International Tax Articles April 2025 issue

Regarding the Scope of Taxable Income for “Non-permanent Residents”

Determinations will be made regarding foreign nationals entering Japan, as to whether they are residents or nonresidents.

Residents are individuals who have a domicile in Japan, or have lived in Japan for at least one year continuously up to the present. Furthermore, residents will be further classified into “permanent residents} and “non-permanent residents”.

A non-permanent resident is an individual who does not have Japanese nationality, and has had a residence or domicile in Japan for a total of five years or less during the past ten years.

In this issue, we will focus on non-permanent residents, and discuss points to note in regards to the taxing of those residents; through the following question & answer case.

1 Cooperation among Countries

I will be working in Japan for 5 years. In Japan, I plan to purchase real estate and start renting it out. My salary while working in Japan will be transferred to my account overseas.

In this case, what will my tax implications in Japan be?

2 Answer:

Your taxpayer classification will be as a non-permanent resident taxpayer, so you will be subject to tax on domestically-sourced (i.e., Japan-sourced) income and other income which is paid in Japan or remitted from abroad.

Your income derived from your working in Japan will not be subject to tax in Japan since it is to be paid outside of Japan; however, your income from renting out your real estate in Japan will be subject to tax. In addition, the act of using a credit card for payment from an account outside of Japan is considered a remittance, so any amounts spent on such a credit card would be subject to taxation.

3 Explanations:

(1) Determination of type of residence:

When classifying taxpayers who are foreign nationals who entered Japan with plans to stay here for one year or more, the type of residence is determined.

Since you are planning to stay in Japan for more than one year, you will be classified as a resident. Then a determination will be made as to whether you are a ‘resident other than a non-permanent a ‘permanent resident’) or a ‘non-permanent resident’. A non-permanent resident is an individual who does not have Japanese nationality, and has had a domicile or residence in Japan for a total of 5 years or less within the past 10 years.

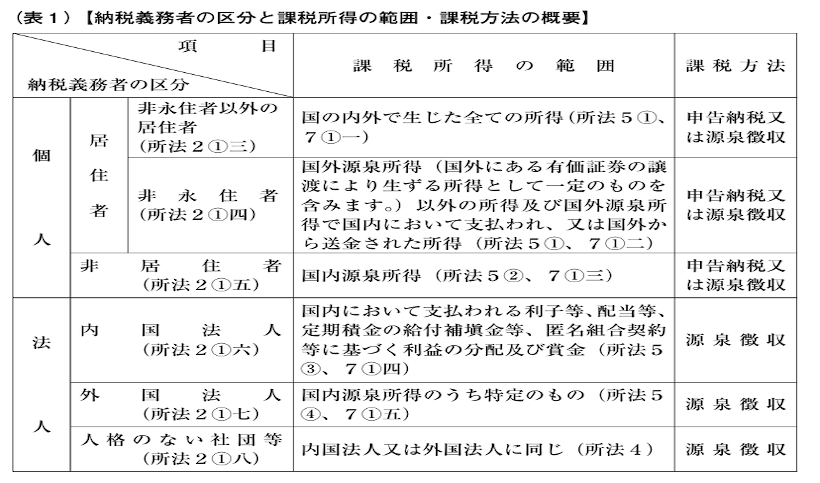

(2) Classifications of taxpayers and scopes of taxable income:

Non-permanent residents are subject to tax on foreign-source income paid in Japan or remitted from abroad. (Law No. 7 (1) (ii) of the Act on the Taxation of Income and Expenses of Non-permanent Residents.

(Reference)

(3) The significance of taxable income of non-permanent residents remitted from abroad:

For non-permanent residents, the act of paying debts with their own deposits, etc., located outside of Japan is also considered to be a remittance. (Basic Income Tax Notification 7-6(2)) In other words, the act of using a credit card for payment from an overseas account is considered a remittance, and the amount used via the credit card is subject to taxation, so care must be taken.