Foreign Corporate Taxation (Taxation of Foreign Corporations in Japan)

The corona virus that plunged the world into a pandemic has calmed down, and the world is struggling to regain the pre-corona rate of economic growth. Japan, too, is striving desperately to regain its pre-corona economic growth level.

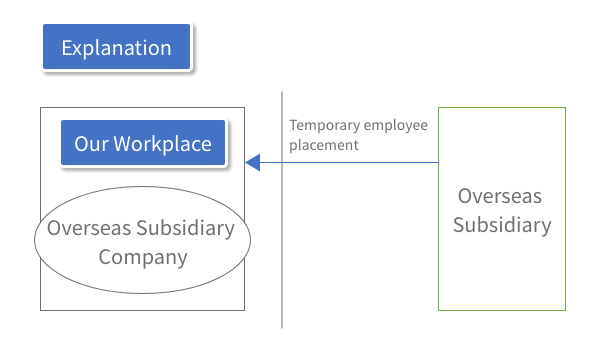

However, the labor force that is supposed to drive growth for each industry is in short supply, and some companies in manufacturing and other fields are seeking labor from overseas subsidiaries or business partners. In such cases, what must be noted is the issue of taxation on foreign corporations that arises when employees of an overseas subsidiary (a foreign corporation) come to Japan to provide labor. If you do not understand the structure of taxation on foreign corporations well enough, you might unexpectedly have issues pointed out by the tax authorities.

Therefore, based on the publication “Case Studies: Taxation of Foreign Corporations in Japan,” we will explain the taxation system for foreign corporations in this and the next issue.

Contents of this first issue:

- Regarding Taxation of Foreign Corporations under Domestic Law (Corporate Tax Law)

- Permanent Establishments under Domestic law (Corporate Tax Law)

- Items (Locations) Not included in Permanent Establishments under Domestic law (Corporate Tax Law)

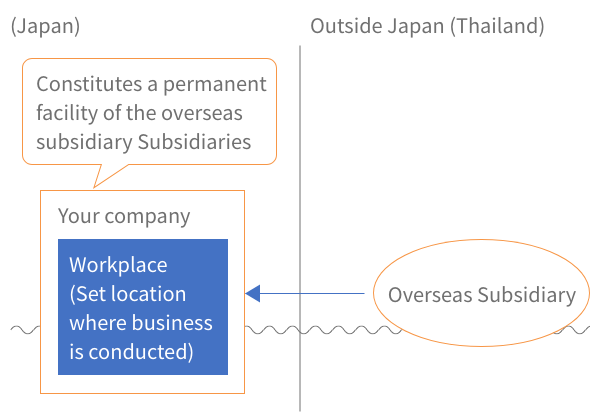

- Workplace(s) of an Overseas Subsidiary within Your Company (Corporate Tax Law)

Case Study: Taxation of Foreign Companies in Japan=1st.

We are a company engaged in the development of software, and we have an overseas subsidiary in Thailand (hereinafter referred to as the “overseas subsidiary”).

As ‘Corona-19’ has settled down, and orders for software development are strong, we plan to request support from our overseas subsidiary, and have some of their employees work in Japan for about a year. The work will be performed at our company.

Does our overseas subsidiary have to pay corporate and consumption taxes in Japan?

