Japanese Companies Opening Deposit Accounts in the U.S.,and Obtaining Taxpayer Identification Numbers

The depreciation of the yen over the past several years has increased the value of the U.S. dollar, and when Japanese companies settle transactions denominated in U.S. dollars, they cannot avoid the impact of foreign exchange risk due to the yen’s depreciation.

Therefore, an option for Japanese companies to avoid foreign exchange risk is by opening a U.S. dollar deposit account in the United States.

In this issue, we will discuss the procedures for opening a deposit account in the U.S. for a Japanese company, and for obtaining a taxpayer identification number.

1 Opening a deposit account in the U.S. and obtaining a taxpayer identification number

When Japanese company opens a bank account in the U.S., it must obtain a taxpayer identification number (Employer Identification Number) and submit it to the bank.

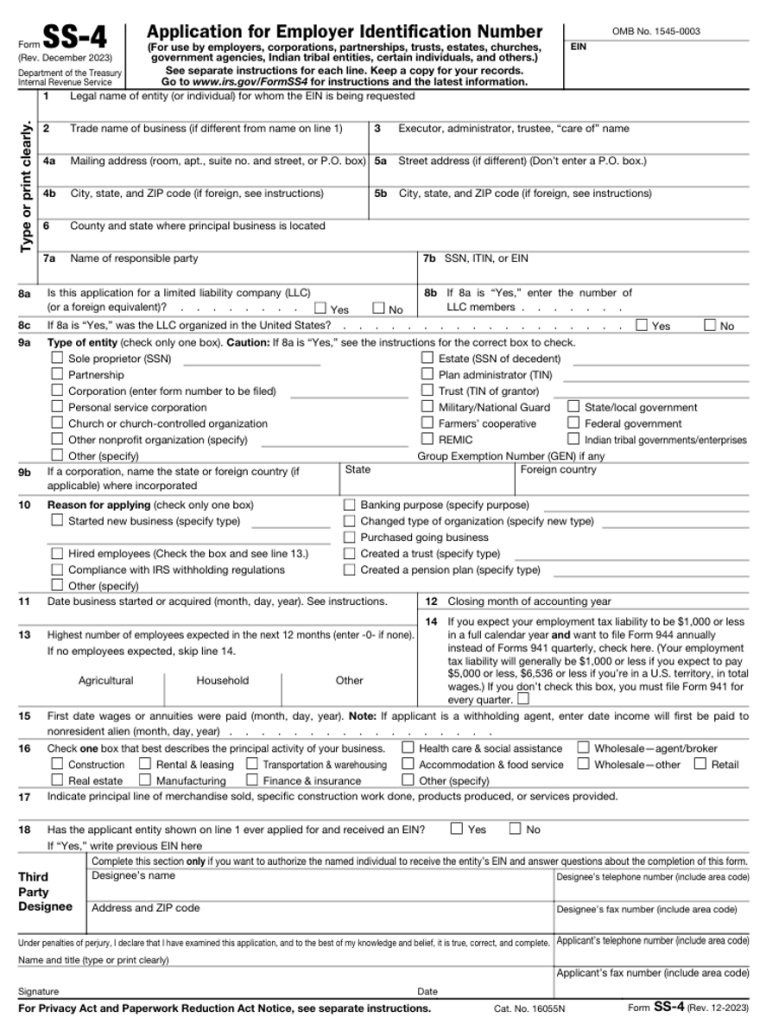

2 How to obtain a taxpayer identification number (Employer Identification Number = EIN)

To obtain an EIN, complete Form SS-4 and submit it to the U.S. Internal Revenue Service (IRS) to apply for and obtain the required number.

To apply, visit the IRS website (IRS.gov/EIN) and file an application, or else you can apply by mail. (Both application methods can be carried out from Japan.)

[Mailing address]

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999 USA

3 U.S. Corporate Tax Returns of Japanese Companies with Deposit Accounts

If you only open a bank account, and do not have a permanent establishment or conduct business activities in the United States, you are not required to file a corporate tax return. (However, if interest on a deposit is received, withholding tax will be levied on the interest income).

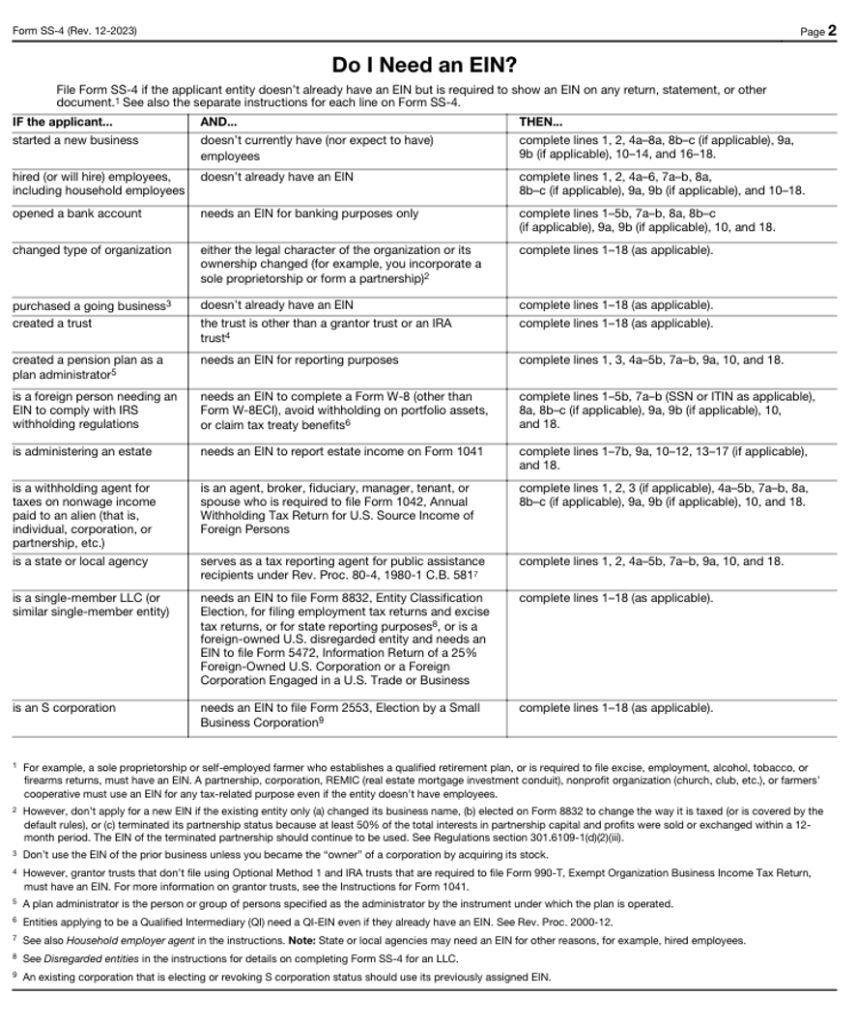

4 About Form SS-4

Form SS-4 consists of two pages.

(Reference) Form SS-4