Omission of Submission Requirement for the “Application Form for the Income Tax Convention Concerning Limitation on Benefits” (often referred to as the “LOB convention”)

A nonresident or foreign corporation that is subject to the provisions of the LOB convention with respect to income tax withholding at the source must, via the withholding agent, submit an “Application Form for the Income Tax Convention Concerning Limitation on Benefits” to the competent tax office by the day before the date on which it receives payments of domestically(i.e., Japan)-sourced income.

Therefore, if the withholding agent does not submit the required application form by the day prior to the day on which the Japan-sourced income is received, the income amount will be subject to withholding tax, at the rate of 20.24% .

Of course, if a tax audit, etc. confirms that the form has not been submitted, withholding tax will be imposed at the rate of 20.24% on the amount received.

On the other hand, on a regular basis, it’s important to understand when the submission of the “Application Form for the Income Tax Convention Concerning Limitation on Benefits” can be omitted.

In this issue, we will talk about when you can skip submitting the form.

1 What is the “Application Form for the Income Tax Convention Concerning Limitation on Benefits”?

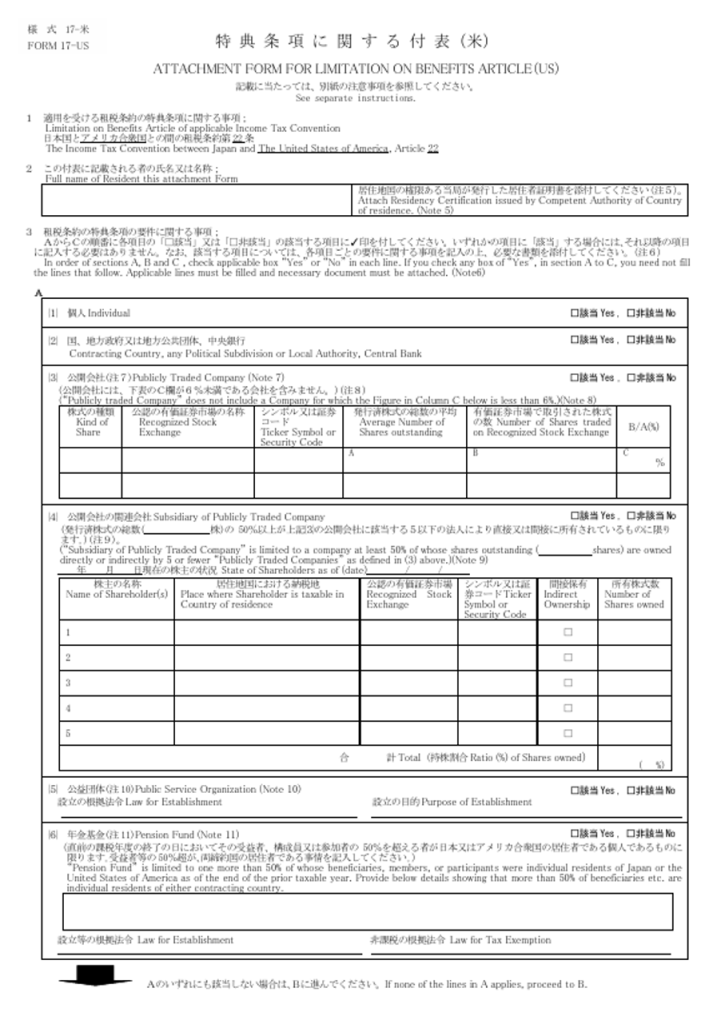

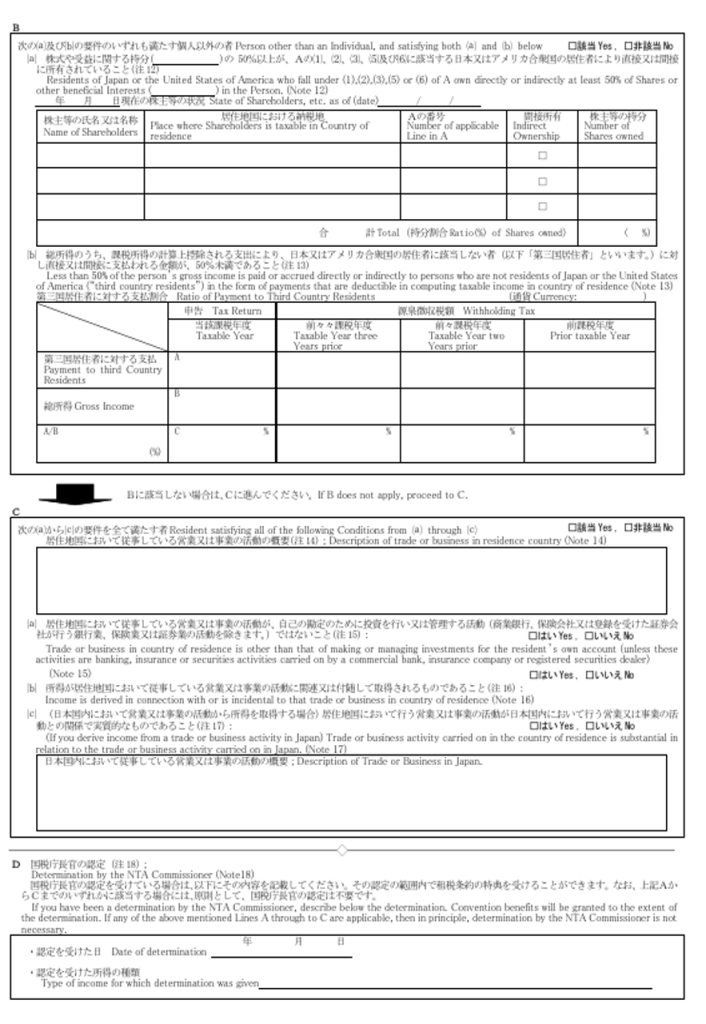

It is an “application form required under a tax convention” (“租税条約の届出書”), attached with documents which relate to the clause concerning the possibility of benefits eligibility for those who are subject to the clause’s provisions.

2 Cases where submission of the “Application Form for the Income Tax Convention Concerning Limitation on Benefits” can be omitted

Those who are residents of/based in a treaty counter-party country other than Japan, and who intend to apply for reduction of, or exemption from, withholding of income tax at the source based on the provisions of the tax convention, can omit submitting an additional form if:

a) They have already submitted an “Application Form for the Income Tax Convention Concerning Limitation on Benefits” for Japan-sourced income for which the assets or contracts that give rise to (generate) the domestically-sourced income are the same throughout the three years preceding the date of receipt of the domestic (Japan)-sourced income (Note: for certified qualified parties, etc., the period is the one-year period prior to the date of receipt); and,