1. Taxation of Foreign Corporations under Domestic Law (Corporate Tax Law)

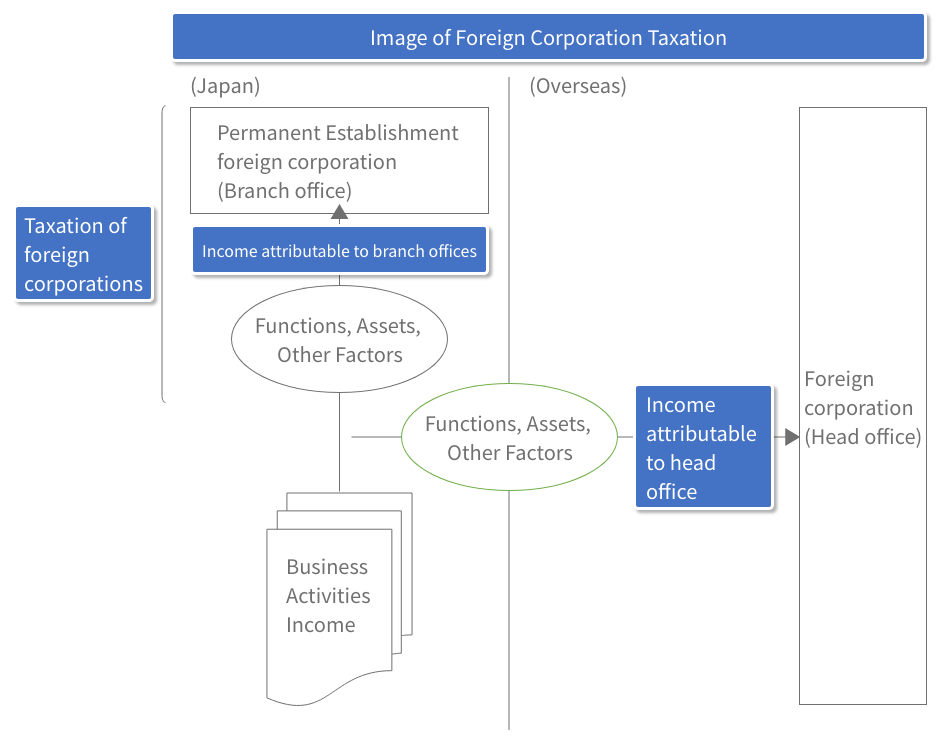

In the case where a foreign corporation conducts business through a permanent establishment (a branch office, etc.), if the permanent establishment is owned by a business entity operating independently of the foreign entity, income that is attributable to the permanent establishment is subject to taxation, taking into account the functions performed by the permanent establishment, the assets used in the permanent establishment, internal transactions between the permanent establishment and the head office of the foreign corporation, and other factors. (Law 138①1, 141①1)

2. What is a “Permanent Establishment” under Domestic Law (Corporate Tax Law)?

In general, a “permanent establishment” means the following: (However, if a tax treaty concluded by Japan provides for provisions different from those listed below, then the treaty’s provisions take precedence.) (Law 2-1-12-19 (a), (b), and (c))

Permanent establishments (under tax law)

(a) Branches, factories, and other facilities specified by a government ordinance as being certain places in Japan where foreign corporations conduct business;

(b) Places where construction or installation work or the provision of services for directing and supervising the same is performed, and other places specified by a government ordinance as equivalent thereto; or,

(c) Facilities where a foreign corporation is authorized to conclude contracts on its own behalf located in Japan, or other facilities specified by a government ordinance accordingly.

3. Items (Locations) Not Included in “Permanent Establishments” under Domestic Law (Corporate Tax Law)

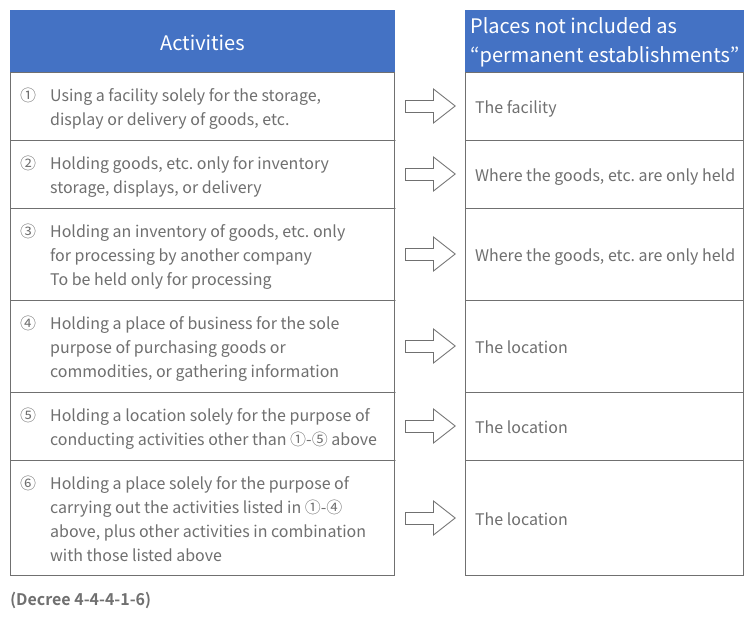

The following are not included as “permanent establishments”, due to the activities being of a temporary or ancillary nature:

4. Workplace(s) of an Overseas Subsidiary within Your Company

When employees of your overseas subsidiary perform work in your company, the location constitutes a set place of business of the overseas subsidiary under domestic law (Corporate Tax Law).