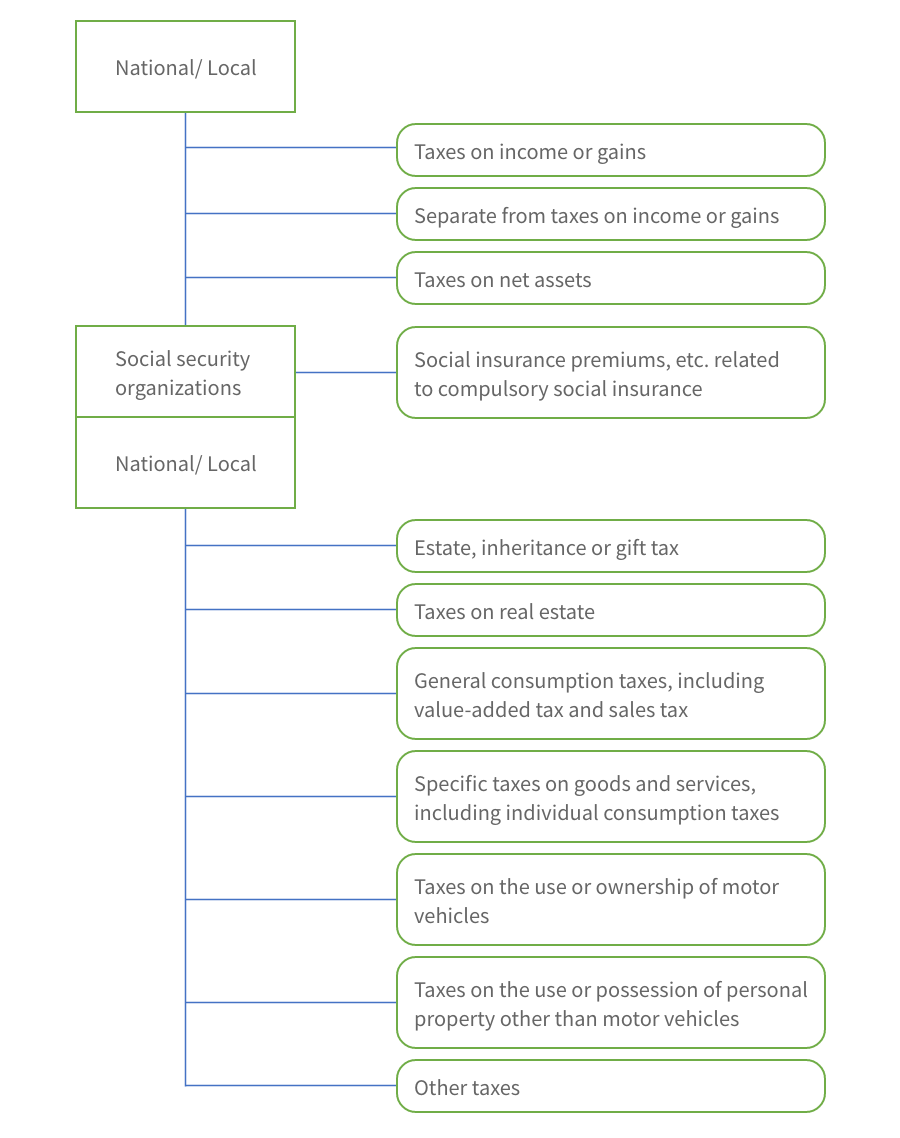

【Schematic Diagram】 The Convention (Image)

(3) Taxes subject to administrative support

(a) Taxes imposed on behalf of a Convention party:

- Taxes on income or gains

- Taxes on transfer proceeds imposed separately from taxes on income or gain

- Taxes on net assets

(b) The following taxes:

- Taxes on income, gains, concessions or net assets imposed by local governments or local public organizations

- Social insurance premiums for compulsory social insurance, which are payable to a general government or to social security organizations established under public law

- Other categories of taxes levied on behalf of a Convention party:

A Estate, inheritance or gift taxes

B Taxes on real estate

C General consumption taxes, including value-added tax and sales tax

D Specific taxes on goods and services, including individual consumption taxes

E Taxes on the use or ownership of motor vehicles

F Taxes on the use or possession of personal property other than motor vehicles

G Other taxes - Taxes in category iii imposed by local governments or local public organizations of a Convention party

【Schematic Diagram】Taxes Subject to Mutual Administrative Assistance (Image)