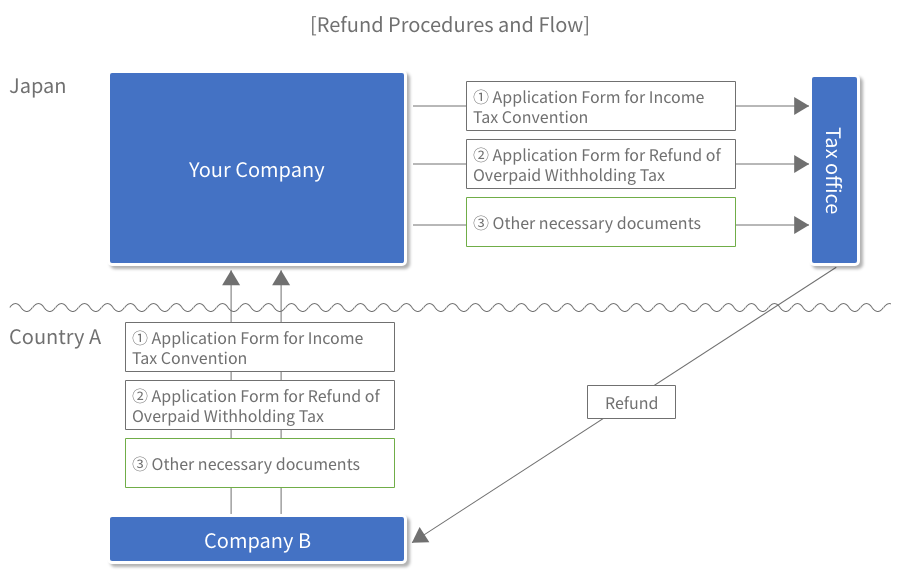

Points to Note When Filing a Refund Claim Under a Tax Treaty

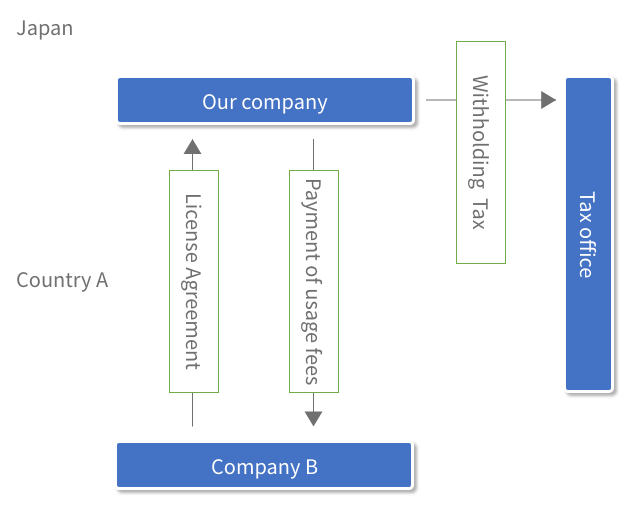

When entering into a software license agreement with an overseas company and paying license fees, by subsequently filing “documents for the Income Tax Convention,” you can claim a refund of the income tax withheld.

In this case, we will explain the specific procedures through an example.

Example

Our company entered into a software license agreement with Company B in Country A. When paying the license fee, since Company B did not submit an “Application Form for Income Tax Convention,” we levied income tax withholding at a rate of 20.42%, and paid it to the tax office.

Recently, Company B submitted an “Application Form for Income Tax Convention” and requested a refund of the tax withheld.

Under the tax treaty between Country A and our country, the tax rate for royalties is 10% (hereinafter referred to as the “maximum tax rate”).

Can a refund claim be made to the tax office for the difference between the income tax withholding collected from Company B and paid to the tax office (i.e., the 20.42% rate) and the maximum tax rate (10%)?

Additionally, if a refund is granted, to whom would it be refunded – our company, or Company B?

Answer

By Company B submitting the “APPLICATION FORM FOR INCOME TAX CONVENTION”(Form3), as well as the “APPLICATION FORM FOR REFUND OF THE OVERPAID WITHHOLDING TAX OTHER THAN REDEMPTION OF SECURITIES AND REMUNERATION DERIVED FROM RENDERING PERSONAL SERVICES EXERCISED BY AN ENTERTAINER OR A SPORTSMAN IN ACCORDANCE WITH THE INCOME TAX CONVENTION” (Form 11), and other necessary documents to the tax office, the tax rate can be reduced to 10%.

The difference between the withholding tax paid (at a rate of 20.42%) and the withholding tax after applying the maximum rate of 10% will be refunded to Company B, presuming it is eligible under the tax treaty, by the tax office.

Explanation

1. Regarding application of reduced tax rates under tax conventions (treaties)

The law that applies tax treaties domestically for tax purposes is the “Act on Special Provisions of the Income Tax Act, the Corporation Tax Act and the Local Tax Act Incidental to Enforcement of Tax Treaties” (hereinafter referred to as the “Special Provisions Act”). Under the Special Provisions Act, the income tax rate applicable to royalties is replaced with the tax rate specified in the tax treaty.

(Special Provisions Act, Article 2-5, Paragraph 3, Item 2 (1)).

2. Submission of the “Application Form for Income Tax Convention” after payment of license fees

The application form for tax reductions or exemptions under a tax treaty “must be submitted by the day before the date of receipt of payment, through the withholding agent, to the tax office with jurisdiction over the withholding agent.”

(Special Provisions Act, Ordinance 2(1))

Therefore, if the “Application Form for Income Tax Convention” is not submitted by the day before the payment date, withholding tax will be withheld at a rate of 20.42% at the time of payment.

However, if the “Application Form for Income Tax Convention” is submitted after the payment, in accordance with the Convention, the difference between the withholding tax amount (20.42%) and the maximum tax rate (10%) may be refunded.

(Special Provisions Act, Enforcement Order 2(8))

3. Procedures for refunding withholding tax, and the refund recipient

Company B in Country A – via your company – must submit the following documents to the tax office in charge of your company: “Application Form for Income Tax Convention” (Form 3), “Application Form for Refund of Overpaid Withholding Tax” (Form 11), and other necessary documents, in order to request a refund of the difference between the withholding tax paid to the tax office (20.42%) and the applicable tax rate (10%).

The withholding tax will be refunded to Company B in Country A.