b) There are no changes in the information entered on the original form.

(cf. Article 9-5, paragraph 2 of the Ministerial Ordinance on Special Provisions for the Implementation of the Convention {below})

- In a situation where a resident, etc. of a counterparty country (for the document shown at the bottom, the U.S.) has submitted an “Application Form for the Income Tax Convention Concerning Limitation on Benefits” within three years prior to the date of receipt of income/payment, the taxpayer would be included in box “A” under number “3” at the top of the ‘U.S.’ appendix table regarding the Convention (Form 17-US, below).

- In a situation where a resident, etc. of a counterparty country (again, for the document shown at the bottom, the U.S.) has submitted an “Application Form for the Income Tax Convention Concerning Limitation on Benefits” within one year prior to the date of receipt of income/payment, the taxpayer would be included in either box “B”, “C” or “D” listed under number “3” at the top of the ‘U.S.’ appendix table regarding the Convention (Form 17-US, below).

Article 9-5, paragraph 2 of the Ministerial Ordinance on Special Provisions for the Implementation of the Convention:

If designated Convention-related documents, etc. have been submitted to the tax office prescribed in the previous section via the withholding agent responsible for withholding tax on domestic-sourced income at any time within three years prior to the day on which the domestic-sourced income is received (or within the one year prior to that date if the person is subject to the provisions listed in each item of Article 9-2, paragraph 5), then concerning the withholding tax on the subject domestic-sourced income, (limited to cases where the assets, contracts and other items that are the sources of the income are the same as those that are the sources of the domestic-sourced income),notwithstanding the provisions mentioned in the previous section, the submission of an Application Form for the Income Tax Convention Concerning Limitation on Benefits for the domestic-sourced income in question can be omitted.

However, this possibility of omission does not apply if the information on the Application Form for the Income Tax Convention Concerning Limitation on Benefits differs from that on the submitted Convention-related documents, etc.